Question: Please help with B,C,D and with all calculations and show step by step what you do please Hi please I need help with B,C,D, please

Please help with B,C,D and with all calculations and show step by step what you do please

Hi please I need help with B,C,D, please show me all calculations and formulas please

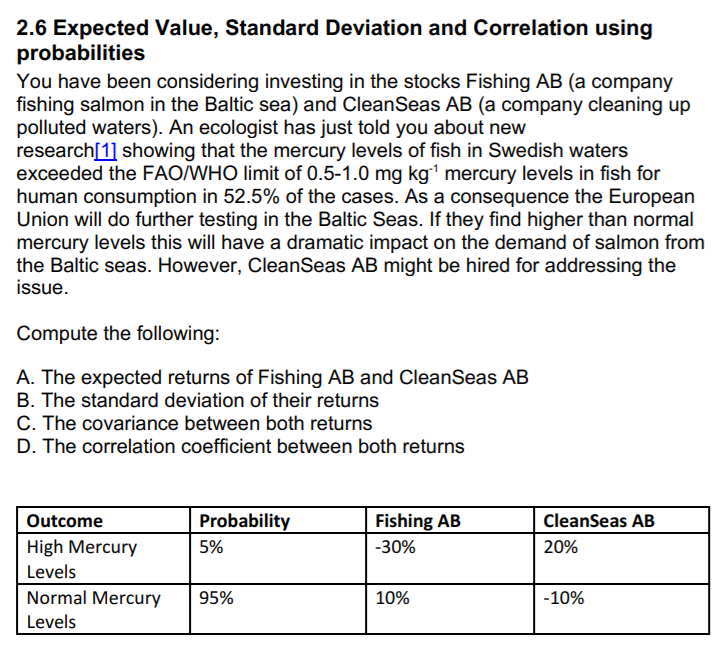

2.6 Expected Value, Standard Deviation and Correlation using probabilities You have been considering investing in the stocks Fishing AB (a company fishing salmon in the Baltic sea) and CleanSeas AB (a company cleaning up polluted waters). An ecologist has just told you about nevw research[11 showing that the mercury levels of fish in Swedish waters exceeded the FAO/WHO limit of 0.5-1.0 mg kg1 mercury levels in fish for human consumption in 52.5% of the cases. As a consequence the European Union will do further testing in the Baltic Seas. If they find higher than normal mercury levels this will have a dramatic impact on the demand of salmon from the Baltic seas. However, CleanSeas AB might be hired for addressing the issue Compute the following A. The expected returns of Fishing AB and CleanSeas AB B. The standard deviation of their returns C. The covariance between both returns D. The correlation coefficient between both returns Fishing AB -30% Outcome High Mercury Levels Normal Mercury Levels Probability 5% CleanSeas AB 20% | 95% 10% -10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts