Question: Please help with a,b, and c!!! (Related to Checkpoint E.1) (Computing the portfolio expected rate of return) Penny Francis inherited a $200,000 portlolio of inrestments

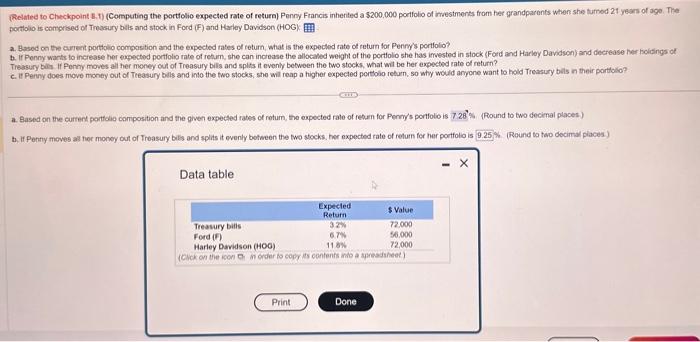

(Related to Checkpoint E.1) (Computing the portfolio expected rate of return) Penny Francis inherited a $200,000 portlolio of inrestments from her grandparonts when she turnod 21 years of age. The portlolio is comprised of Thesury blits and stock in Ford (F) and Harley Davidsen (HOG). a. Based on the curment portholio composition and the expected tates of return what is the expected rate of retum for Penrys portlolio? Treasury bles if Penny moves ali her money oul of Treasury bils and spits it evenly betwoen the two stocks, what wil be her expected rate of return? c. If Perny does move money out of Treasury bills and into the two stocks, she will roap a higher expected portolio retarn, so why would anyone want to hold Treasury bills in their porttilio? a. Based on the current porttoia composition and the giver expected rates of retum, the copected rale of retum for Pennys portfolo is 7.28 's (Round to two decimal places) b. If Pertity moves al her monoy out of Treasury bils and splits it ewenly botween the two stocks, her expected rate of relum for her portfolo is 9.25 ;. (Round ta tao decimal places) Data table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts