Question: please help with all blanks with X's by them Determine Marginal Tax Rate and the Tax on Operating Profit Amgen Inc. reported the following in

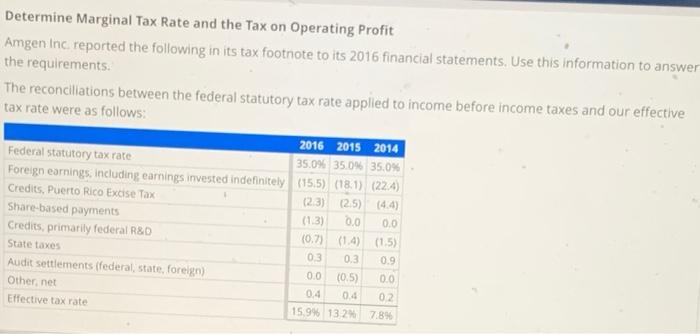

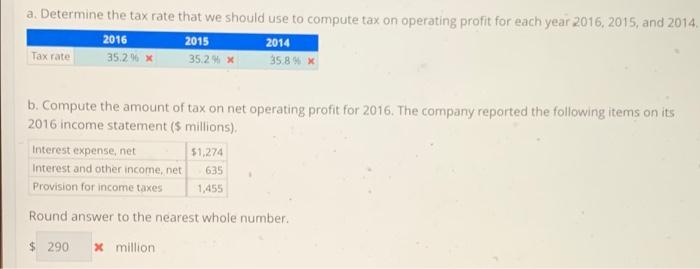

Determine Marginal Tax Rate and the Tax on Operating Profit Amgen Inc. reported the following in its tax footnote to its 2016 financial statements. Use this information to answer the requirements. The reconciliations between the federal statutory tax rate applied to income before income taxes and our effective tax rate were as follows: 2016 2015 2014 Federal statutory tax rate 35.0% 35.0% 35.0% Foreign earnings including earnings invested indefinitely (15,5) (18.1) (224) Credits, Puerto Rico Excise Tax (23) (2.5) (4.4) Share-based payments (13) 0.0 0.0 Credits, primarily federal R&D (0.7) (1.4) (1.5) State taxes 03 0.3 0.9 Audit Settlements (federal, state, foreign) 0.0 0.0 Othernet 0.4 04 02 Effective tax rate 15.9% 13 27.8% (0.5) a. Determine the tax rate that we should use to compute tax on operating profit for each year 2016, 2015, and 2014 2014 Tax rate 35.2 % x 35,2% X 35.8% 2016 2015 b. Compute the amount of tax on net operating profit for 2016. The company reported the following items on its 2016 income statement (5 millions), Interest expense, net 51.274 Interest and other income, net Provision for income taxes 1,455 635 Round answer to the nearest whole number 290 x million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts