Question: please help with Accounting..thank you Presented below are the comparative income statements for Watson Industries for the years 2018 and 2019, prior to the information

please help with Accounting..thank you

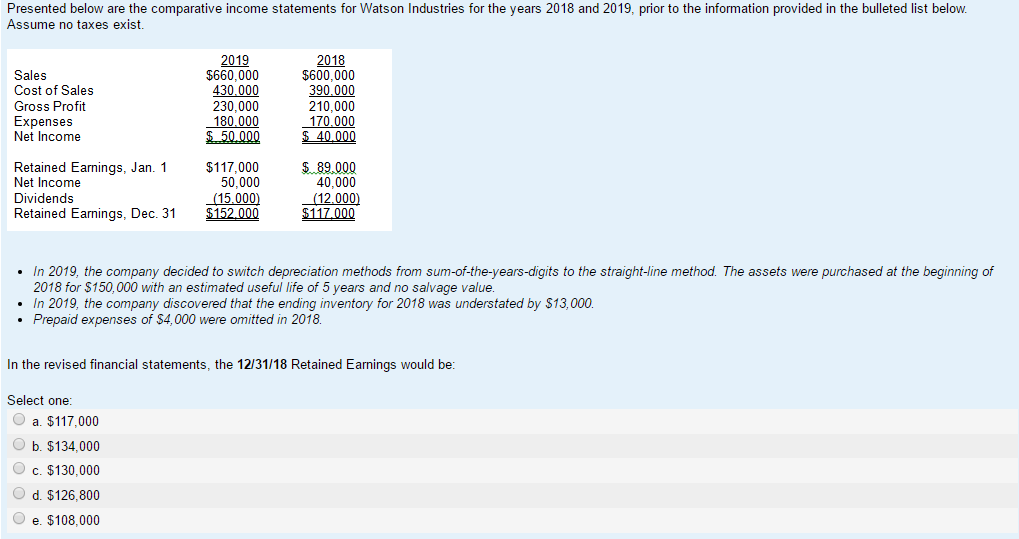

Presented below are the comparative income statements for Watson Industries for the years 2018 and 2019, prior to the information provided in the bulleted list below. Assume no taxes exist. In 2019, the company decided to switch depreciation methods from sum-of-the-years-digits to the straight-line method. The assets were purchased at the beginning of 2018 for exist150,000 with an estimated useful life of 5 years and no salvage value. In 2019, the company discovered that the ending inventory for 2018 was understated by exist13,000. Prepaid expenses of exist4,000 were omitted in 2018. In the revised financial statements, the 12/31/18 Retained Earnings would be: Select one: a. exist117,000 b. exist134,000 c. exist130,000 d. exist126, 800 e. exist108,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts