Question: please help with both (Expected rate of return using CAPM) a. Compute the expected rate of return for Intel common stock, which has a 1.3

please help with both

please help with both

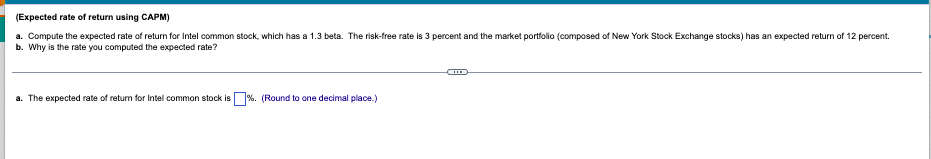

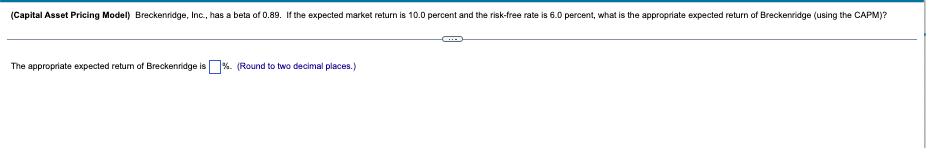

(Expected rate of return using CAPM) a. Compute the expected rate of return for Intel common stock, which has a 1.3 beta. The risk-free rate is 3 percent and the market portfolio (composed of New York Stock Exchange stocks) has an expected return of 12 percent. b. Why is the rate you computed the expected rate? a. The expected rate of return for Intel common stock is % (Round to one decimal place.) . (Capital Asset Pricing Model) Breckenridge, Inc., has a beta of 0.89. If the expected market return is 10.0 percent and the risk-free rate is 6.0 percent, what is the appropriate expected return of Breckenridge (using the CAPM)? ... The appropriate expected return of Breckenridge is % (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts