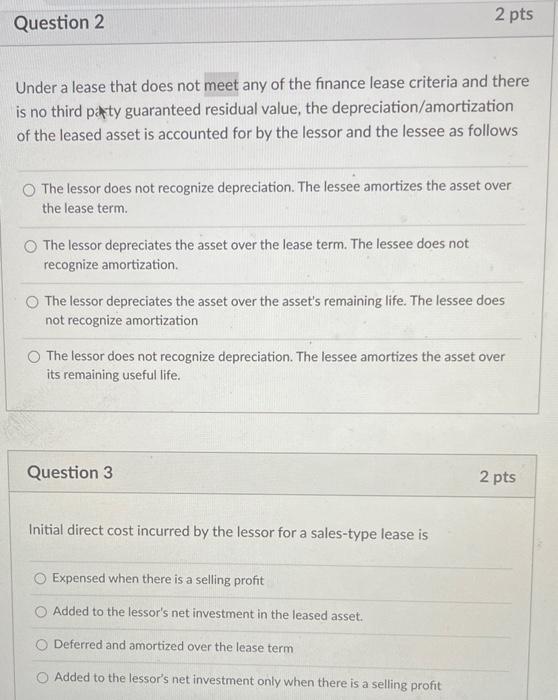

Question: please help with both Under a lease that does not meet any of the finance lease criteria and there is no third party guaranteed residual

Under a lease that does not meet any of the finance lease criteria and there is no third party guaranteed residual value, the depreciation/amortization of the leased asset is accounted for by the lessor and the lessee as follows The lessor does not recognize depreciation. The lessee amortizes the asset over the lease term. The lessor depreciates the asset over the lease term. The lessee does not recognize amortization. The lessor depreciates the asset over the asset's remaining life. The lessee does not recognize amortization The lessor does not recognize depreciation. The lessee amortizes the asset over its remaining useful life. Question 3 2 pts Initial direct cost incurred by the lessor for a sales-type lease is Expensed when there is a selling profit Added to the lessor's net investment in the leased asset. Deferred and amortized over the lease term Added to the lessor's net investment only when there is a selling profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts