Question: please help with all 14 adjustments for journal entries, dont skip any please!!! for accounting 2301 i just need help for journal entry, what do

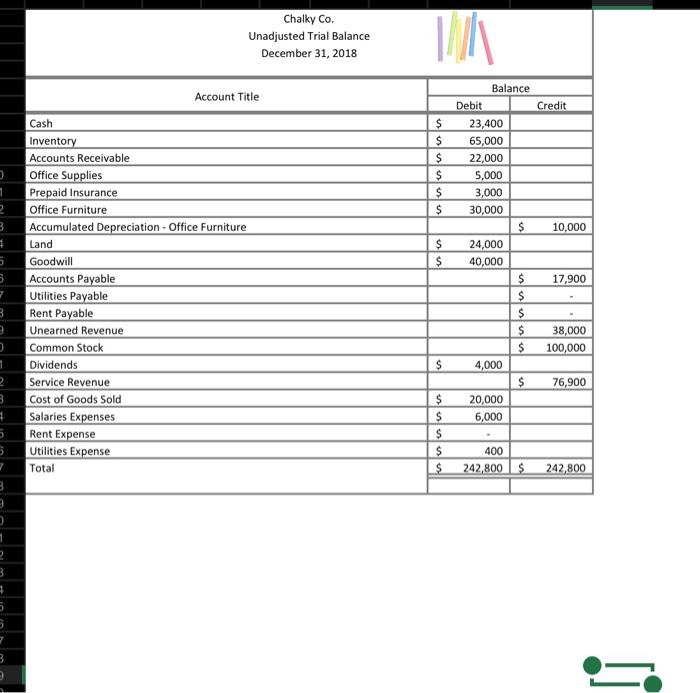

You are hired as a new staff accountant for Chalky Co, a reputable chalkboard company, that specialises in selling and installing chalkboards. Your first task is to peepare the financial suatements for December 31, 2018. provided with the unadjusted trai balance, and but need to make the following adjusting entries. 1. Chalky Co audited their mpply inventory and realzed that it erily had $1,000 of eflice supplies on tiand. 2. Previously Chalky Co had purchased affice furniture. The office furniture was purchased for $30,000. Chalky Co. expects the furniture to lass 10 years and value $0 at the end of its iseful You notice that monthly depreciation expense for 2018 has not been recorded. They will need to book 12 months of depreciation expense in December. 3. Aa insurance pelicy was purchased for $3,000. The policy 4 erm was for Aaril 20s8 - Mar 2019 . 4. Star Company paid for $00 chalkboards last month for $50 each. These chalkboards were shipped out in December, but not yet recorded. The shipping cort was already included in the selling price. The cost of each chak board to Chalky Co. is $10 each 5. Chatry Co provided installation service to Red Bam inc for $78,000. Chalky Co, hsued an invoice to Red Barn ine with payment terms 5/10 net 30 . 6. Pretty Office Cleaning. a cleaneng service, provided services to Chathy Co. during Becember. An invoice was received for the amount of $12,000 due in 30 days. 7. Chalixy Ca conducted a physical tesnh of their invedtery. The value of turtent inventory was $39,000. (physical inventory count revealed an imventory shortage) 8. Based on previous experience, Chalky Co estimates that 5$ of its accounts receivable balance will go uncellected. 9. Chalky Co aquired 80 Company, smaller company, in 2017 for $200,000. At the time of acquisition, BD Company had net assets of $100,000. The curtent value of BD Company is $188,000 0n 2018]. 10. Chalky Co. offers warranty on the services it provides. Based on the companies past expenence they estimate warranty expense to be 5% of total service revenue. Since this it an entimate, the company rounds the ameuns to closest thousand dollars. 11. Chalfy Co. is wanting to expand its operations and needs additional funding. As a result, they decide to sell an additional 10,000 shares at a market price of $20. The par value of the stock is $1 12. Chaky Co. purchased 1,000 of its own shares at the market price of 335.00 13. Rent expense is $2,000 manthly, but has not yet been paid for December. 14. Two utilities impoices were received in the mail on Dec 29th, they have not been paid, or recorded on the general ledger. The total amount for these 2 unpaid bills is $600. Chalky Co. Unadjusted Trial Balance December 31,2018 You are hired as a new staff accountant for Chalky Co, a reputable chalkboard company, that specialises in selling and installing chalkboards. Your first task is to peepare the financial suatements for December 31, 2018. provided with the unadjusted trai balance, and but need to make the following adjusting entries. 1. Chalky Co audited their mpply inventory and realzed that it erily had $1,000 of eflice supplies on tiand. 2. Previously Chalky Co had purchased affice furniture. The office furniture was purchased for $30,000. Chalky Co. expects the furniture to lass 10 years and value $0 at the end of its iseful You notice that monthly depreciation expense for 2018 has not been recorded. They will need to book 12 months of depreciation expense in December. 3. Aa insurance pelicy was purchased for $3,000. The policy 4 erm was for Aaril 20s8 - Mar 2019 . 4. Star Company paid for $00 chalkboards last month for $50 each. These chalkboards were shipped out in December, but not yet recorded. The shipping cort was already included in the selling price. The cost of each chak board to Chalky Co. is $10 each 5. Chatry Co provided installation service to Red Bam inc for $78,000. Chalky Co, hsued an invoice to Red Barn ine with payment terms 5/10 net 30 . 6. Pretty Office Cleaning. a cleaneng service, provided services to Chathy Co. during Becember. An invoice was received for the amount of $12,000 due in 30 days. 7. Chalixy Ca conducted a physical tesnh of their invedtery. The value of turtent inventory was $39,000. (physical inventory count revealed an imventory shortage) 8. Based on previous experience, Chalky Co estimates that 5$ of its accounts receivable balance will go uncellected. 9. Chalky Co aquired 80 Company, smaller company, in 2017 for $200,000. At the time of acquisition, BD Company had net assets of $100,000. The curtent value of BD Company is $188,000 0n 2018]. 10. Chalky Co. offers warranty on the services it provides. Based on the companies past expenence they estimate warranty expense to be 5% of total service revenue. Since this it an entimate, the company rounds the ameuns to closest thousand dollars. 11. Chalfy Co. is wanting to expand its operations and needs additional funding. As a result, they decide to sell an additional 10,000 shares at a market price of $20. The par value of the stock is $1 12. Chaky Co. purchased 1,000 of its own shares at the market price of 335.00 13. Rent expense is $2,000 manthly, but has not yet been paid for December. 14. Two utilities impoices were received in the mail on Dec 29th, they have not been paid, or recorded on the general ledger. The total amount for these 2 unpaid bills is $600. Chalky Co. Unadjusted Trial Balance December 31,2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts