Question: please help with accounting 1 question with 4 parts, please answer all parts :) Below is information for Company A and Company B: Given this

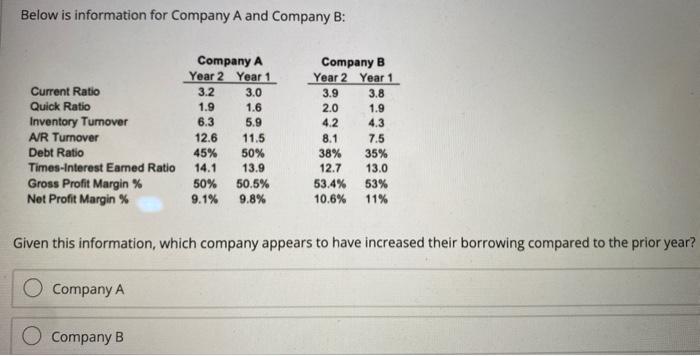

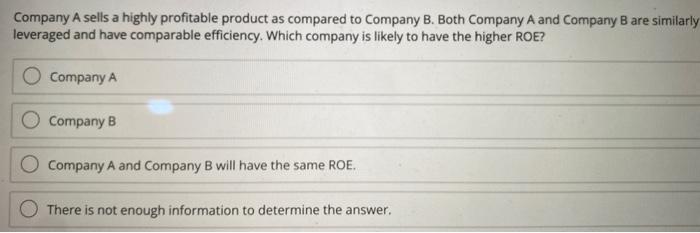

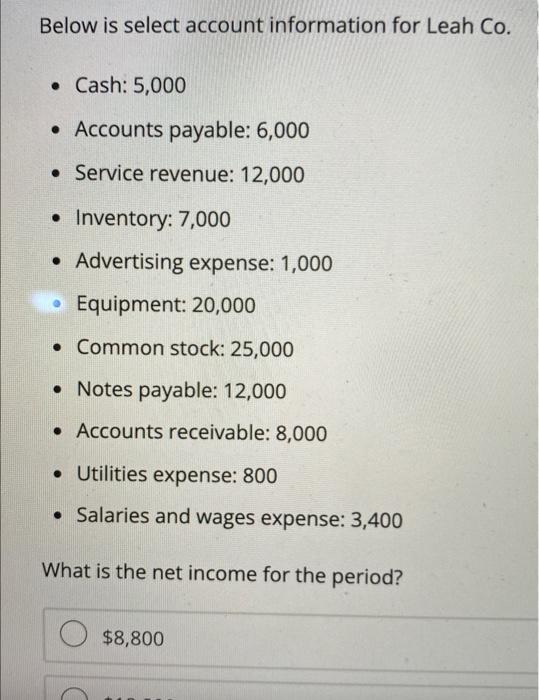

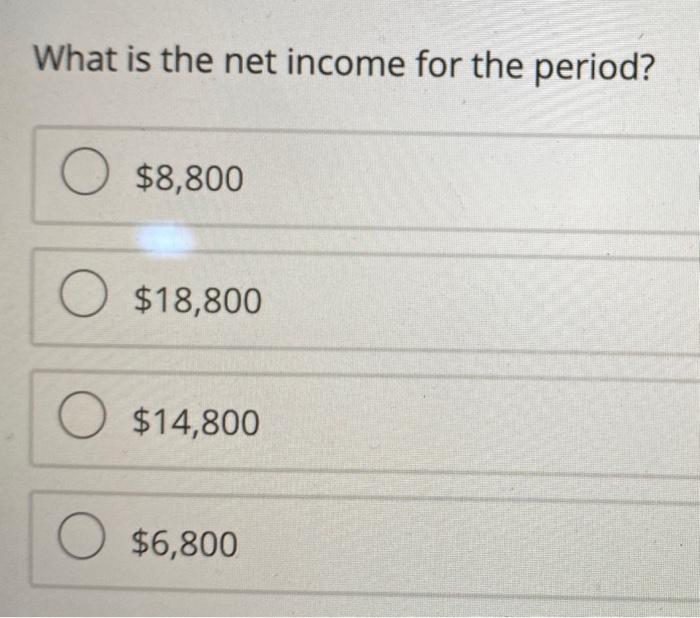

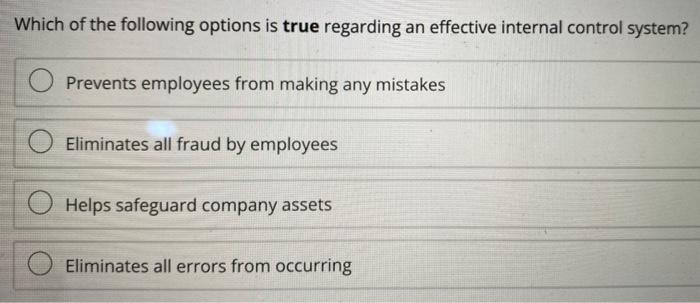

Below is information for Company A and Company B: Given this information, which company appears to have increased their borrowing compared to the prior year? Company A Company B Company A sells a highly profitable product as compared to Company B. Both Company A and Company B are similarly leveraged and have comparable efficiency. Which company is likely to have the higher ROE? Company A Company B Company A and Company B will have the same ROE. There is not enough information to determine the answer. Below is select account information for Leah Co - Cash: 5,000 - Accounts payable: 6,000 - Service revenue: 12,000 - Inventory: 7,000 - Advertising expense: 1,000 Equipment: 20,000 - Common stock: 25,000 - Notes payable: 12,000 - Accounts receivable: 8,000 - Utilities expense: 800 - Salaries and wages expense: 3,400 What is the net income for the period? $8,800 What is the net income for the period? $8,800 $18,800 $14,800 $6,800 Which of the following options is true regarding an effective internal control system? Prevents employees from making any mistakes Eliminates all fraud by employees Helps safeguard company assets Eliminates all errors from occurring

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts