Question: Question One Inventory Valuation Method (10 marks) Calculate the stock on hand @ January 2019 using the First-in-First-Out inventory valuation method and illustrate the

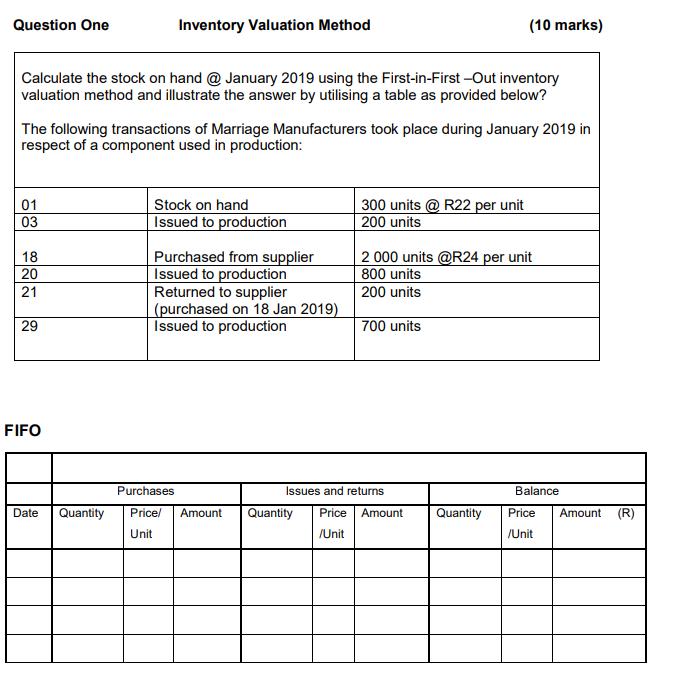

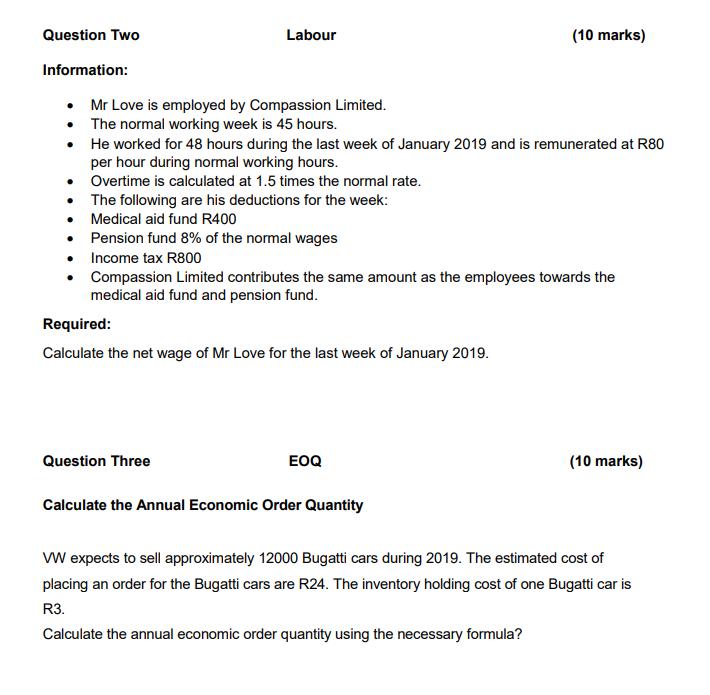

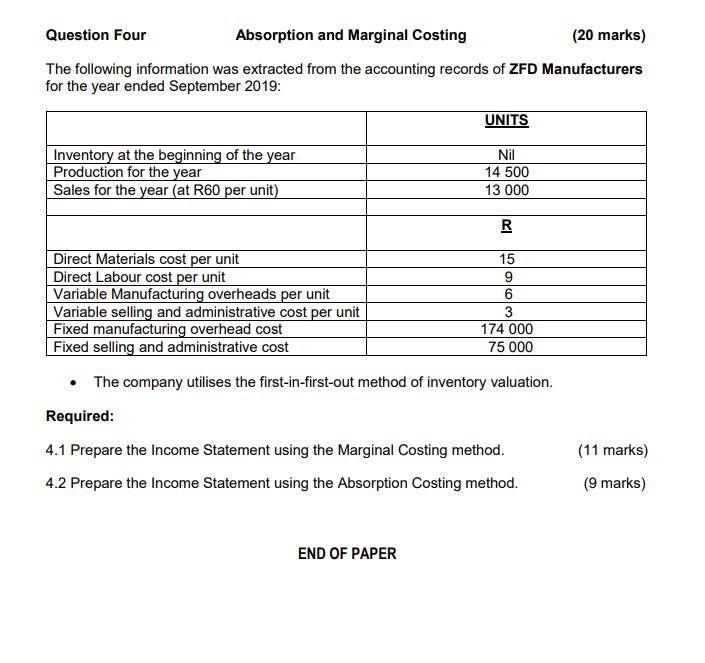

Question One Inventory Valuation Method (10 marks) Calculate the stock on hand @ January 2019 using the First-in-First-Out inventory valuation method and illustrate the answer by utilising a table as provided below? The following transactions of Marriage Manufacturers took place during January 2019 in respect of a component used in production: 01 03 Stock on hand Issued to production 300 units @R22 per unit 200 units 2 000 units @R24 per unit 800 units 8 & 18 Purchased from supplier 20 Issued to production 21 Returned to supplier 200 units (purchased on 18 Jan 2019) Issued to production 700 units FIFO Purchases Issues and returns Balance Date Quantity Price/ Amount Quantity Price Amount Quantity Price Unit /Unit /Unit Amount (R) Question Two Information: Labour (10 marks) Mr Love is employed by Compassion Limited. The normal working week is 45 hours. He worked for 48 hours during the last week of January 2019 and is remunerated at R80 per hour during normal working hours. Overtime is calculated at 1.5 times the normal rate. The following are his deductions for the week: Medical aid fund R400 Pension fund 8% of the normal wages Income tax R800 Compassion Limited contributes the same amount as the employees towards the medical aid fund and pension fund. Required: Calculate the net wage of Mr Love for the last week of January 2019. Question Three EOQ Calculate the Annual Economic Order Quantity (10 marks) VW expects to sell approximately 12000 Bugatti cars during 2019. The estimated cost of placing an order for the Bugatti cars are R24. The inventory holding cost of one Bugatti car is R3. Calculate the annual economic order quantity using the necessary formula? Question Four Absorption and Marginal Costing (20 marks) The following information was extracted from the accounting records of ZFD Manufacturers for the year ended September 2019: Inventory at the beginning of the year Production for the year Sales for the year (at R60 per unit) UNITS Nil 14 500 13 000 R Direct Materials cost per unit Direct Labour cost per unit Variable Manufacturing overheads per unit Variable selling and administrative cost per unit Fixed manufacturing overhead cost Fixed selling and administrative cost 15 9 6 3 174 000 75 000 The company utilises the first-in-first-out method of inventory valuation. Required: 4.1 Prepare the Income Statement using the Marginal Costing method. 4.2 Prepare the Income Statement using the Absorption Costing method. (11 marks) (9 marks) END OF PAPER

Step by Step Solution

There are 3 Steps involved in it

MAC2601 Assignment 022016 Full Solution Guide QUESTION 1 DIRECT AND ABSORPTION COSTING 25 marks Given Elite Selling Price R600 DM R100 DL R20 Ordinary ... View full answer

Get step-by-step solutions from verified subject matter experts