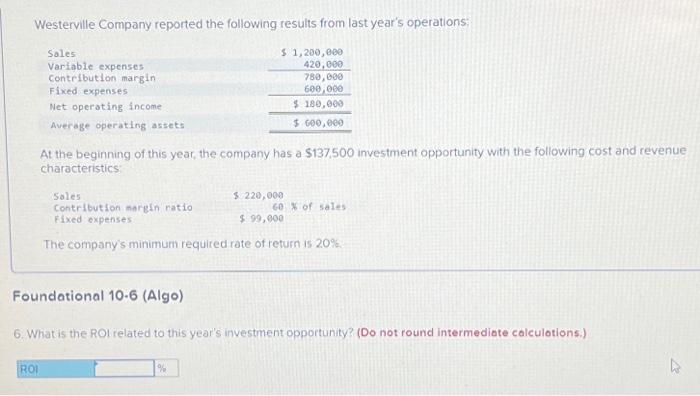

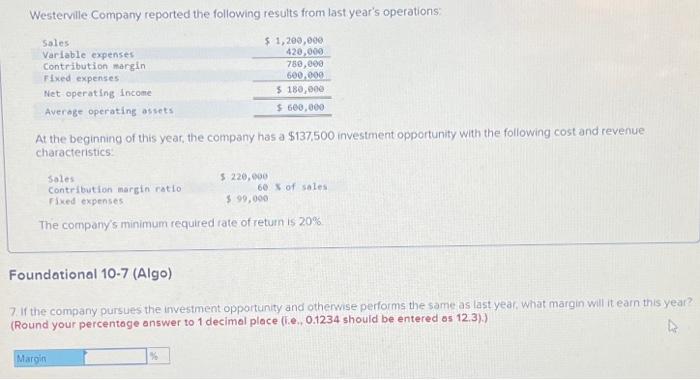

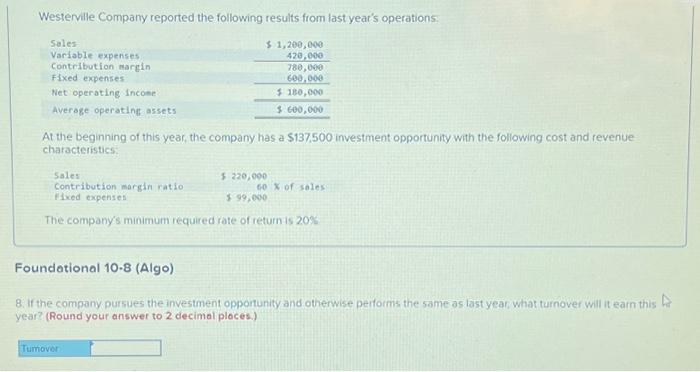

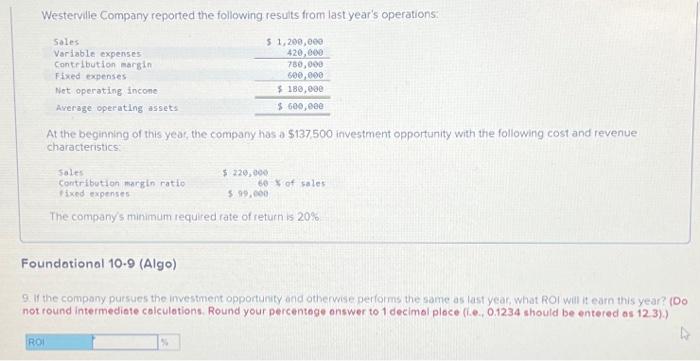

Question: please help with all questions for studying. i will hit thumbs up!!!! thank you!! Westerville Company reported the following results from last year's operations: At

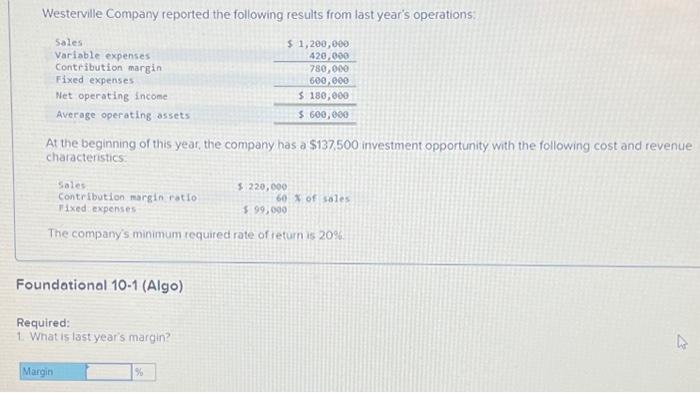

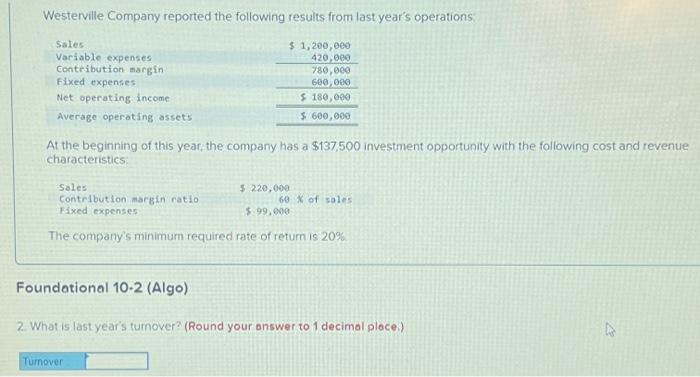

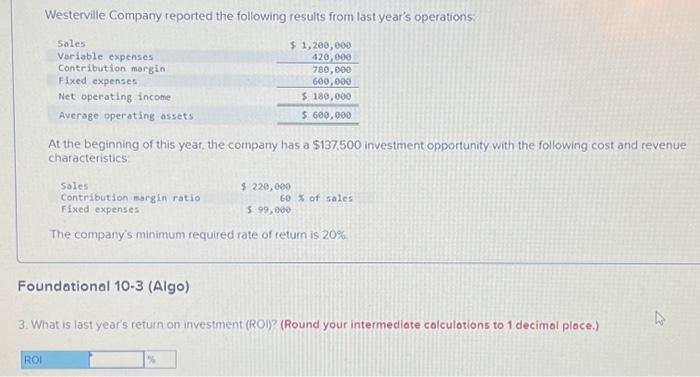

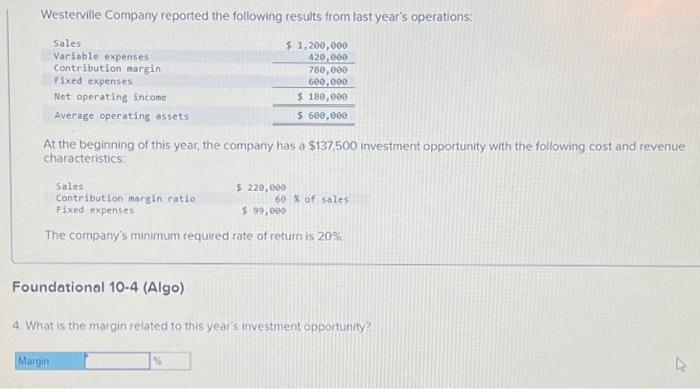

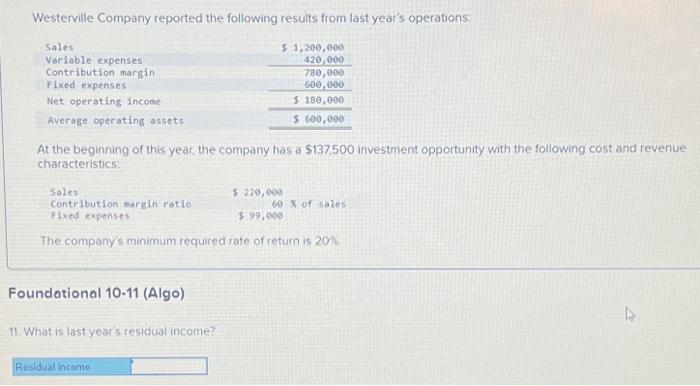

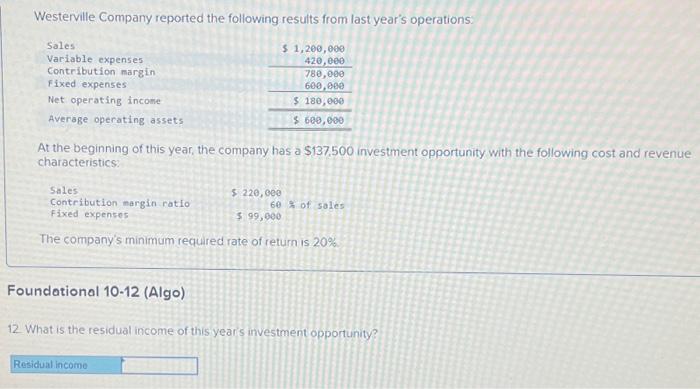

Westerville Company reported the following results from last year's operations: At the beginning of this year, the company has a $137,500 investment opportunity with the following cost and revenue characteristics: The company's minimum required rate of return is 20% Foundational 10-3 (Algo) 3. What is last year's return on investment (ROI)? (Round your intermediate colculotions to 1 decimal ploce.) Westerville Company reported the following results from last year's operations. At the beginning of this year, the company has a $137,500 investment opportunity with the following cost and revenue characteristics: The company's minimum required rate of return is 20% Foundational 10-11 (Algo) 11. What is last year's residual income? Westerville Company reported the following results from last year's operations: At the beginning of this year, the company has a $137,500 investment opportunity with the following cost and revenue characteristics: The company's minimum required rate of return is 20% Foundational 10-12 (Algo) 12. What is the residual income of this year's investment opportunity? Westerville Company reported the following results from last year's operations: At the beginning of this year, the company has a $137.500 investment opportunity with the following cost and revenue characteristics. The company's minimum required rate of return is 20% Foundational 10.4 (Algo) 4. What is the margin related to this year's investment opportunity? Westerville Company reported the following results from last year's operations: At the beginning of this year, the company has a $137,500 investment opportunity with the following cost and revenue characteristics: The company's minimum required rate of return is 20% Foundational 10-1 (Algo) Required: 1. What is last year's margin? Westerville Company reported the following results from last year's operations. At the beginning of this year, the company has a $137,500 investment opportunity with the following cost and revenue characteristics: The company's minimum required rate of return is 20% Foundational 10.8 (Algo) 8. If the company pursues the investment oppontunity and otherwise performs the same as last year, what turnover will it earn this year? (Round your answer to 2 decimal ploces.) Westerville Company reported the following results from last year's operations: At the beginning of this year, the company has a $137,500 investment opportunity with the following cost and revenue characteristics: The company's minimum required rate of return is 20% Foundational 10.6 (Algo) 6. What is the ROI related to this year's investment opportunity? (Do not round intermediate calculotions.) Westerville Company reported the following results from last year's operations: At the beginning of this year, the company has a $137,500 investment opportunity with the following cost and revenue characteristics: The company's minimum required rate of return is 20% Foundational 10.9 (Algo) 9. If the company pursues the investment opportunity and otherwise performs the same as last year, what ROI will it earn this year? 100 not round intermediete colculations. Round your percentage onswer to 1 decimol ploce (i.e., 0.1234 should be entered as 12.3).)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts