Question: please help with both will like and appreciate help (Evaluating profitability) The Malia Corporation had sales in 2019 of $68 million, total assets of $40

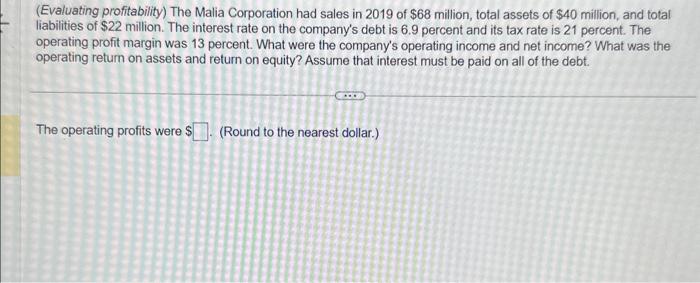

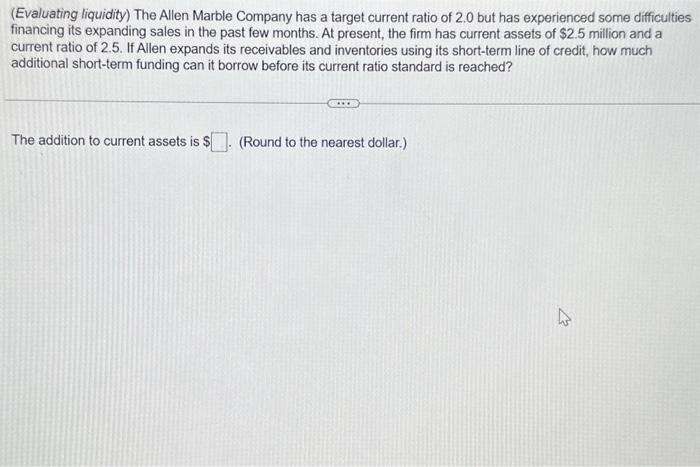

(Evaluating profitability) The Malia Corporation had sales in 2019 of $68 million, total assets of $40 million, and total liabilities of $22 million. The interest rate on the company's debt is 6.9 percent and its tax rate is 21 percent. The operating profit margin was 13 percent. What were the company's operating income and net income? What was the operating return on assets and refurn on equity? Assume that interest must be paid on all of the debt. The operating profits were $ (Round to the nearest dollar.) (Evaluating liquidity) The Allen Marble Company has a target current ratio of 2.0 but has experienced some difficulties financing its expanding sales in the past few months. At present, the firm has current assets of $2.5 million and a current ratio of 2.5. If Allen expands its receivables and inventories using its short-term line of credit, how much additional short-term funding can it borrow before its current ratio standard is reached? The addition to current assets is $ (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts