Question: please help with C Time value-Annuities Personal Finance Problem Marian Kirk wishes to select the better of two 12-year annuities. Annuity 1 is an ordinary

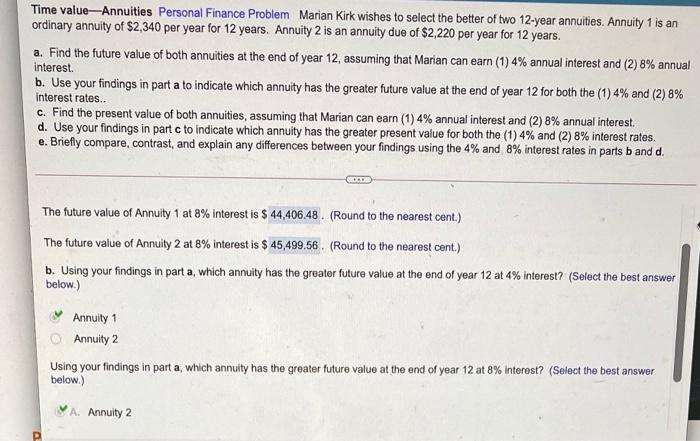

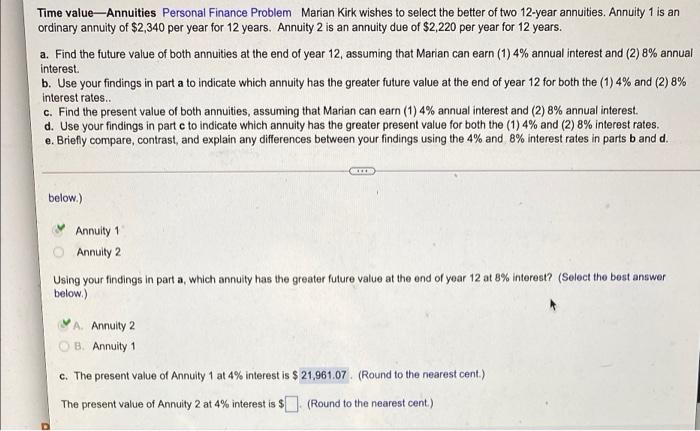

Time value-Annuities Personal Finance Problem Marian Kirk wishes to select the better of two 12-year annuities. Annuity 1 is an ordinary annuity of $2,340 per year for 12 years. Annuity 2 is an annuity due of $2,220 per year for 12 years. a. Find the future value of both annuities at the end of year 12, assuming that Marian can earn (1) 4% annual interest and (2) 8% annual interest b. Use your findings in part a to indicate which annuity has the greater future value at the end of year 12 for both the (1) 4% and (2) 8% interest rates.. c. Find the present value of both annuities, assuming that Marian can earn (1) 4% annual interest and (2) 8% annual interest. d. Use your findings in partc to indicate which annuity has the greater present value for both the (1) 4% and (2) 8% interest rates. e. Briefly compare, contrast, and explain any differences between your findings using the 4% and 8% interest rates in parts b and d. The future value of Annuity 1 at 8% interest is $ 44,406.48. (Round to the nearest cent.) The future value of Annuity 2 at 8% interest is $ 45,499.56. (Round to the nearest cent.) b. Using your findings in part a, which annuity has the greater future value at the end of year 12 at 4% interest? (Select the best answer below.) Annuity 1 Annuity 2 Using your findings in part a, which annuity has the greater future value at the end of year 12 at 8% Interest? (Select the best answer below.) A. Annuity 2 P Time value-Annuities Personal Finance Problem Marian Kirk wishes to select the better of two 12-year annuities. Annuity 1 is an ordinary annuity of $2,340 per year for 12 years. Annuity 2 is an annuity due of $2,220 per year for 12 years. a. Find the future value of both annuities at the end of year 12, assuming that Marian can earn (1)4% annual interest and (2) 8% annual interest. b. Use your findings in part a to indicate which annuity has the greater future value at the end of year 12 for both the (1) 4% and (2) 8% interest rates. c. Find the present value of both annuities, assuming that Marian can earn (1) 4% annual interest and (2) 8% annual interest. d. Use your findings in partc to indicate which annuity has the greater present value for both the (1)4% and (2) 8% interest rates, e. Briefly compare, contrast, and explain any differences between your findings using the 4% and 8% interest rates in parts b and d. below.) Annuity 1 Annuity 2 Using your findings in part a, which annuity has the greater future value at the end of year 12 at 8% interest? (Select the bost answer below.) MA Annuity 2 B. Annuity 1 c. The present value of Annuity 1 at 4% interest is $ 21,961.07. (Round to the nearest cent) The present value of Annuity 2 at 4% interest is $(Round to the nearest cent)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts