Question: Please help with a, b and c. Please provide formulas and steps with answers. thank you for your help! Ayayai Pix currently uses a six-year-old

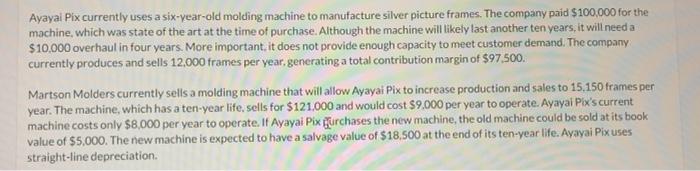

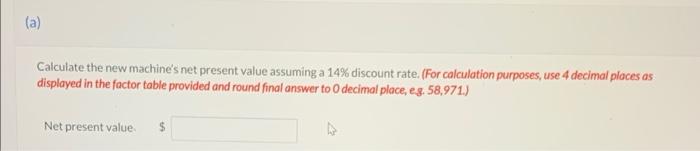

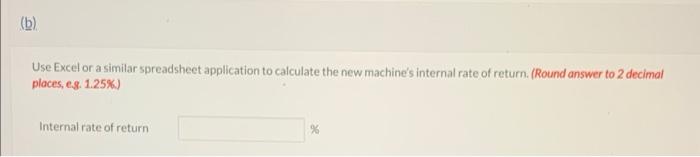

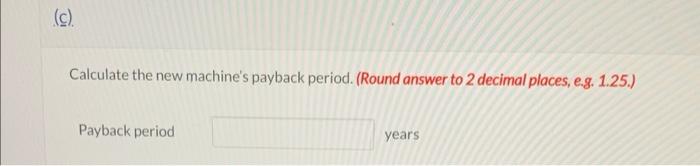

Ayayai Pix currently uses a six-year-old molding machine to manufacture silver picture frames. The company paid $100,000 for the machine, which was state of the art at the time of purchase. Although the machine will likely last another ten years, it will need a $10,000 overhaul in four years. More important, it does not provide enough capacity to meet customer demand. The company currently produces and sells 12,000 frames per year, generating a total contribution margin of $97,500. Martson Molders currently sells a molding machine that will allow Ayayai Pix to increase production and sales to 15.150 frames per year. The machine, which has a ten-year life. sells for $121.000 and would cost $9.000 per year to operate. Ayayai Pix's current. machine costs only $8,000 per year to operate. If Ayayai Pix faurchases the new machine, the old machine could be sold at its book value of $5,000. The new machine is expected to have a salvage value of $18,500 at the end of its ten-year life. Avayai Pixuses straight-line depreciation. Calculate the new machine's net present value assuming a 14% discount rate. (For calculation purposes, use 4 decimal ploces as displayed in the factor table provided and round final answer to 0 decimal place, e.g. 58,971.) Net present value. Use Excel or a similar spreadsheet application to calculate the new machine's internal rate of return. (Round answer to 2 decimal places, e.8. 1.25\%) Internal rate of return \% Calculate the new machine's payback period. (Round answer to 2 decimal places, e.g. 1.25.) Payback period years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts