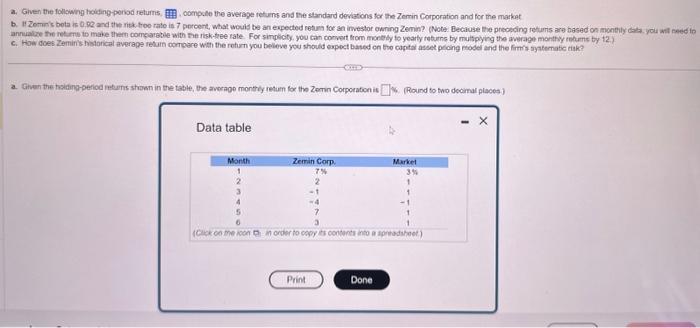

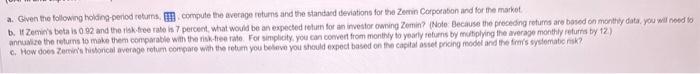

Question: Please help with a,b, and c a. Given the following hoiding poriod rehurns, oompole the average fetuens and the standard deviations for the Zerrin Corporation

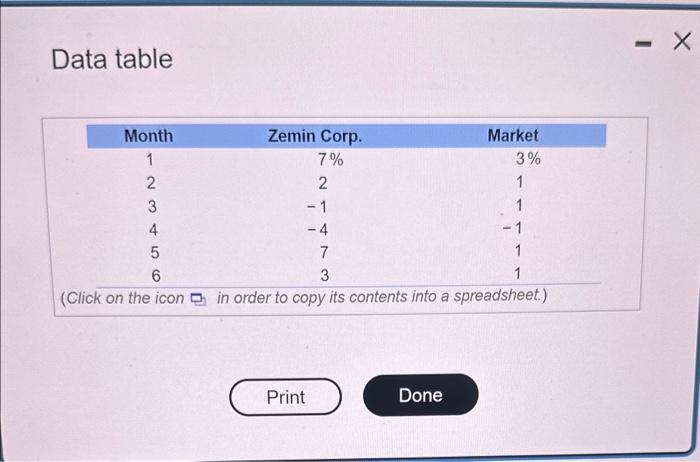

a. Given the following hoiding poriod rehurns, oompole the average fetuens and the standard deviations for the Zerrin Corporation and for me markat. a. Given the haliding-period mouns stosen in the table, the avorape monthy retum for the Zemin Corporaton is 6. (Round to two decimal places) Data table a. Given the following holdmp-penod roturss, coompute the average returns and the standacd devations for the Zeenin Corpota5on and far the market. b. It Zemins beta is 092 and the rikk.tee rate is 7 percent, what wovid be an expected totum lot an investor owning Zemin? (Note Bechuse the preceding returns are bosed on monthy data. you we noed lo Data table (CAPM and expected returns) a. Given the following holding-period returns, , compute the average returns and the standard deviations for the Zemin Corporation and for the market. b. If Zemin's beta is 0.92 and the risk-free rate is 7 percent, what would be an expected return for an investor owning Zemin? (Note: Because the preceding returns are based on monthly data, you will need to annualize the returns to make them comparable with the risk-free rate. For simplicity, you can convert from monthly to yearly returns by multiplying the average monthly returns by 12 .) c. How does Zemin's historical average return compare with the return you believe you should expect based on the capital asset pricing model and the firm's systematic risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts