Question: Please help with adjusted Trail balance using information from journal entry. Thank You Trial Balance At December 31, 2019 Debit Credit 98,641 Adjustments Debit Credit

Please help with adjusted Trail balance using information from journal entry. Thank You

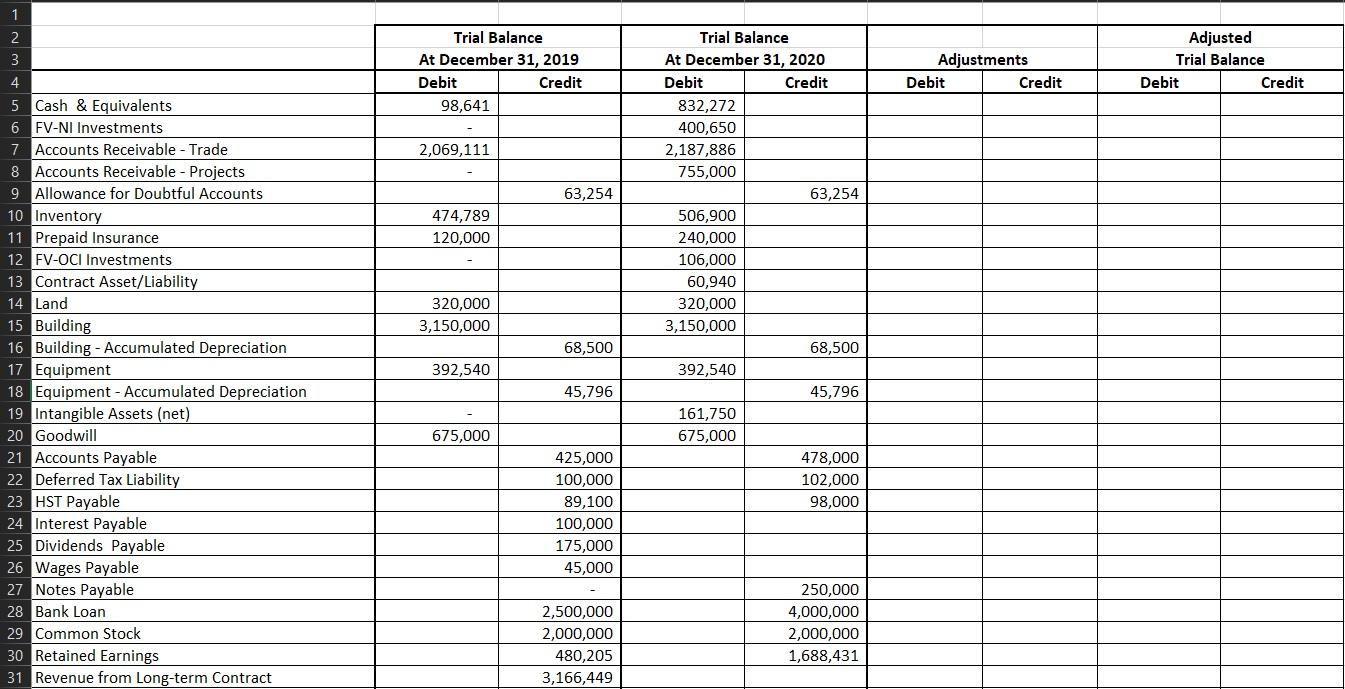

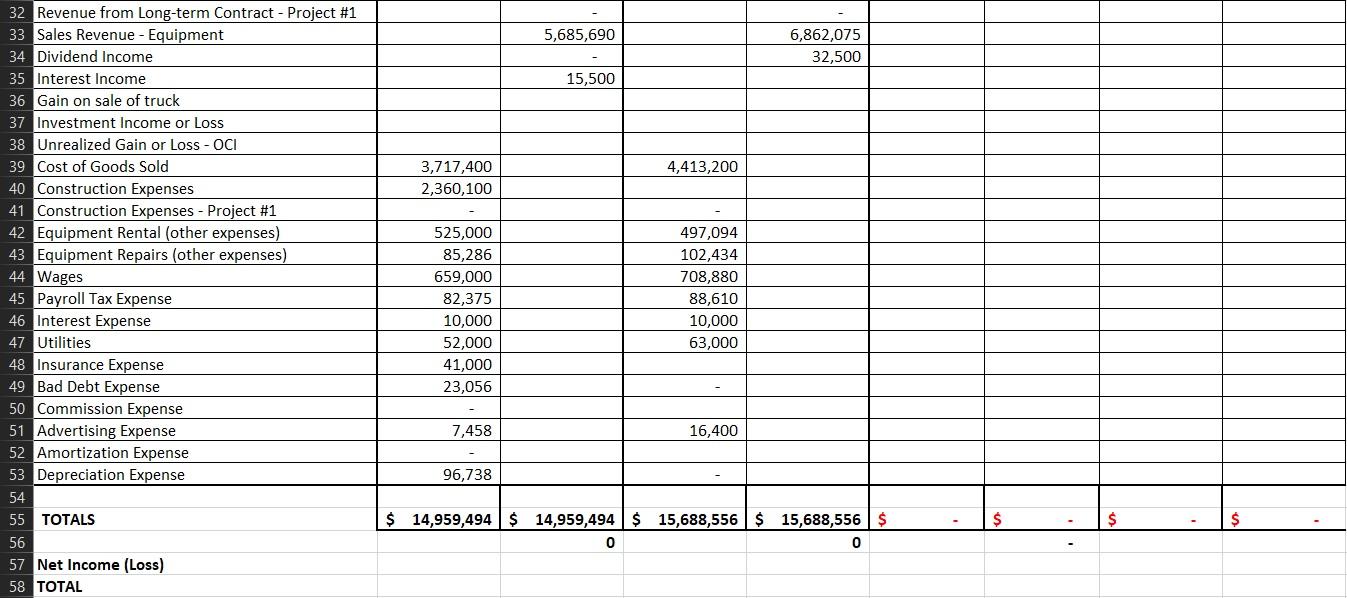

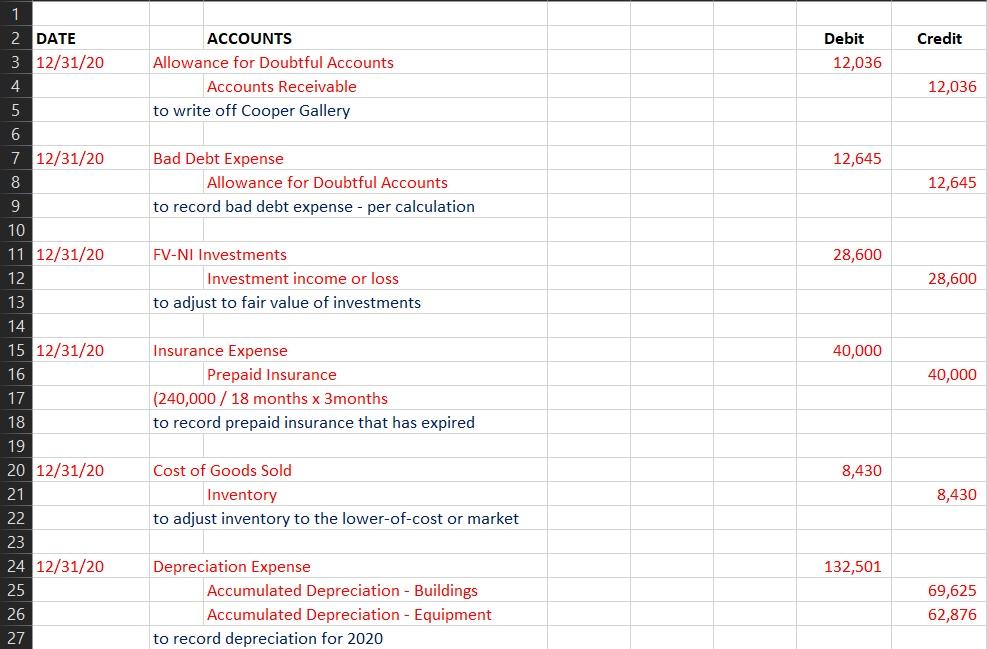

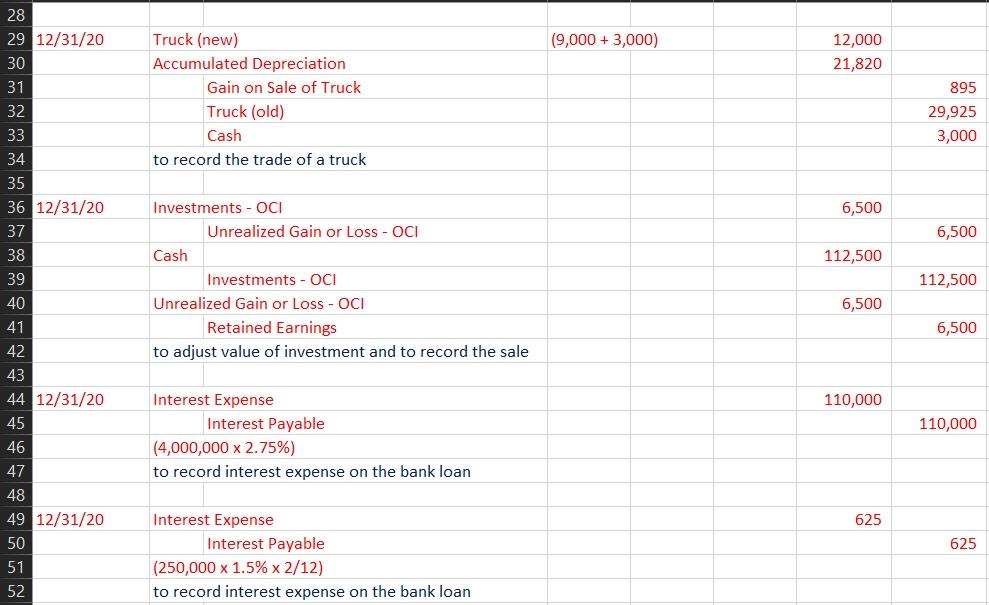

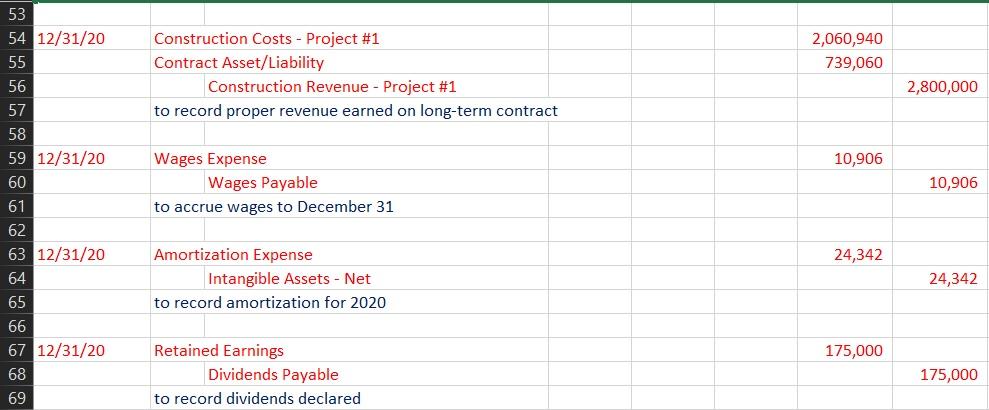

Trial Balance At December 31, 2019 Debit Credit 98,641 Adjustments Debit Credit Adjusted Trial Balance Debit Credit 2,069,111 63,254 474,789 120,000 1 2 3 4 5 Cash & Equivalents 6 FV-NI Investments 7 Accounts Receivable - Trade 8 Accounts Receivable - Projects 9 Allowance for Doubtful Accounts 10 Inventory 11 Prepaid Insurance 12 FV-OCI Investments 13 Contract Asset/Liability 14 Land 15 Building 16 Building - Accumulated Depreciation 17 Equipment 18 Equipment - Accumulated Depreciation 19 Intangible Assets (net) 20 Goodwill 21 Accounts Payable 22 Deferred Tax Liability 23 HST Payable 24 Interest Payable 25 Dividends Payable 26 Wages Payable 27 Notes Payable 28 Bank Loan 29 Common Stock 30 Retained Earnings 31 Revenue from Long-term Contract Trial Balance At December 31, 2020 Debit Credit 832,272 400,650 2,187,886 755,000 63,254 506,900 240,000 106,000 60,940 320,000 3,150,000 68,500 392,540 45,796 161,750 675,000 478,000 102,000 98,000 320,000 3,150,000 68,500 392,540 45,796 675,000 425,000 100,000 89,100 100,000 175,000 45,000 2,500,000 2,000,000 480,205 3,166,449 250,000 4,000,000 2,000,000 1,688,431 5,685,690 6,862,075 32,500 15,500 4,413,200 3,717,400 2,360,100 32 Revenue from Long-term Contract - Project #1 33 Sales Revenue - Equipment 34 Dividend Income 35 Interest Income 36 Gain on sale of truck 37 Investment Income or Loss 38 Unrealized Gain or Loss - OCI 39 Cost of Goods Sold 40 Construction Expenses 41 Construction Expenses - Project #1 42 Equipment Rental (other expenses) 43 Equipment Repairs (other expenses) 44 Wages 45 Payroll Tax Expense 46 Interest Expense 47 Utilities 48 Insurance Expense 49 Bad Debt Expense 50 Commission Expense 51 Advertising Expense 52 Amortization Expense 53 Depreciation Expense 54 55 TOTALS 56 57 Net Income (Loss) 58 TOTAL 525,000 85,286 659,000 82,375 10,000 52,000 41,000 23,056 497,094 102,434 708,880 88,610 10,000 63,000 7,458 16,400 96,738 $ 14,959,494 $ 14,959,494 $ 15,688,556 $ 15,688,556 $ 0 0 Debit Credit 12,036 1 2 DATE 3 12/31/20 4 5 6 7 12/31/20 8 ACCOUNTS Allowance for Doubtful Accounts Accounts Receivable to write off Cooper Gallery 12,036 12,645 Bad Debt Expense Allowance for Doubtful Accounts to record bad debt expense - per calculation 12,645 28,600 FV-NI Investments Investment income or loss to adjust to fair value of investments 28,600 40,000 40,000 9 10 11 12/31/20 12 13 14 15 12/31/20 16 17 18 19 20 12/31/20 21 22 23 24 12/31/20 25 26 27 Insurance Expense Prepaid Insurance (240,000 / 18 months x 3months to record prepaid insurance that has expired 8,430 Cost of Goods Sold Inventory to adjust inventory to the lower-of-cost or market 8,430 132,501 Depreciation Expense Accumulated Depreciation - Buildings Accumulated Depreciation - Equipment to record depreciation for 2020 69,625 62,876 (9,000 + 3,000) 12,000 21,820 Truck (new) Accumulated Depreciation Gain on Sale of Truck Truck (old) Cash to record the trade of a truck 895 29,925 3,000 6,500 6,500 112,500 28 29 12/31/20 30 31 32 33 34 35 36 12/31/20 37 38 39 40 41 42 43 44 12/31/20 45 46 47 48 49 12/31/20 50 51 52 Investments - OCI Unrealized Gain or Loss - OCI Cash Investments - OCI Unrealized Gain or Loss - OCI Retained Earnings to adjust value of investment and to record the sale 112,500 6,500 6,500 110,000 110,000 Interest Expense Interest Payable (4,000,000 x 2.75%) to record interest expense on the bank loan 625 625 Interest Expense Interest Payable (250,000 x 1.5% x 2/12) to record interest expense on the bank loan 2,060,940 739,060 Construction Costs - Project #1 Contract Asset/Liability Construction Revenue - Project #1 to record proper revenue earned on long-term contract 2,800,000 10,906 53 54 12/31/20 55 56 57 58 59 12/31/20 60 61 62 63 12/31/20 64 65 66 67 12/31/20 68 69 Wages Expense Wages Payable to accrue wages to December 31 10,906 24,342 Amortization Expense Intangible Assets - Net to record amortization for 2020 24,342 175,000 Retained Earnings Dividends Payable to record dividends declared 175,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts