Question: please help with both questions Question 28 3 pts On April 2. Kelvin sold $40,000 of inventory items on credit with the terms 1/10, net

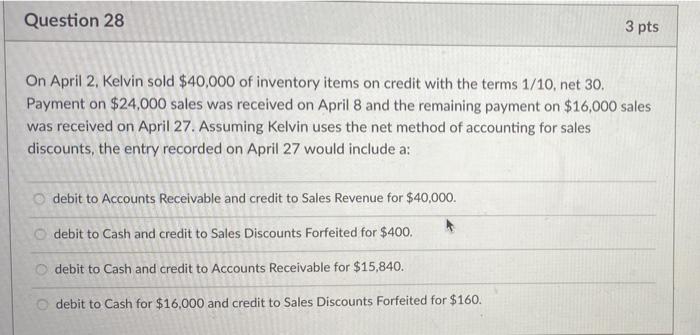

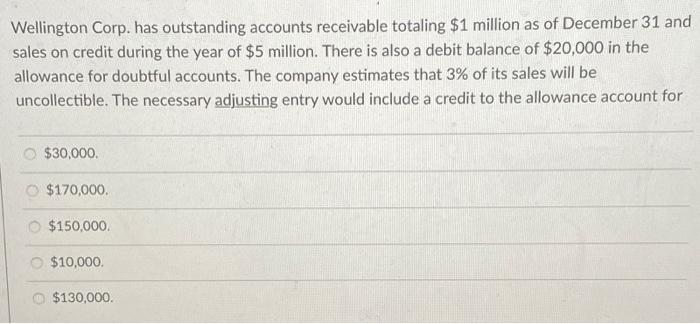

Question 28 3 pts On April 2. Kelvin sold $40,000 of inventory items on credit with the terms 1/10, net 30. Payment on $24,000 sales was received on April 8 and the remaining payment on $16,000 sales was received on April 27. Assuming Kelvin uses the net method of accounting for sales discounts, the entry recorded on April 27 would include a: debit to Accounts Receivable and credit to Sales Revenue for $40,000. debit to Cash and credit to Sales Discounts Forfeited for $400. debit to Cash and credit to Accounts Receivable for $15,840. debit to Cash for $16,000 and credit to Sales Discounts Forfeited for $160. Wellington Corp. has outstanding accounts receivable totaling $1 million as of December 31 and sales on credit during the year of $5 million. There is also a debit balance of $20,000 in the allowance for doubtful accounts. The company estimates that 3% of its sales will be uncollectible. The necessary adjusting entry would include a credit to the allowance account for $30,000 $170,000. $150,000 $10,000 $130,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts