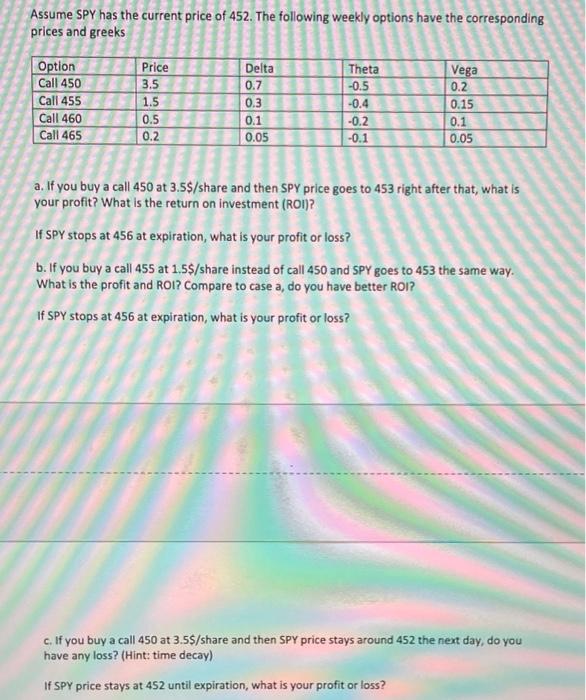

Question: please help with a through d, thanks! Assume SPY has the current price of 452. The following weekly options have the corresponding prices and greeks

Assume SPY has the current price of 452. The following weekly options have the corresponding prices and greeks Option Call 450 Call 455 Call 460 Call 465 Price 3.5 1.5 0.5 0.2 Delta 0.7 0.3 0.1 0.05 Theta -0.5 -0.4 -0.2 -0.1 Vega 0.2 0.15 0.1 0.05 olo a. If you buy a call 450 at 3.5$/share and then SPY price goes to 453 right after that, what is your profit? What is the return on investment (RON)? If SPY stops at 456 at expiration, what is your profit or loss? b. If you buy a call 455 at 1.5$/share instead of call 450 and SPY goes to 453 the same way. What is the profit and ROI? Compare to case a, do you have better ROI? If SPY stops at 456 at expiration, what is your profit or loss? c. If you buy a call 450 at 3.5$/share and then SPY price stays around 452 the next day, do you have any loss? (Hint: time decay) If SPY price stays at 452 until expiration, what is your profit or loss? Assume SPY has the current price of 452. The following weekly options have the corresponding prices and greeks Option Call 450 Call 455 Call 460 Call 465 Price 3.5 1.5 0.5 0.2 Delta 0.7 0.3 0.1 0.05 Theta -0.5 -0.4 -0.2 -0.1 Vega 0.2 0.15 0.1 0.05 olo a. If you buy a call 450 at 3.5$/share and then SPY price goes to 453 right after that, what is your profit? What is the return on investment (RON)? If SPY stops at 456 at expiration, what is your profit or loss? b. If you buy a call 455 at 1.5$/share instead of call 450 and SPY goes to 453 the same way. What is the profit and ROI? Compare to case a, do you have better ROI? If SPY stops at 456 at expiration, what is your profit or loss? c. If you buy a call 450 at 3.5$/share and then SPY price stays around 452 the next day, do you have any loss? (Hint: time decay) If SPY price stays at 452 until expiration, what is your profit or loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts