Question: PLEASE HELP WITH C AND D You are a treasure analyst for your bank. One of your large corporate customers is interested in a currency

PLEASE HELP WITH C AND D

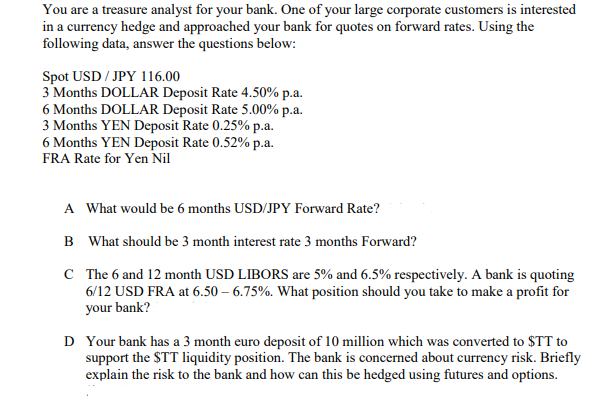

You are a treasure analyst for your bank. One of your large corporate customers is interested in a currency hedge and approached your bank for quotes on forward rates. Using the following data, answer the questions below: Spot USD/JPY 116.00 3 Months DOLLAR Deposit Rate 4.50% p.a. 6 Months DOLLAR Deposit Rate 5.00% p.a. 3 Months YEN Deposit Rate 0.25% p.a. 6 Months YEN Deposit Rate 0.52% p.a. FRA Rate for Yen Nil A What would be 6 months USD/JPY Forward Rate? B What should be 3 month interest rate 3 months Forward? C The 6 and 12 month USD LIBORS are 5% and 6.5% respectively. A bank is quoting 6/12 USD FRA at 6.50 6.75%. What position should you take to make a profit for your bank? D Your bank has a 3 month euro deposit of 10 million which was converted to $TT to support the $TT liquidity position. The bank is concerned about currency risk. Briefly explain the risk to the bank and how can this be hedged using futures and options. You are a treasure analyst for your bank. One of your large corporate customers is interested in a currency hedge and approached your bank for quotes on forward rates. Using the following data, answer the questions below: Spot USD/JPY 116.00 3 Months DOLLAR Deposit Rate 4.50% p.a. 6 Months DOLLAR Deposit Rate 5.00% p.a. 3 Months YEN Deposit Rate 0.25% p.a. 6 Months YEN Deposit Rate 0.52% p.a. FRA Rate for Yen Nil A What would be 6 months USD/JPY Forward Rate? B What should be 3 month interest rate 3 months Forward? C The 6 and 12 month USD LIBORS are 5% and 6.5% respectively. A bank is quoting 6/12 USD FRA at 6.50 6.75%. What position should you take to make a profit for your bank? D Your bank has a 3 month euro deposit of 10 million which was converted to $TT to support the $TT liquidity position. The bank is concerned about currency risk. Briefly explain the risk to the bank and how can this be hedged using futures and options

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts