Question: Please help with b,c, and d. Problem 5-67 (LO 5-2) (Algo) [The following information applies to the questions displayed below.) George and Weezy received $30,700

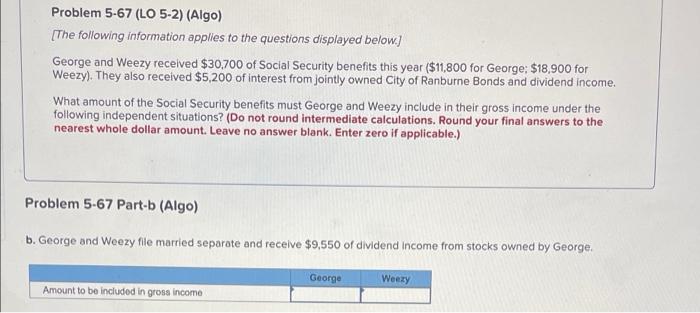

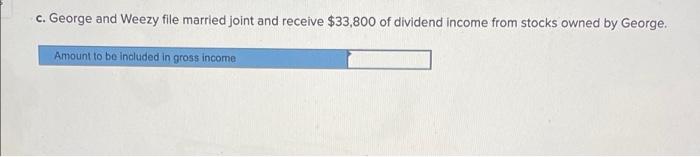

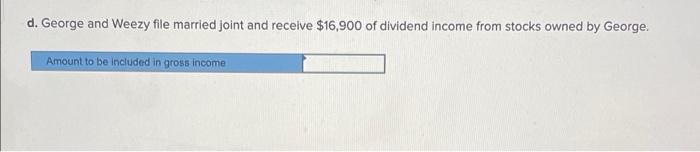

Problem 5-67 (LO 5-2) (Algo) [The following information applies to the questions displayed below.) George and Weezy received $30,700 of Social Security benefits this year ($11,800 for George: $18,900 for Weezy). They also received $5,200 of interest from jointly owned City of Ranburne Bonds and dividend income. What amount of the Social Security benefits must George and Weezy include in their gross income under the following independent situations? (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Leave no answer blank. Enter zero if applicable.) Problem 5-67 Part-b (Algo) b. George and Weezy file married separate and receive $9,550 of dividend Income from stocks owned by George. George Weery Amount to be included in gross income c. George and Weezy file married joint and receive $33,800 of dividend income from stocks owned by George. Amount to be included in gross income d. George and Weezy file married joint and receive $16,900 of dividend income from stocks owned by George, Amount to be included in gross income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts