Question: please help with accounting asap :) 1 question with 3 parts Which of the following is an example of a product cost when manufacturing products?

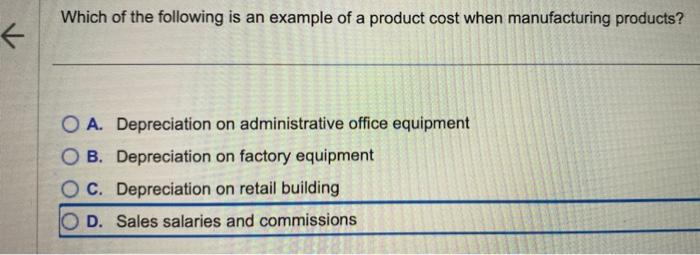

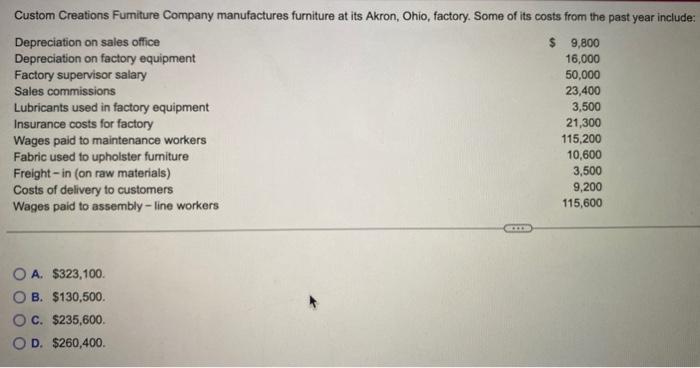

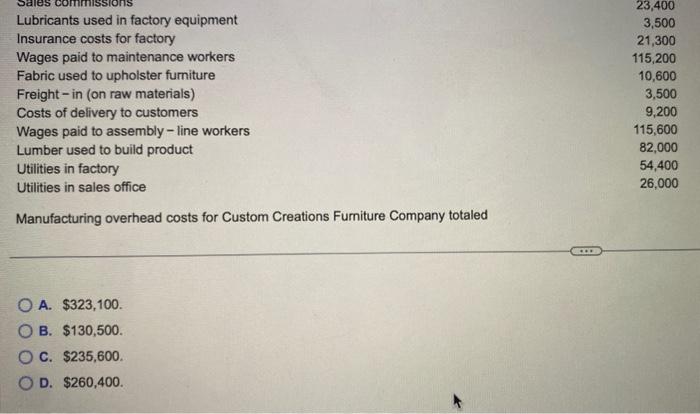

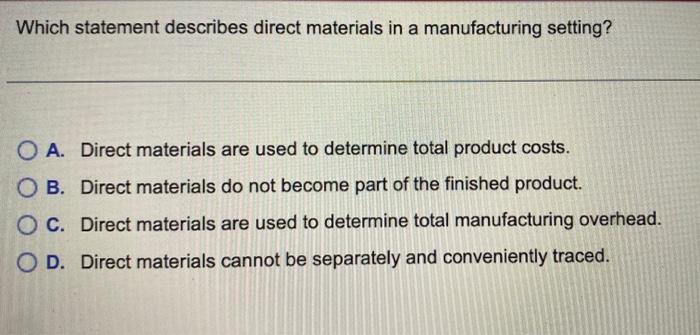

Which of the following is an example of a product cost when manufacturing products? A. Depreciation on administrative office equipment B. Depreciation on factory equipment C. Depreciation on retail building D. Sales salaries and commissions A. $323,100. B. $130,500. c. $235,600. D. $260,400. A. $323,100. B. $130,500. C. $235,600. D. $260,400. Which statement describes direct materials in a manufacturing setting? A. Direct materials are used to determine total product costs. B. Direct materials do not become part of the finished product. C. Direct materials are used to determine total manufacturing overh D. Direct materials cannot be separately and conveniently traced

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts