Question: Please help with a , b , and c You can invest in a risk-free technology that requires an upfront payment of $1.05 million and

Please help with a, b, and c

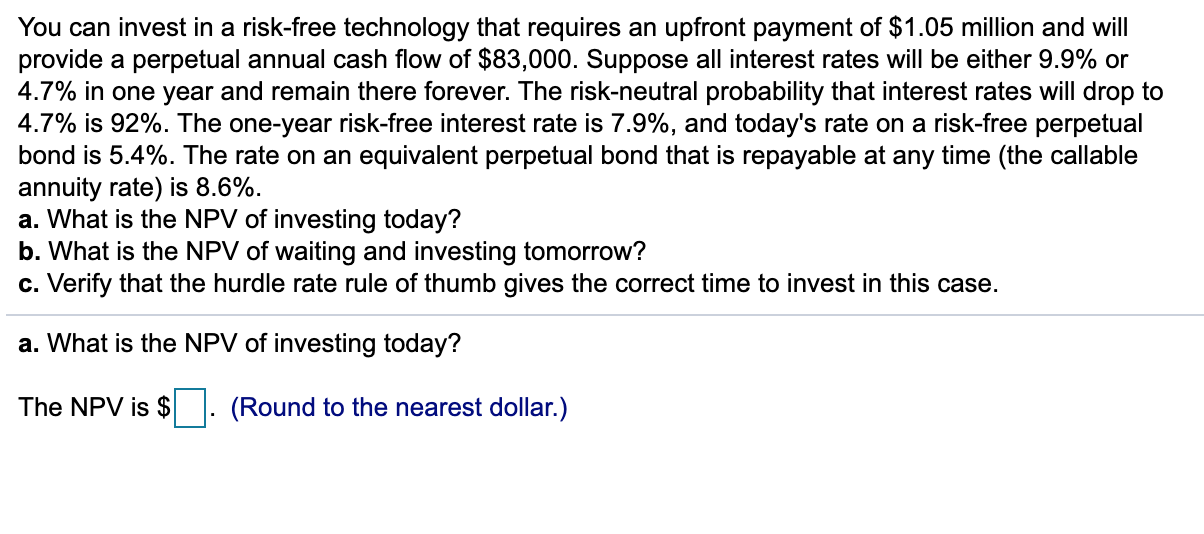

You can invest in a risk-free technology that requires an upfront payment of $1.05 million and will provide a perpetual annual cash ow of $83,000. Suppose all interest rates will be either 9.9% or 4.7% in one year and remain there forever. The risk-neutral probability that interest rates will drop to 4.7% is 92%. The one-year risk-free interest rate is 7.9%, and today's rate on a risk-free perpetual bond is 5.4%. The rate on an equivalent perpetual bond that is repayable at any time (the callable annuity rate) is 8.6%. a. What is the NPV of investing today? b. What is the NPV of waiting and investing tomorrow? c. Verify that the hurdle rate rule of thumb gives the correct time to invest in this case. a. What is the NPV of investing today? The NPV is $|:|. (Round to the nearest dollar.)

You can invest in a risk-free technology that requires an upfront payment of $1.05 million and will provide a perpetual annual cash ow of $83,000. Suppose all interest rates will be either 9.9% or 4.7% in one year and remain there forever. The risk-neutral probability that interest rates will drop to 4.7% is 92%. The one-year risk-free interest rate is 7.9%, and today's rate on a risk-free perpetual bond is 5.4%. The rate on an equivalent perpetual bond that is repayable at any time (the callable annuity rate) is 8.6%. a. What is the NPV of investing today? b. What is the NPV of waiting and investing tomorrow? c. Verify that the hurdle rate rule of thumb gives the correct time to invest in this case. a. What is the NPV of investing today? The NPV is $|:|. (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock