Question: Please help with A, I believe it's $89.05 per direct labor-hours, not so sure. Tommy Lyons Company manufactures and sells two products: Product S3 and

Please help with A, I believe it's $89.05 per direct labor-hours, not so sure.

Please help with A, I believe it's $89.05 per direct labor-hours, not so sure.

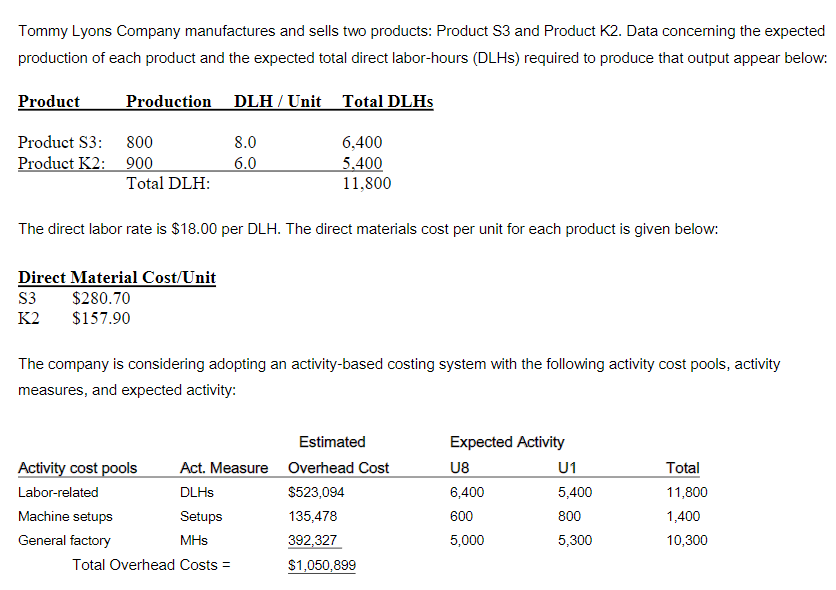

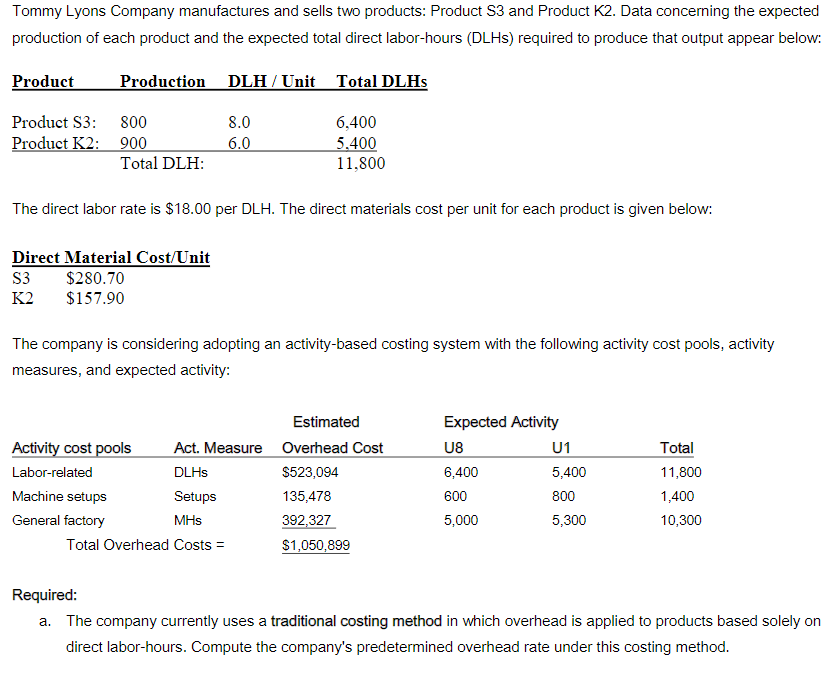

Tommy Lyons Company manufactures and sells two products: Product S3 and Product K2. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below: The direct labor rate is $18.00 per DLH. The direct materials cost per unit for each product is given below: The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity: Tommy Lyons Company manufactures and sells two products: Product S3 and Product K2. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below: The direct labor rate is $18.00 per DLH. The direct materials cost per unit for each product is given below: The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity: Required: a. The company currently uses a traditional costing method in which overhead is applied to products based solely on direct labor-hours. Compute the company's predetermined overhead rate under this costing method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts