Question: Please help with all 3! McDonald's has an expected return of 12% and a standard deviation of 20%. The risk-free rate for both borrowing and

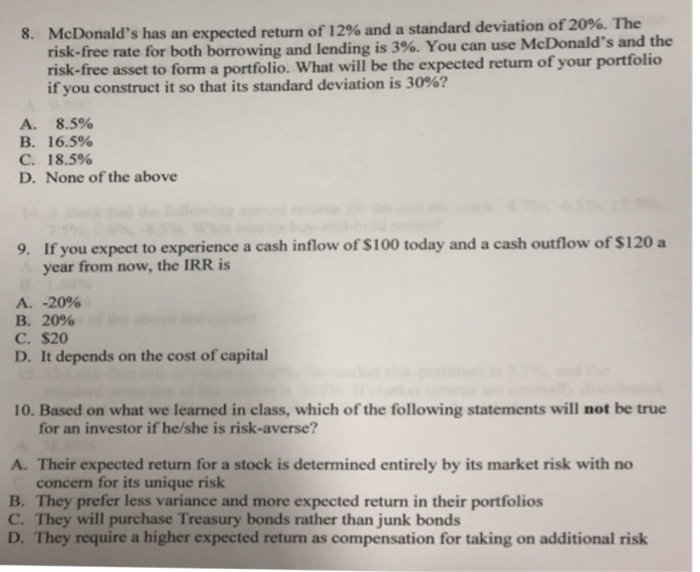

McDonald's has an expected return of 12% and a standard deviation of 20%. The risk-free rate for both borrowing and lending is 3%. You can use McDonald's and the risk-free asset to form a portfolio. What will be the expected return of your portfolio if you construct it so that its standard deviation is 30%? 8, A. 8.5% B. 16.5% C. 18.5% D. None of the above 9. If you expect to experience a cash inflow of $100 today and a cash outflow of $120 a year from now, the IRR is . -2096 B, 2090 C. $20 D. It depends on the cost of capital 10. Based on what we learned in class, which of the following statements will not be true for an investor if he/she is risk-averse? A. Their expected return for a stock is determined entirely by its market risk with no concern for its unique risk B. They prefer less variance and more expected return in their portfolios C. They will purchase Treasury bonds rather than junk bonds D. They require a higher expected return as compensation for taking on additional risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts