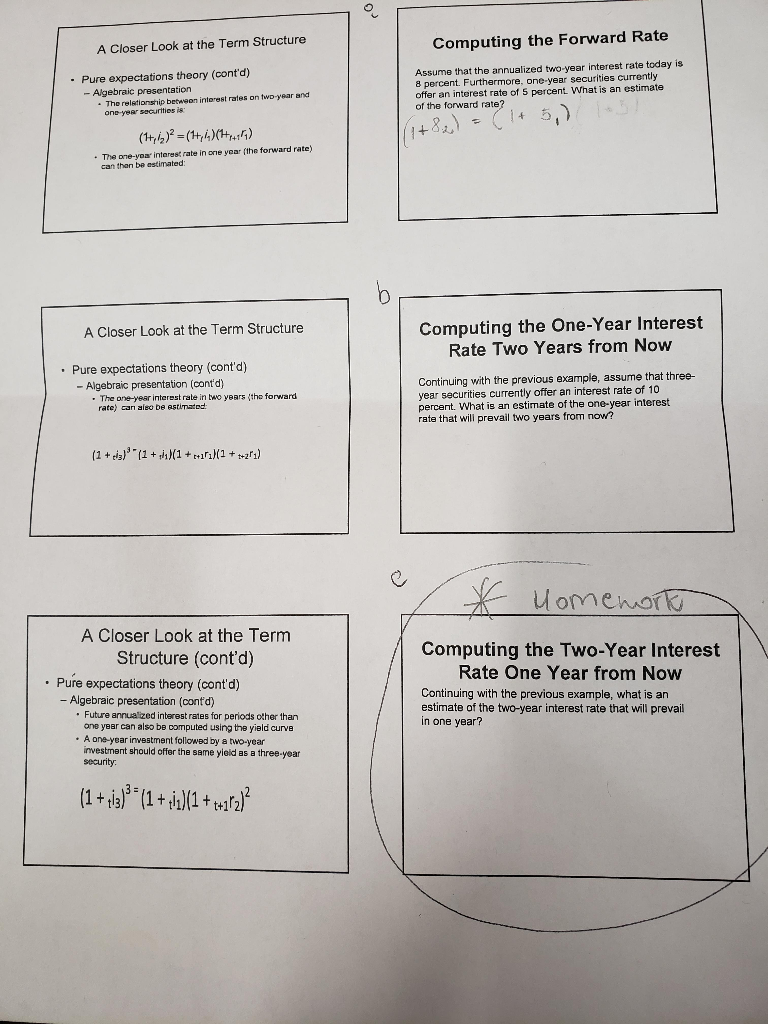

Question: please help with c A Closer Look at the Term Structure Computing the Forward Rate Pure expectations theory (cont'd) - Algebraic presentation Assume that the

please help with c

A Closer Look at the Term Structure Computing the Forward Rate Pure expectations theory (cont'd) - Algebraic presentation Assume that the annualized two-year interest rate today is 8 percent. Furthermore, one-year securities currently offer an interest rate of 5 percent What is an estimate of the forward rate The reletionstiip betweon interest rates on twD-year ancd one year securttios is The one-yoa intarest rate in one year [the forward rate) can then be astimated: A Closer Look at the Term Structure Computing the One-Year Interest Rate Two Years from Now Pure expectations theory (cont'd) - Algebraic presentation (cont'd) Continuing with the previous example, assume that three- year securities currently offer an interest rate of 10 percent. What is an estimate of the one-year interest rate that will prevail two years from now? The one-year interest rate in two years the forward rate) can aiso be estimated A Closer Look at the Term Structure (cont'd) Computing the Two-Year Interest Rate One Year from Now Pure expectations theory (cont'd) Algebraic presentation (cont'd) Continuing with the previous example, what is an estimate of the two-year interest rate that will prevail in one year? Future annualized interest rates for periods other than one year can also be computed using the yiald curve . A one-year investment followed by a two-year nvestment should offer the same yieid as a three-year security: t+1r2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts