Question: please help with assignement G 1 Background: 3 4 5 6 You have been contracted to do the payroll for a small software development start-up

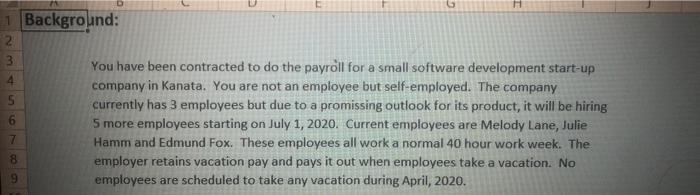

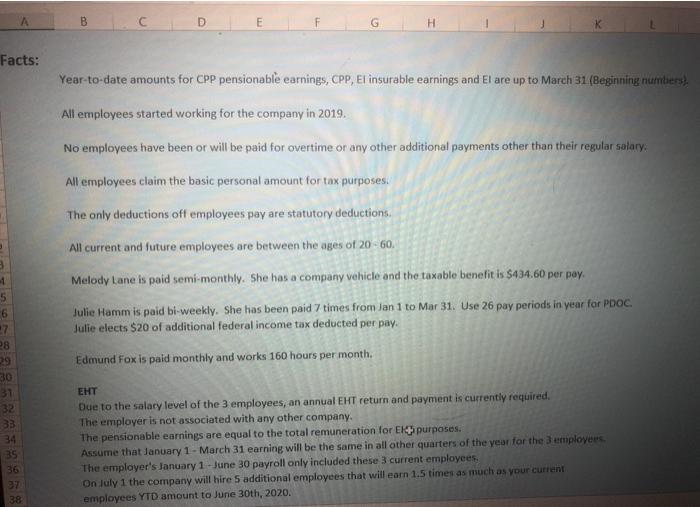

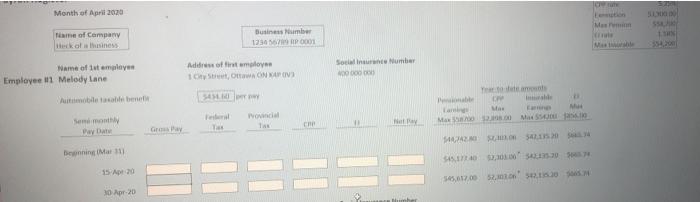

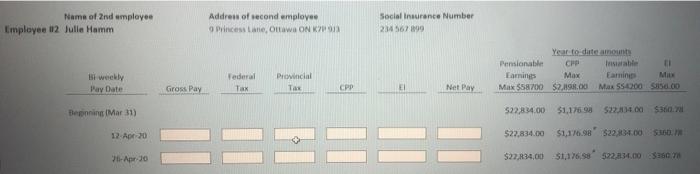

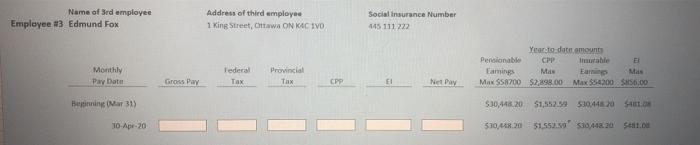

G 1 Background: 3 4 5 6 You have been contracted to do the payroll for a small software development start-up company in Kanata. You are not an employee but self-employed. The company currently has 3 employees but due to a promissing outlook for its product, it will be hiring 5 more employees starting on July 1, 2020. Current employees are Melody Lane, Julie Hamm and Edmund Fox. These employees all work a normal 40 hour work week. The employer retains vacation pay and pays it out when employees take a vacation. No employees are scheduled to take any vacation during April, 2020. 7 8 9 B D E H Facts: Year-to-date amounts for CPP pensionable earnings, CPP, El insurable earnings and El are up to March 31 (Beginning numbers) All employees started working for the company in 2019. No employees have been or will be paid for overtime or any other additional payments other than their regular salary: All employees claim the basic personal amount for tax purposes. The only deductions off employees pay are statutory deductions, All current and future employees are between the ages of 20-60. 1 5 6 7 28 Melody Lane is paid semi-monthly. She has a company vehicle and the taxable benefit is $434.60 per pay. Julie Hamm is paid bi-weekly. She has been paid 7 times from Jan 1 to Mar 31. Use 26 pay periods in year for PDOC. Julie elects $20 of additional federal income tax deducted per pay. Edmund Fox is paid monthly and works 160 hours per month. 30 31 32 33 34 35 Due to the salary level of the 3 employees, an annual EHT return and payment is currently required. The employer is not associated with any other company. The pensionable earnings are equal to the total remuneration for purposes. Assume that January 1 - March 31 earning will be the same in all other quarters of the year for the employers The employer's January 1 - June 30 payroll only included these 3 current employees. On July 1 the company will hire 5 additional employees that will earn 1.5 times as much as your current employees YTD amount to June 30th, 2020. 37 88 Month of April 2070 Mus Time of Company Business mor 1250001 Name of tot amalaya Employee 111 Melody Lane Address of time 1, Ottawa ONV Sonne Number 0 000 Send monthly PH, THU M Lang Me Max Mara CRO GP beginning Mar S542.54 SS. 15 Apr 20 UN IL 5,037.00 52.0 30 Apr 20 Name of 2nd employee Employee 2 Julie Hamm Address of second employee Princess Lane, Ottawa ON Social Insurance Number 2345671999 Year to date amount Pensionable EI Famnings Max Earning M Max $58700 $2.00 Max 55-4000 SU50.00 i weekly Pay Date Federal Provincial Tas Gross Pay CPP Net Pay Benning Mar 31) 522,834,00 $1,176.98 $22.400S30 12- A20 $22.834.00 $1,176.852234.000 9-Apr 30 $22,834,00 $1,176.58 322,834.00100 H Name of 3rd employee Employee 13 Edmund Fox Address of third employee 1 King Street, Ottawa ON KA IVO Social Insurance Number 445111222 Monthly Pay bata federal Tax Provincial Thx Year-to-date amount Pencionable CPP ustable Caming Mas Mas Max SSA700 $2,898.00 Max S54200 SS6,00 Gross Pay CPP FI Net Day Being Mar 31) $30,448.20 $1,552.39 $30,440 S. TO-Apr-20 510,448.20 51.553.59 10,448.20 Selt. G 1 Background: 3 4 5 6 You have been contracted to do the payroll for a small software development start-up company in Kanata. You are not an employee but self-employed. The company currently has 3 employees but due to a promissing outlook for its product, it will be hiring 5 more employees starting on July 1, 2020. Current employees are Melody Lane, Julie Hamm and Edmund Fox. These employees all work a normal 40 hour work week. The employer retains vacation pay and pays it out when employees take a vacation. No employees are scheduled to take any vacation during April, 2020. 7 8 9 B D E H Facts: Year-to-date amounts for CPP pensionable earnings, CPP, El insurable earnings and El are up to March 31 (Beginning numbers) All employees started working for the company in 2019. No employees have been or will be paid for overtime or any other additional payments other than their regular salary: All employees claim the basic personal amount for tax purposes. The only deductions off employees pay are statutory deductions, All current and future employees are between the ages of 20-60. 1 5 6 7 28 Melody Lane is paid semi-monthly. She has a company vehicle and the taxable benefit is $434.60 per pay. Julie Hamm is paid bi-weekly. She has been paid 7 times from Jan 1 to Mar 31. Use 26 pay periods in year for PDOC. Julie elects $20 of additional federal income tax deducted per pay. Edmund Fox is paid monthly and works 160 hours per month. 30 31 32 33 34 35 Due to the salary level of the 3 employees, an annual EHT return and payment is currently required. The employer is not associated with any other company. The pensionable earnings are equal to the total remuneration for purposes. Assume that January 1 - March 31 earning will be the same in all other quarters of the year for the employers The employer's January 1 - June 30 payroll only included these 3 current employees. On July 1 the company will hire 5 additional employees that will earn 1.5 times as much as your current employees YTD amount to June 30th, 2020. 37 88 Month of April 2070 Mus Time of Company Business mor 1250001 Name of tot amalaya Employee 111 Melody Lane Address of time 1, Ottawa ONV Sonne Number 0 000 Send monthly PH, THU M Lang Me Max Mara CRO GP beginning Mar S542.54 SS. 15 Apr 20 UN IL 5,037.00 52.0 30 Apr 20 Name of 2nd employee Employee 2 Julie Hamm Address of second employee Princess Lane, Ottawa ON Social Insurance Number 2345671999 Year to date amount Pensionable EI Famnings Max Earning M Max $58700 $2.00 Max 55-4000 SU50.00 i weekly Pay Date Federal Provincial Tas Gross Pay CPP Net Pay Benning Mar 31) 522,834,00 $1,176.98 $22.400S30 12- A20 $22.834.00 $1,176.852234.000 9-Apr 30 $22,834,00 $1,176.58 322,834.00100 H Name of 3rd employee Employee 13 Edmund Fox Address of third employee 1 King Street, Ottawa ON KA IVO Social Insurance Number 445111222 Monthly Pay bata federal Tax Provincial Thx Year-to-date amount Pencionable CPP ustable Caming Mas Mas Max SSA700 $2,898.00 Max S54200 SS6,00 Gross Pay CPP FI Net Day Being Mar 31) $30,448.20 $1,552.39 $30,440 S. TO-Apr-20 510,448.20 51.553.59 10,448.20 Selt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts