Question: please help with all parts Data table (Click on the icon here in order to copy the contents of the data table below into a

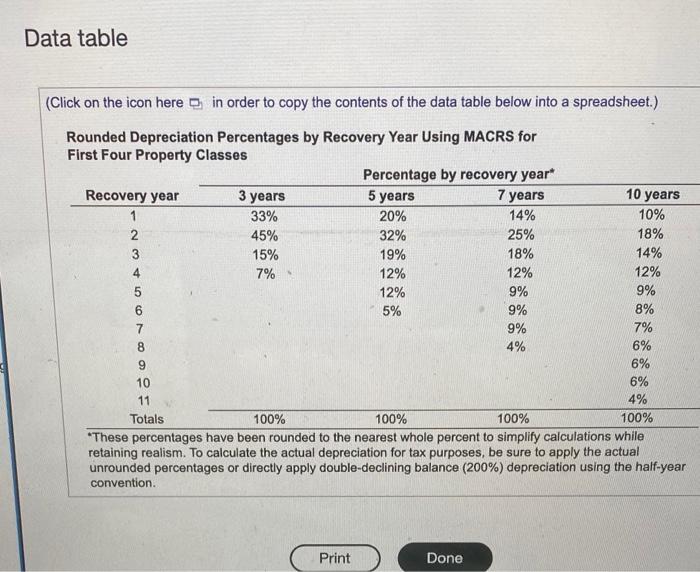

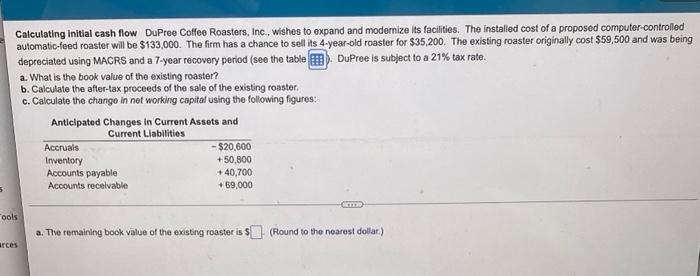

Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year" Recovery year 3 years 5 years 7 years 10 years 1 33% 20% 14% 10% 2 45% 32% 25% 18% 3 15% 19% 18% 14% 4 7% 12% 12% 12% 5 12% 9% 9% 5% 9% 8% 9% 7% 6% 6% 10 6% 11 4% Totals 100% 100% 100% 100% *These percentages en rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year convention OOOOO 4% Print Done Calculating initial cash flow DuPree Coffee Roasters, Inc., wishes to expand and modernize its facilities. The installed cost of a proposed computer-controlled automatic-feed roaster will be $133,000. The firm has a chance to sell its 4-year-old roastor for $35,200. The existing roaster originally cost $59,500 and was being depreciated using MACRS and a 7-year recovery period (see the table. Dupree is subject to a 21% tax rate. a. What is the book value of the existing roaster? b. Calculate the after-tax proceeds of the sale of the existing roaster c. Calculate the change in not working capital using the following figures: Anticipated Changes in Current Assets and Current Liabilities Accruals $20,600 Inventory +50,800 Accounts payable + 40,700 Accounts receivable +69,000 5 ools a. The remaining book value of the existing roaster is $(Round to the nearest dollar) ances

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts