Question: please help with a,b,c Round all final dollar amounts to the nearest cent and don't enter the dollar sign. Round all final percentages to the

please help with a,b,c

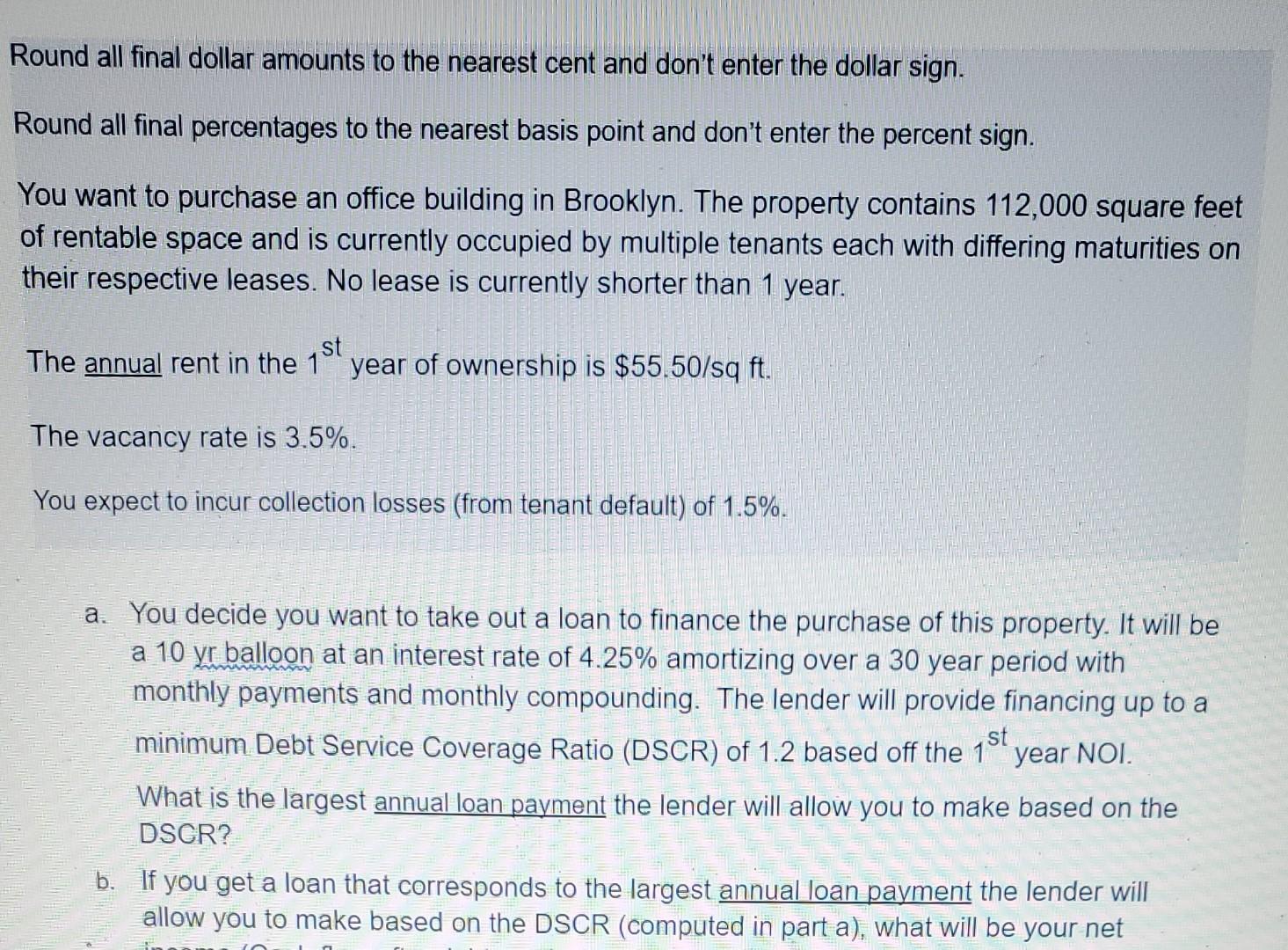

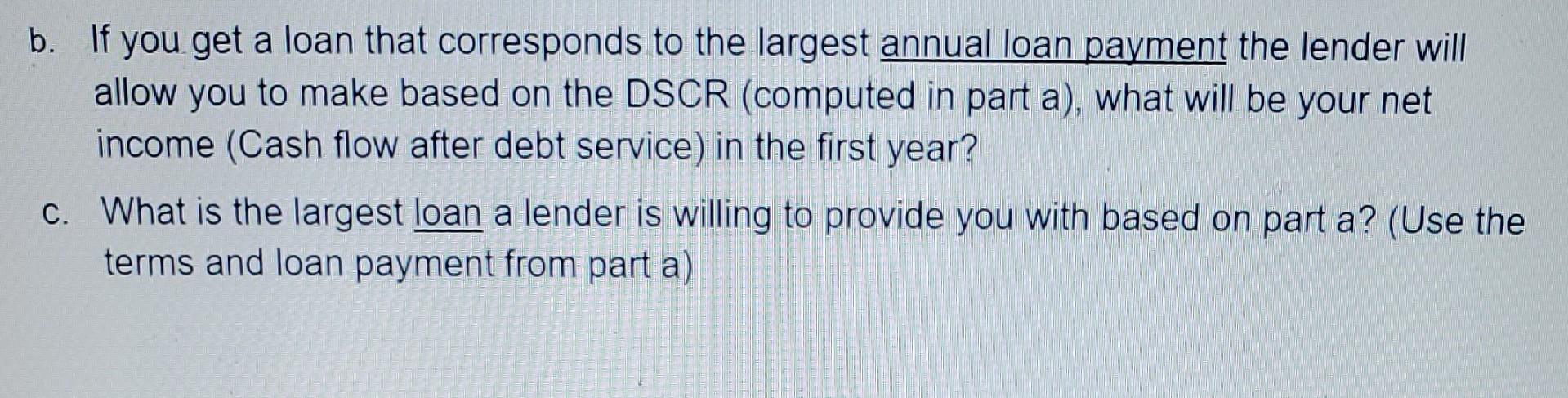

Round all final dollar amounts to the nearest cent and don't enter the dollar sign. Round all final percentages to the nearest basis point and don't enter the percent sign. You want to purchase an office building in Brooklyn. The property contains 112,000 square feet of rentable space and is currently occupied by multiple tenants each with differing maturities on their respective leases. No lease is currently shorter than 1 year. st The annual rent in the 1 year of ownership is $55.50/sq ft. The vacancy rate is 3.5%. You expect to incur collection losses (from tenant default) of 1.5%. a. You decide you want to take out a loan to finance the purchase of this property. It will be a 10 yr balloon at an interest rate of 4.25% amortizing over a 30 year period with monthly payments and monthly compounding. The lender will provide financing up to a minimum Debt Service Coverage Ratio (DSCR) of 1.2 based off the 1st year NOI. What is the largest annual loan payment the lender will allow you to make based on the DSCR? b. If you get a loan that corresponds to the largest annual loan payment the lender will allow you to make based on the DSCR (computed in part a), what will be your net b. If you get a loan that corresponds to the largest annual loan payment the lender will allow you to make based on the DSCR (computed in part a), what will be your net income (Cash flow after debt service) in the first year? c. What is the largest loan a lender is willing to provide you with based on part a? (Use the terms and loan payment from part a) Round all final dollar amounts to the nearest cent and don't enter the dollar sign. Round all final percentages to the nearest basis point and don't enter the percent sign. You want to purchase an office building in Brooklyn. The property contains 112,000 square feet of rentable space and is currently occupied by multiple tenants each with differing maturities on their respective leases. No lease is currently shorter than 1 year. st The annual rent in the 1 year of ownership is $55.50/sq ft. The vacancy rate is 3.5%. You expect to incur collection losses (from tenant default) of 1.5%. a. You decide you want to take out a loan to finance the purchase of this property. It will be a 10 yr balloon at an interest rate of 4.25% amortizing over a 30 year period with monthly payments and monthly compounding. The lender will provide financing up to a minimum Debt Service Coverage Ratio (DSCR) of 1.2 based off the 1st year NOI. What is the largest annual loan payment the lender will allow you to make based on the DSCR? b. If you get a loan that corresponds to the largest annual loan payment the lender will allow you to make based on the DSCR (computed in part a), what will be your net b. If you get a loan that corresponds to the largest annual loan payment the lender will allow you to make based on the DSCR (computed in part a), what will be your net income (Cash flow after debt service) in the first year? c. What is the largest loan a lender is willing to provide you with based on part a? (Use the terms and loan payment from part a)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts