Question: please help with 7 and 8. thank you 5. [4 Points Your mortgage lender states that it charges a 18% annual percentage rate (APR), and

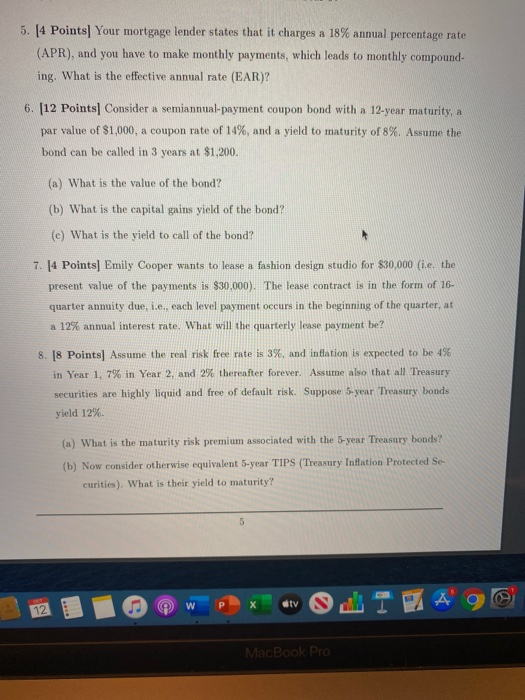

5. [4 Points Your mortgage lender states that it charges a 18% annual percentage rate (APR), and you have to make monthly payments, which leads to monthly compound- ing. What is the effective annual rate (EAR)? 6. [12 Points Consider a semiannual-payment coupon bond with a 12-year maturity, a par value of $1,000, a coupon rate of 14%, and a yield to maturity of 8%. Assume the bond can be called in 3 years at $1,200. (a) What is the value of the bond? (b) What is the capital gains yield of the bond? (c) What is the yield to call of the bond? 7. [4 Points) Emily Cooper wants to lease a fashion design studio for $30,000 (i... the present value of the payments is $30,000). The lease contract is in the form of 16- quarter annuity due. i.e., each level payment occurs in the beginning of the quarter, at a 12% annual interest rate. What will the quarterly lease payment be? 8. [8 Points) Assume the real risk free rate is 3%, and inflation is expected to be 4% in Year 1,7% in Year 2, and 2% thereafter forever. Assume also that all Treasury securities are highly liquid and free of default risk. Suppose 5-year Treasury bonds yield 12% (a) What is the maturity risk premium associated with the 5-year Treasury bonds? (b) Now consider otherwise equivalent 5-year TIPS (Treasury Inflation Protected Se. curities). What is their yield to maturity? 5 w ctv 12 MacBook Pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts