Question: Please help with a, b, c and d. Please show all the calculations. Question 41 Question ID: 619 Not yet saved Not graded Flag question

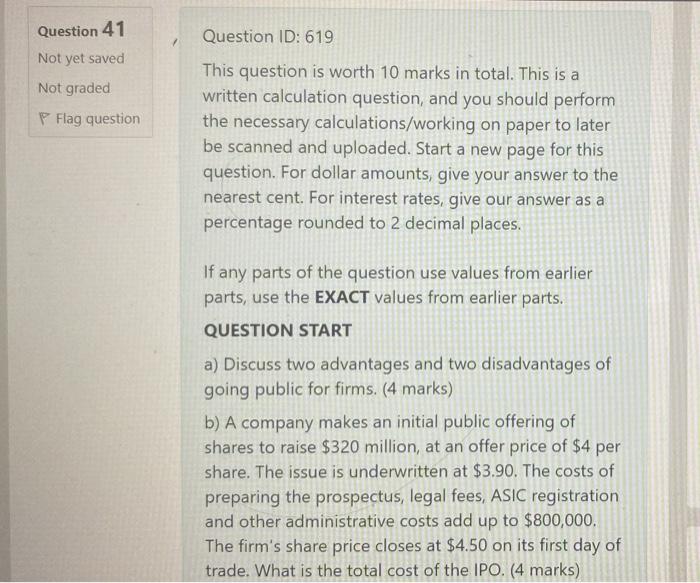

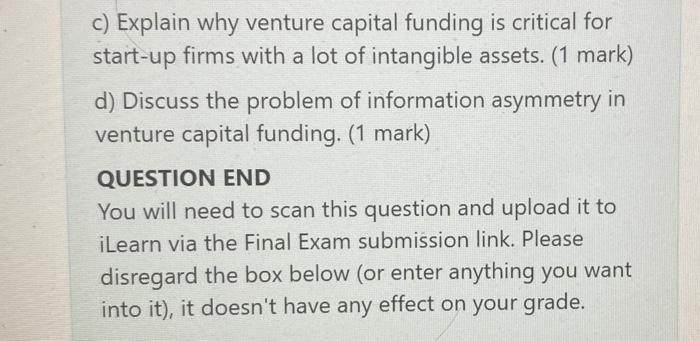

Question 41 Question ID: 619 Not yet saved Not graded Flag question This question is worth 10 marks in total. This is a written calculation question, and you should perform the necessary calculations/working on paper to later be scanned and uploaded. Start a new page for this question. For dollar amounts, give your answer to the nearest cent. For interest rates, give our answer as a percentage rounded to 2 decimal places. If any parts of the question use values from earlier parts, use the EXACT values from earlier parts. QUESTION START a) Discuss two advantages and two disadvantages of going public for firms. (4 marks) b) A company makes an initial public offering of shares to raise $320 million, at an offer price of $4 per share. The issue is underwritten at $3.90. The costs of preparing the prospectus, legal fees, ASIC registration and other administrative costs add up to $800,000. The firm's share price closes at $4.50 on its first day of trade. What is the total cost of the IPO. (4 marks) c) Explain why venture capital funding is critical for start-up firms with a lot of intangible assets. (1 mark) d) Discuss the problem of information asymmetry in venture capital funding. (1 mark) QUESTION END You will need to scan this question and upload it to iLearn via the Final Exam submission link. Please disregard the box below (or enter anything you want into it), it doesn't have any effect on your grade. Question 41 Question ID: 619 Not yet saved Not graded Flag question This question is worth 10 marks in total. This is a written calculation question, and you should perform the necessary calculations/working on paper to later be scanned and uploaded. Start a new page for this question. For dollar amounts, give your answer to the nearest cent. For interest rates, give our answer as a percentage rounded to 2 decimal places. If any parts of the question use values from earlier parts, use the EXACT values from earlier parts. QUESTION START a) Discuss two advantages and two disadvantages of going public for firms. (4 marks) b) A company makes an initial public offering of shares to raise $320 million, at an offer price of $4 per share. The issue is underwritten at $3.90. The costs of preparing the prospectus, legal fees, ASIC registration and other administrative costs add up to $800,000. The firm's share price closes at $4.50 on its first day of trade. What is the total cost of the IPO. (4 marks) c) Explain why venture capital funding is critical for start-up firms with a lot of intangible assets. (1 mark) d) Discuss the problem of information asymmetry in venture capital funding. (1 mark) QUESTION END You will need to scan this question and upload it to iLearn via the Final Exam submission link. Please disregard the box below (or enter anything you want into it), it doesn't have any effect on your grade

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts