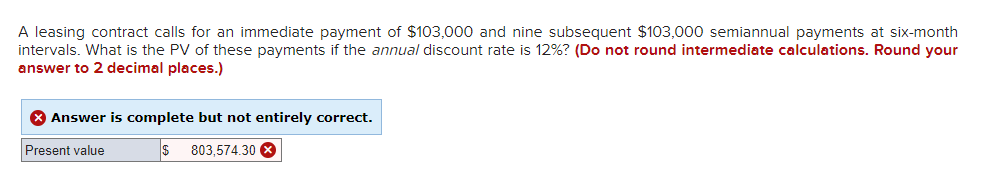

Question: PLEASE HELP WITH ALL WRONG ANSWERS! A leasing contract calls for an immediate payment of $103,000 and nine subsequent $103,000 semiannual payments at six-month intervals.

PLEASE HELP WITH ALL WRONG ANSWERS!

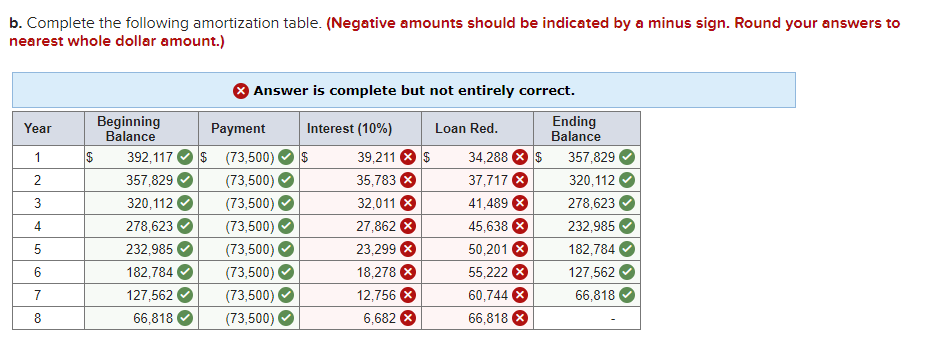

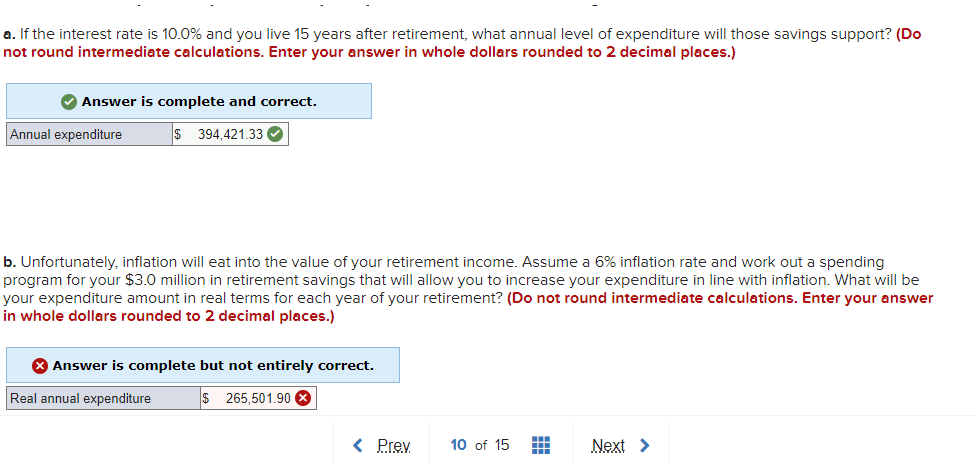

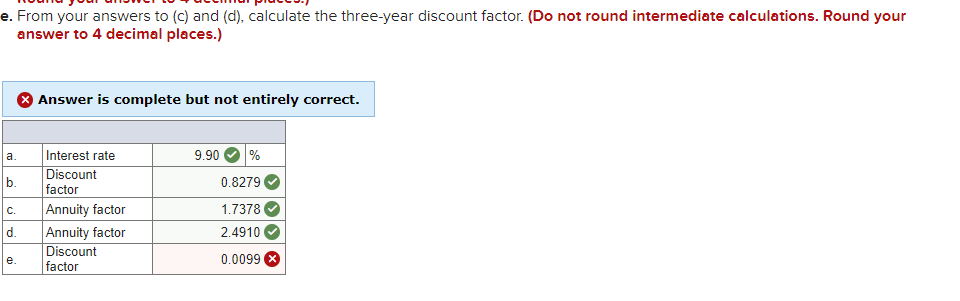

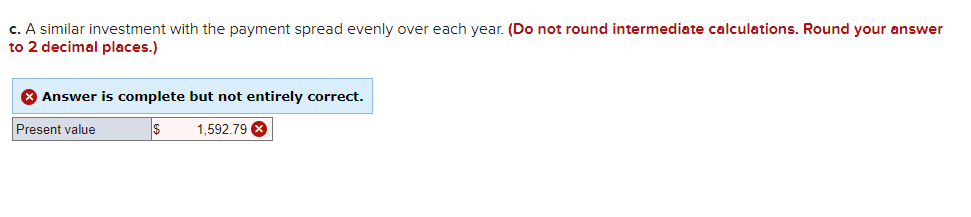

A leasing contract calls for an immediate payment of $103,000 and nine subsequent $103,000 semiannual payments at six-month intervals. What is the PV of these payments if the annual discount rate is 12% ? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. Complete the following amortization table. (Negative amounts should be indicated by a minus sign. Round your answers to nearest whole dollar amount.) a. If the interest rate is 10.0% and you live 15 years after retirement, what annual level of expenditure will those savings support? (Do not round intermediate calculations. Enter your answer in whole dollars rounded to 2 decimal places.) b. Unfortunately, inflation will eat into the value of your retirement income. Assume a 6% inflation rate and work out a spending program for your $3.0 million in retirement savings that will allow you to increase your expenditure in line with inflation. What will be your expenditure amount in real terms for each year of your retirement? (Do not round intermediate calculations. Enter your answer in whole dollars rounded to 2 decimal places.) Answer is complete but not entirely correct. From your answers to (c) and (d), calculate the three-year discount factor. (Do not round intermediate calculations. Round your answer to 4 decimal places.) Answer is complete but not entirely correct. c. A similar investment with the payment spread evenly over each year. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Answer is complete but not entirely correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts