Question: please help with both will upvote 7. In one year, a form will pay a common stock dividend of $335. The dividends have been growing

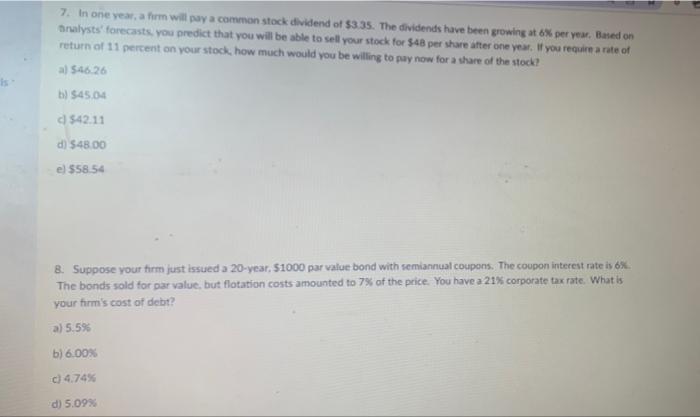

7. In one year, a form will pay a common stock dividend of $335. The dividends have been growing at 6% per year. Based on nalysts forecasts. you predict that you will be able to sell your stock for $48 per share after one year you require a rate of return of 11 percent on your stock, how much would you be willing to pay now for a share of the stock? al 546.26 is b) $45.04 d $42.11 d) $48.00 el 558.54 8. Suppose your time just issued a 20-year, 51000 par value bond with semiannual coupons. The coupon interest rate is 6% The bonds sold for par value, but flotation costs amounted to 7% of the price. You have a 21% corporate tax rate. What is your firm's cost of debt? a) 5.5% b) 6.00% c) 4.74% d) 5.09%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts