Question: Please help with all missing fields. Thanks! Requlred Informatlon Problem 6-4A Preparing a bank reconciliation and recording adjustments LO P3 The following information applies to

Please help with all missing fields. Thanks!

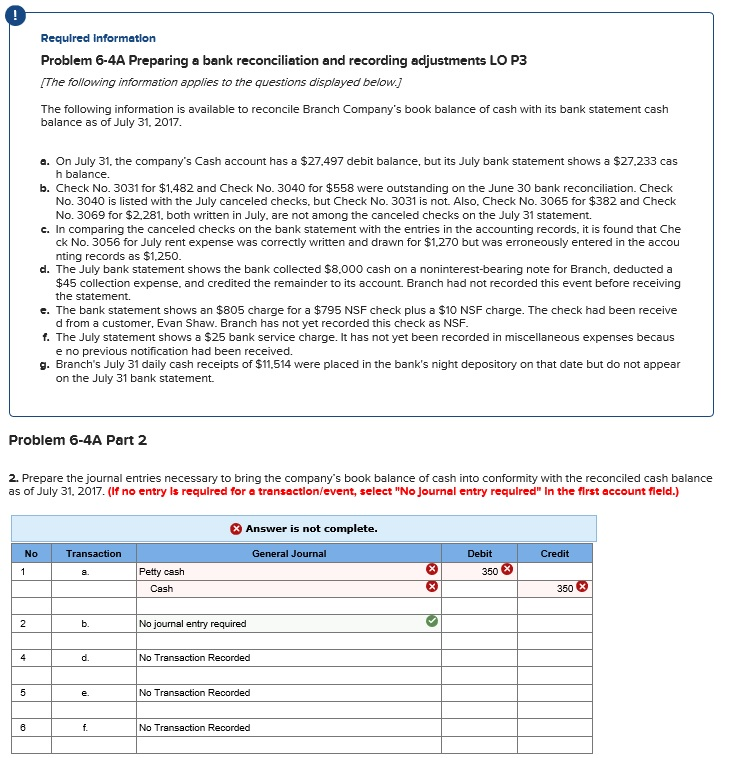

Requlred Informatlon Problem 6-4A Preparing a bank reconciliation and recording adjustments LO P3 The following information applies to the questions displayed below. The following information is available to reconcile Branch Company's book balance of cash with its bank statement cash balance as of July 31, 2017 a. On July 31, the company's Cash account has a $27,497 debit balance, but its July bank statement shows a $27.233 cas h balance b. Check No. 3031 for $1,482 and Check No. 3040 for $558 were outstanding on the June 30 bank reconciliation. Check No. 3040 is listed with the July canceled checks, but Check No. 3031 is not. Also, Check No. 3065 for $382 and Check No. 3069 for $2,281, both written in July, are not among the canceled checks on the July 31 statement. c. In comparing the canceled checks on the bank statement with the entries in the accounting records, it is found that Che ck No. 3056 for July rent expense was correctly written and drawn for $1,270 but was erroneously entered in the accou nting records as $1,250 d. The July bank statement shows the bank collected $8,000 cash on a noninterest-bearing note for Branch, deducted a $45 collection expense, and credited the remainder to its account. Branch had not recorded this event before receiving e. The bank statement shows an $805 charge for a $795 NSF check plus a $10 NSF charge. The check had been receive f. The July statement shows a $25 bank service charge. It has not yet been recorded in miscellaneous expenses becaus g. Branch's July 31 daily cash receipts of $11,514 were placed in the bank's night depository on that date but do not appear the statement. d from a customer, Evan Shaw. Branch has not yet recorded this check as NSF e no previous notification had been received. on the July 31 bank statement. Problem 6-4A Part 2 2. Prepare the journal entries necessary to bring the company's book balance of cash into conformity with the reconciled cash balance as of July 31, 2017. (If no entry ls required for a transaction/event, select "No Journal entry required" In the first account field.) Answer is not complete. Transaction General Journal Debit Credit Pety cash 350 Cash 350 b. No journal entry required d. No Transaction Recorded No Transaction Recorded No Transaction Recorded

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts