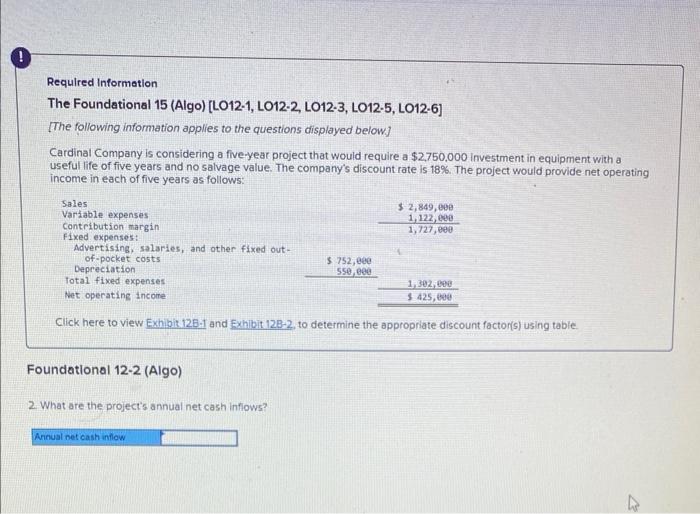

Question: Please help with all Requlred Information The Foundational 15 (Algo) [LO12-1, LO12-2, LO12-3, LO12-5, LO12-6] [he following information applies to the questions displayed below] Cardinal

![LO12-3, LO12-5, LO12-6] [he following information applies to the questions displayed below]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/671893688697d_84767189367ec729.jpg)

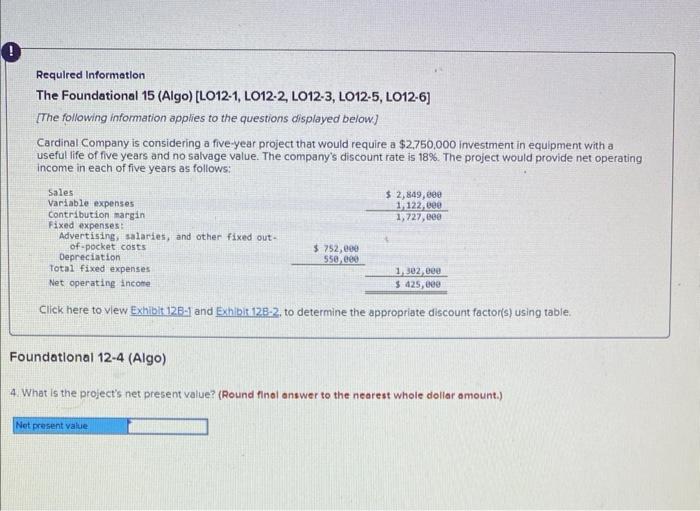

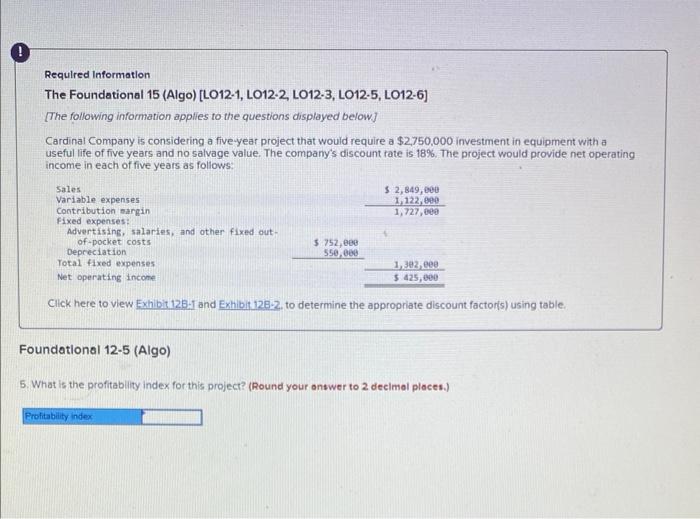

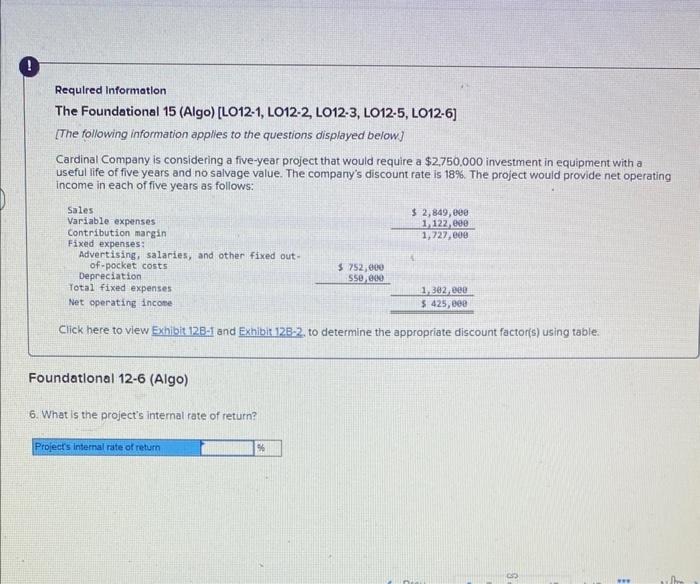

Requlred Information The Foundational 15 (Algo) [LO12-1, LO12-2, LO12-3, LO12-5, LO12-6] [he following information applies to the questions displayed below] Cardinal Company is considering a five-year project that would require a $2,750,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 18%. The project would provide net operating income in each of five years as follows: Click here to view Exhibit 12B-1 and Exhibit 128-2, to determine the appropriate discount factor(s) using table. Foundatlonal 12-2 (Algo) 2. What are the project's annual net cash infiows? Required Information The Foundational 15 (Algo) [LO12-1, LO12-2, LO12-3, LO12-5, LO12-6] [The following information applies to the questions displayed below.] Cardinal Company is considering a five-year project that would require a $2,750.000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 18%. The project would provide net operating income in each of five years as follows: Click here to view Exhibit 128- and Exhibit128-2, to determine the appropriate discount factor(5) using table. Foundatlonal 12-3 (Algo) 3. What is the present value of the project's annual net casti infiows? (Round your flnal answer to the nearest whole dollar amount.) Required Information The Foundational 15 (Algo) [LO12-1, LO12-2, LO12-3, LO12-5, LO12-6] [The following information applies to the questions displayed below] Cardinal Company is considering a five-year project that would require a $2.750.000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 18%. The project would provide net operating income in each of five years as follows: Click here to vlew Exhiblit 12B-1 and to determine the appropriate discount factor(s) using table. Foundational 12-4 (Algo) 4. What is the project's net present value? (Round final answer to the nearest whole dollar amount.) Requlred Information The Foundational 15 (Algo) [LO12-1, LO12-2, LO12-3, LO12-5, LO12-6] [The following information applies to the questions displayed below] Cardinal Company is considering a five-year project that would require a $2,750,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 18%. The project would provide net operating income in each of five years as follows: Click here to view Exhibit 128.I and Exhibit 128-2, to determine the appropriate discount factoris) using table. Foundational 12-5 (Algo) 5. What is the profitablity index for this project? (Round your anewer to 2 decimal places.) Requlred Information The Foundational 15 (Algo) [LO12-1, LO12-2, LO12-3, LO12-5, LO12-6] [The following information applies to the questions displayed below] Cardinal Company is considering a five-year project that would require a $2,750.000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 18%. The project would provide net operating income in each of five years as follows: Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using table. Foundatlonal 12-6 (Algo) 6. What is the project's internal rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts