Question: please help with a-c! Duluth Ranch, Inc. purchased a machine on January 1 , 2018. The cost of the machine was $36,500. Its estimated residual

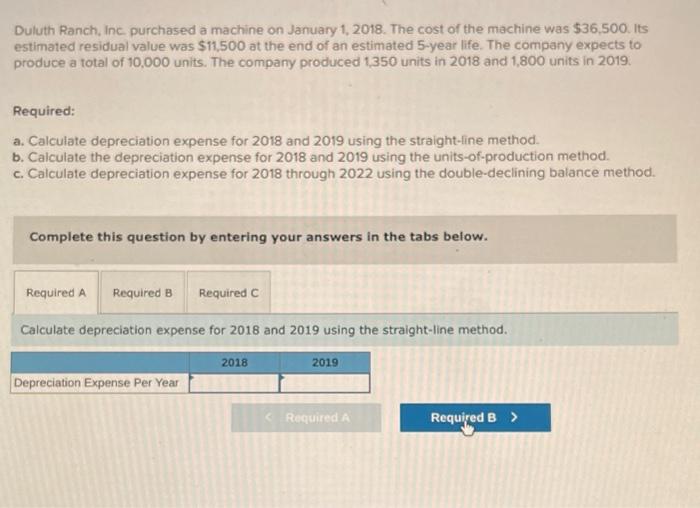

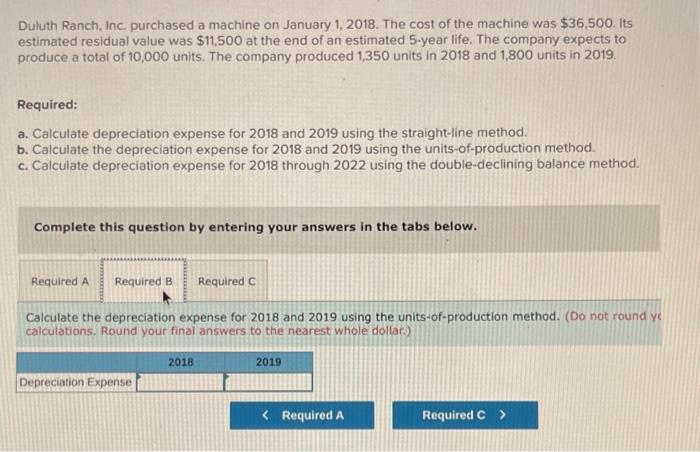

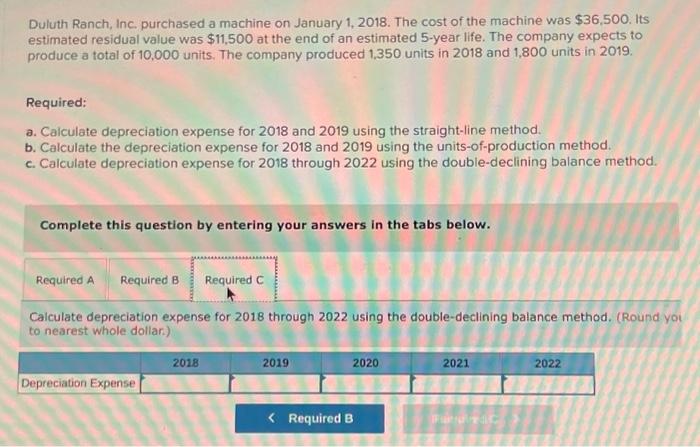

Duluth Ranch, Inc. purchased a machine on January 1 , 2018. The cost of the machine was $36,500. Its estimated residual value was $11,500 at the end of an estimated 5 -year life. The company expects to produce a total of 10,000 units. The company produced 1,350 units in 2018 and 1,800 units in 2019. Required: a. Calculate depreciation expense for 2018 and 2019 using the straight-line method. b. Calculate the depreciation expense for 2018 and 2019 using the units-of-production method. c. Calculate depreciation expense for 2018 through 2022 using the double-declining balance method. Complete this question by entering your answers in the tabs below. Calculate depreciation expense for 2018 and 2019 using the straight-line method. Duluth Ranch, Inc. purchased a machine on January 1, 2018. The cost of the machine was $36,500. Its estimated residual value was $11,500 at the end of an estimated 5 -year life. The company expects to produce a total of 10,000 units. The company produced 1,350 units in 2018 and 1,800 units in 2019. Required: a. Calculate depreciation expense for 2018 and 2019 using the straight-line method. b. Calculate the depreciation expense for 2018 and 2019 using the units-of-production method. c. Calculate depreciation expense for 2018 through 2022 using the double-declining balance method. Complete this question by entering your answers in the tabs below. Calculate the depreciation expense for 2018 and 2019 using the units-of-production method. (Do not round ye calculations. Round your final answers to the nearest whole dollar.) Duluth Ranch, Inc. purchased a machine on January 1,2018 . The cost of the machine was $36,500. Its estimated residual value was $11,500 at the end of an estimated 5-year life. The company expects to produce a total of 10,000 units. The company produced 1,350 units in 2018 and 1,800 units in 2019. Required: a. Caiculate depreciation expense for 2018 and 2019 using the straight-line method. b. Calculate the depreciation expense for 2018 and 2019 using the units-of-production method. c. Calculate depreciation expense for 2018 through 2022 using the double-declining balance method. Complete this question by entering your answers in the tabs below. Calculate depreciation expense for 2018 through 2022 using the double-declining balance method. (Round y to nearest whole dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts