Question: Please help with a financial analysis on the Appleton Children Association (ACF) as a member of an ad hoc committee. Standard ratios, balance sheet, and

Please help with a financial analysis on the Appleton Children Association (ACF) as a member of an ad hoc committee. Standard ratios, balance sheet, and income statement information for the case study is located in the course textbook (Francois, 2014, p. 163 165). Provide responses to all the case study questions:

1. Does the management of ACF revenues reflect its mission statement? Explain! 2. Do the financial statements of ACF provide indicators of organizational growth? Explain! 3. How much flexibility does the management have to make financial decisions? Explain! 4. Do you think the foundation has the ability to pay its bills on time? Explain! 5. Do you think that ACF has become more solvent or less solvent? Explain! 6. What factors account for the increase or decrease in ACF solvency? 7. How well is ACF doing comparing to other non-profit organizations of its size? 8. Do you think that ACF is on a path for financial sustainability? Explain! 9. What would be your financial management recommendations to the ACF board for the next fiscal year?

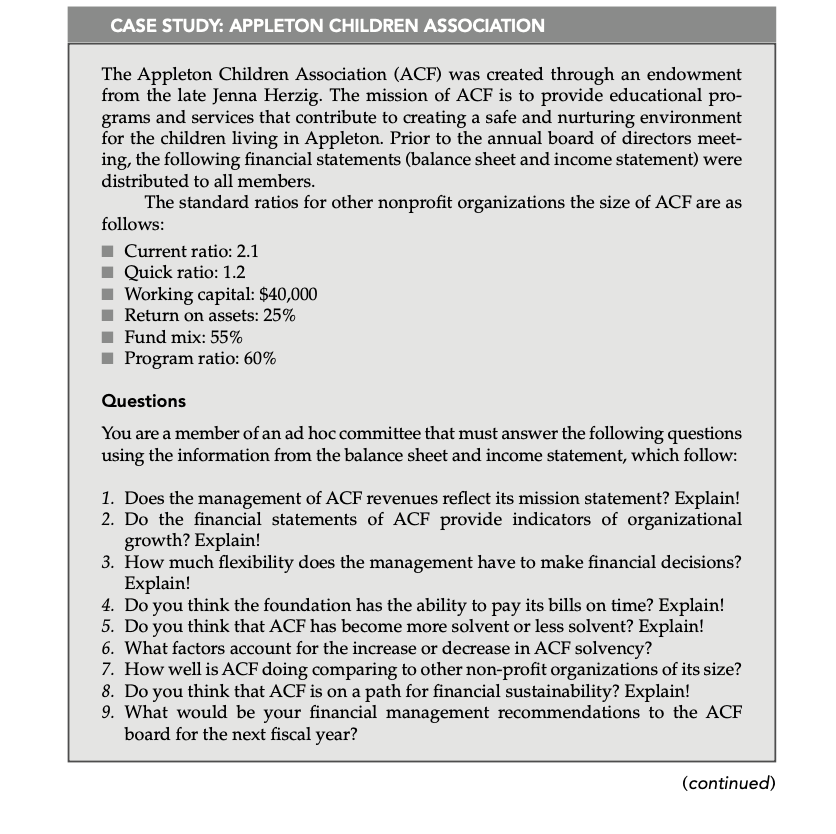

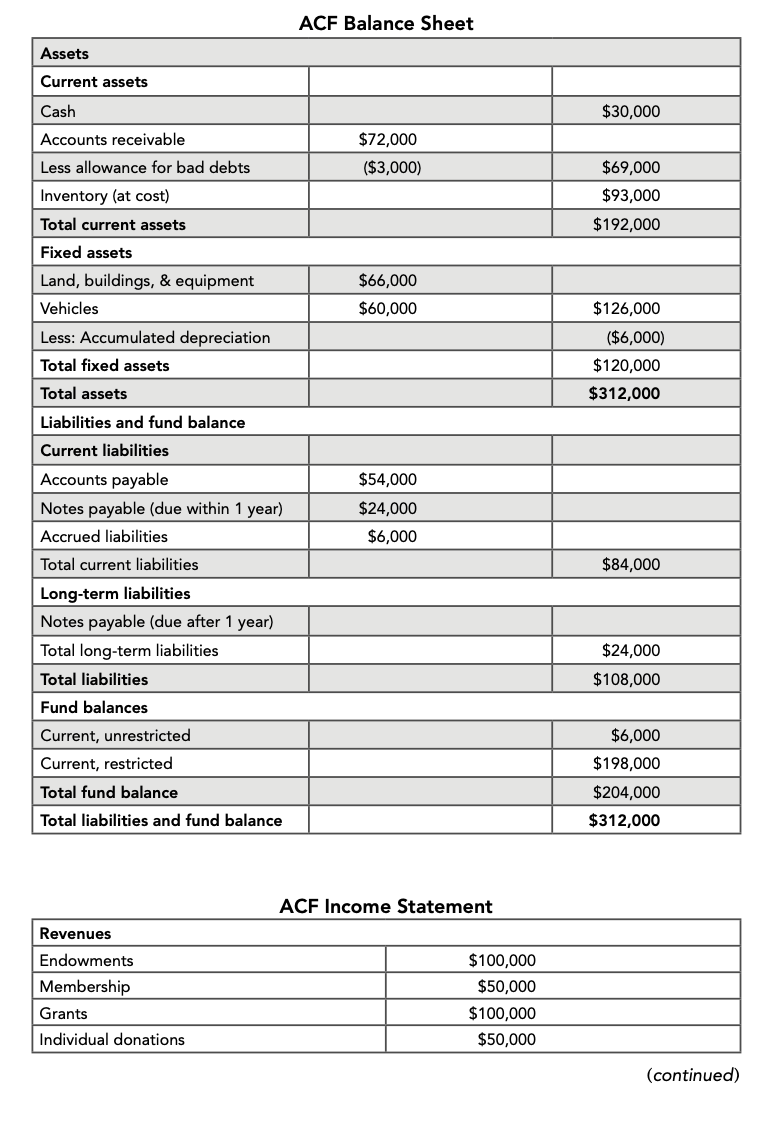

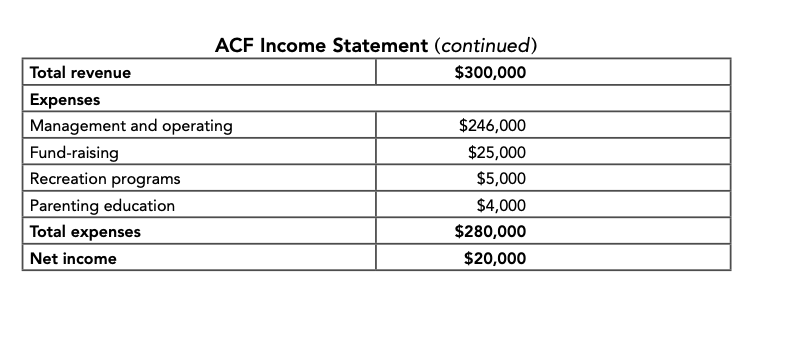

The Appleton Children Association (ACF) was created through an endowment from the late Jenna Herzig. The mission of ACF is to provide educational programs and services that contribute to creating a safe and nurturing environment for the children living in Appleton. Prior to the annual board of directors meeting, the following financial statements (balance sheet and income statement) were distributed to all members. The standard ratios for other nonprofit organizations the size of ACF are as follows: Current ratio: 2.1 Quick ratio: 1.2 Working capital: $40,000 Return on assets: 25% Fund mix: 55\% Program ratio: 60% Questions You are a member of an ad hoc committee that must answer the following questions using the information from the balance sheet and income statement, which follow: 1. Does the management of ACF revenues reflect its mission statement? Explain! 2. Do the financial statements of ACF provide indicators of organizational growth? Explain! 3. How much flexibility does the management have to make financial decisions? Explain! 4. Do you think the foundation has the ability to pay its bills on time? Explain! 5. Do you think that ACF has become more solvent or less solvent? Explain! 6. What factors account for the increase or decrease in ACF solvency? 7. How well is ACF doing comparing to other non-profit organizations of its size? 8. Do you think that ACF is on a path for financial sustainability? Explain! 9. What would be your financial management recommendations to the ACF board for the next fiscal year? (continued) ArE Ralanro Choat AC.F Inrome Statement (continued) ACF Income Statement (continued) \begin{tabular}{|l|r|} \hline Total revenue & $300,000 \\ \hline Expenses \\ \hline Management and operating & $246,000 \\ \hline Fund-raising & $25,000 \\ \hline Recreation programs & $5,000 \\ \hline Parenting education & $4,000 \\ \hline Total expenses & $280,000 \\ \hline Net income & $20,000 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts