Question: Please help with all but question 10, thank you. Problem Set 1 Directions: If required, solve all questions formulaically unless use of a financial calculator

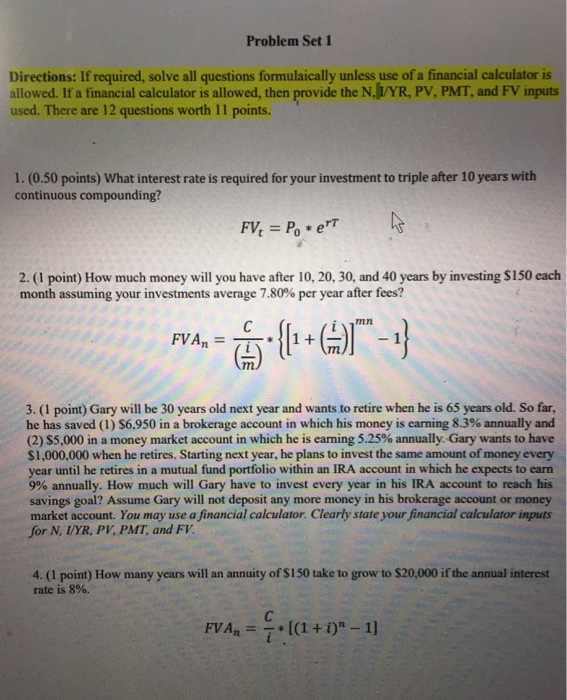

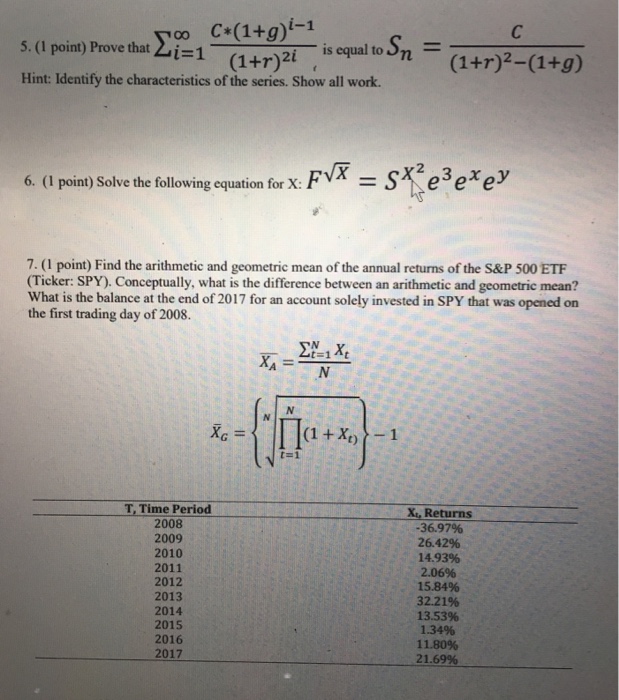

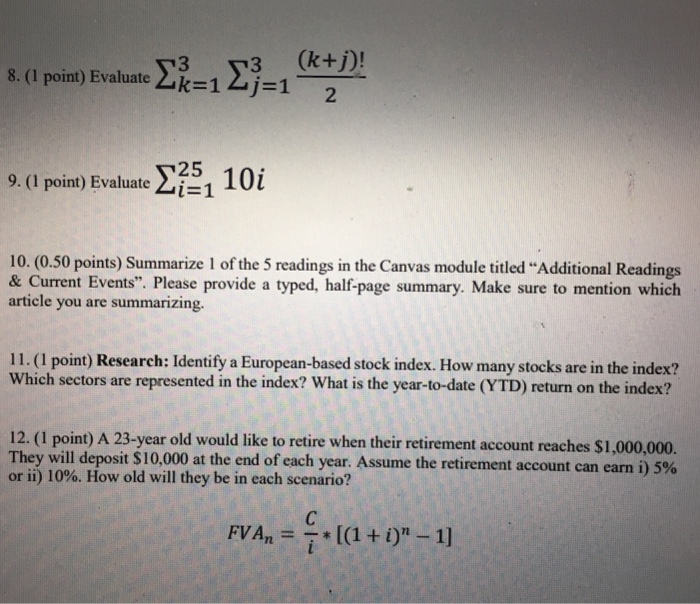

Problem Set 1 Directions: If required, solve all questions formulaically unless use of a financial calculator is allowed. If a financial calculator is allowed, then provide the N, UYR, PV, PMT, and FV inputs used. There are 12 questions worth 11 points 1. (0.50 points) What interest rate is required for your investment to triple after 10 years with continuous compounding? 2. (1 point) How much money will you have after 10, 20, 30, and 40 years by investing S150 each month assuming your investments average 7.80% per year after fees? 3. (I point) Gary will be 30 years old next year and wants to retire when he is 65 years old. So far, he has saved (1) S6950 in a brokerage account in which his money is earning 83% annually and (2) $5,000 in a money market account in which he is earning 5.25% annually, Gary wants to have $1,000,000 when he retires. Starting next year, he plans to invest the same amount of money every year until he retires in a mutual fund portfolio within an IRA account in which he expects to earr 9% annually. How much will Gary have to invest every year in his IRA account to reach his savings goal? Assume Gary will not deposit any more money in his brokerage account or money market account. You may use a financial calculator. Clearly state your financial calculator inputs for N, IYR, PV PMT, and FV 4. (1 point) How many years will an annuity of S150 take to grow to $20,000 if the annual interest rate is 8%. FVAn--* [(1 + i)"-1]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts