Question: Please help with answer on below question Leah owns a financial services business called Leah Hunter & Associates and lodges a quarterly Business Activity Statement

Please help with answer on below question

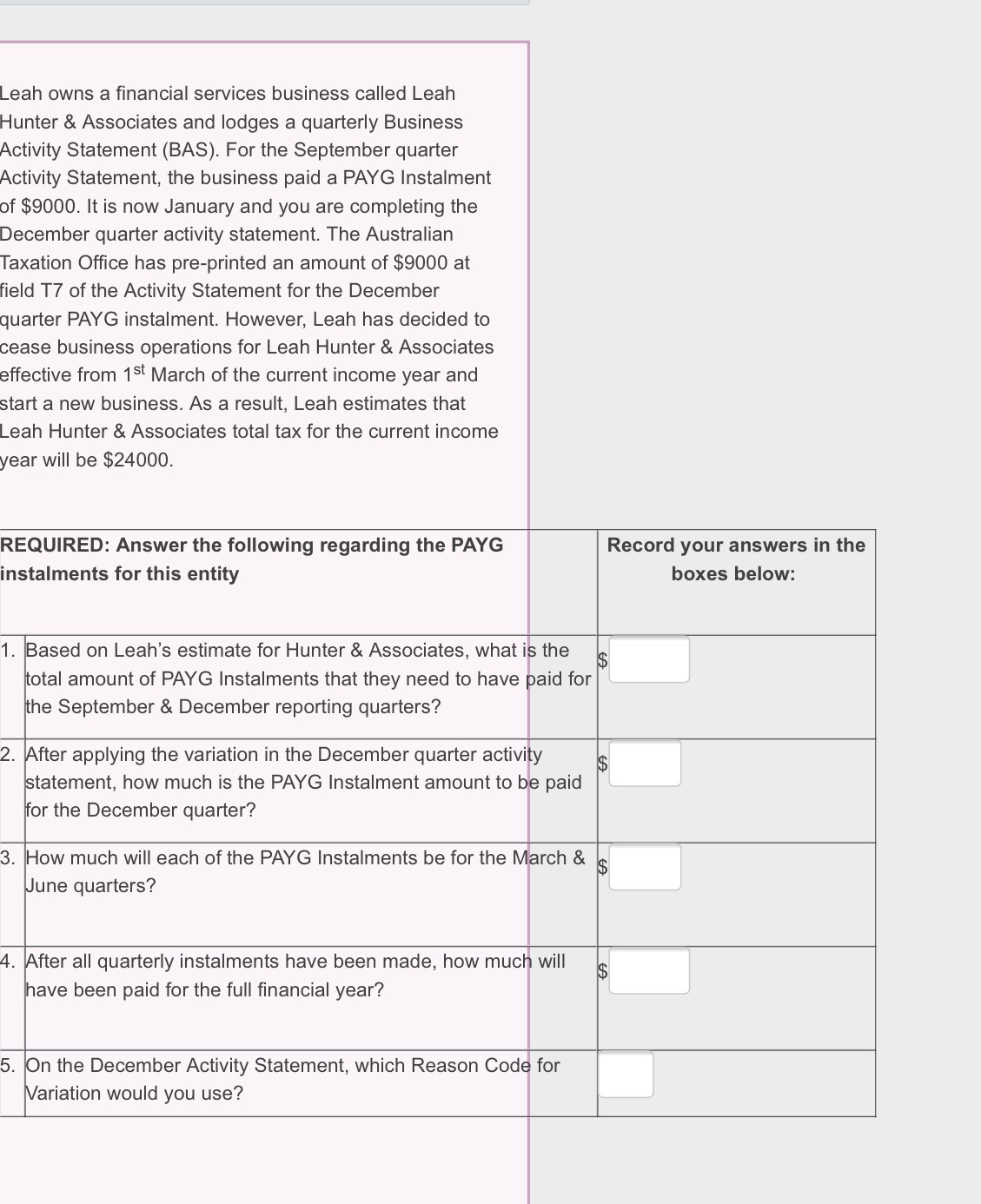

Leah owns a financial services business called Leah Hunter & Associates and lodges a quarterly Business Activity Statement (BAS). For the September quarter Activity Statement, the business paid a PAYG Instalment of $9000. It is now January and you are completing the December quarter activity statement. The Australian Taxation Office has pre-printed an amount of $9000 at ield T7 of the Activity Statement for the December quarter PAYG instalment. However, Leah has decided to cease business operations for Leah Hunter & Associates effective from 1st March of the current income year and start a new business. As a result, Leah estimates that eah Hunter & Associates total tax for the current income year will be $24000. REQUIRED: Answer the following regarding the PAYG Record your answers in the instalments for this entity boxes below: 1. Based on Leah's estimate for Hunter & Associates, what is the $ total amount of PAYG Instalments that they need to have paid for the September & December reporting quarters? 2. After applying the variation in the December quarter activity $ statement, how much is the PAYG Instalment amount to be paid for the December quarter? 3. How much will each of the PAYG Instalments be for the March & June quarters? 4. After all quarterly instalments have been made, how much will $ have been paid for the full financial year? 5. On the December Activity Statement, which Reason Code for Variation would you use

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts