Question: Please help with case study! A breakdown would be greatly appreciated as well. Radstone, Inc., a prominent stone fabrication firm was formed 5 years ago

Please help with case study! A breakdown would be greatly appreciated as well.

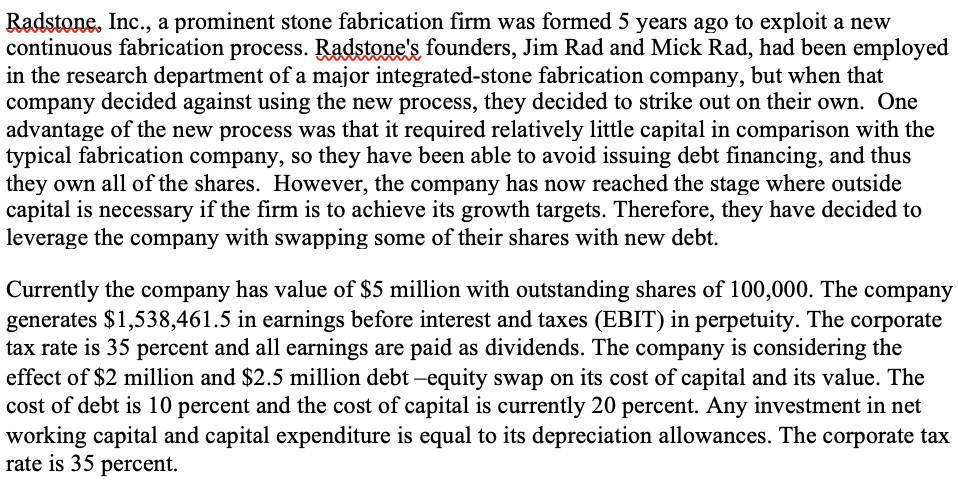

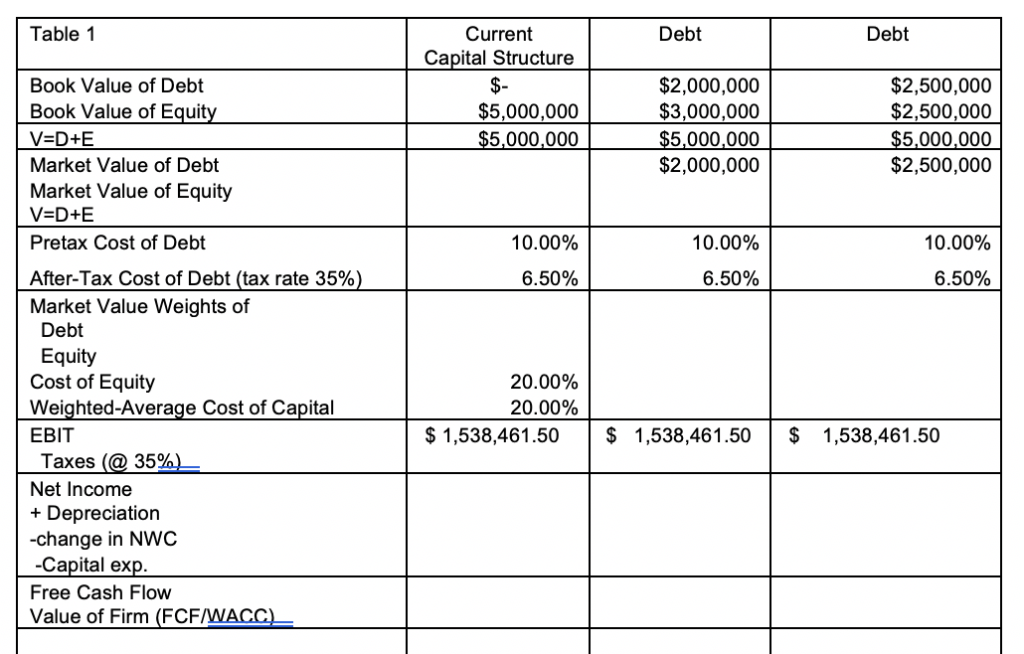

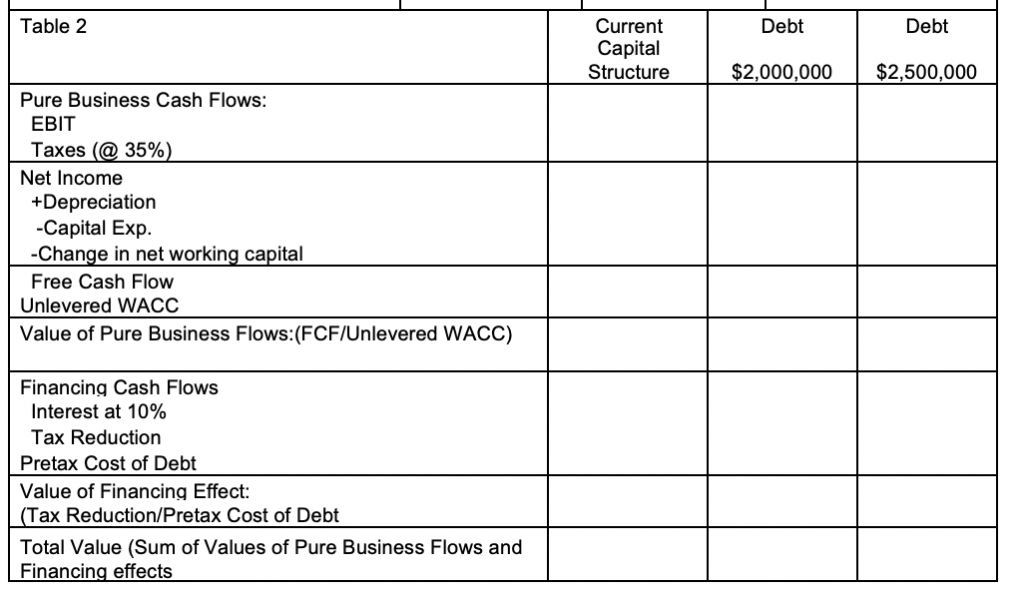

Radstone, Inc., a prominent stone fabrication firm was formed 5 years ago to exploit a new continuous fabrication process. Radstone's founders, Jim Rad and Mick Rad, had been employed in the research department of a major integrated-stone fabrication company, but when that company decided against using the new process, they decided to strike out on their own. One advantage of the new process was that it required relatively little capital in comparison with the typical fabrication company, so they have been able to avoid issuing debt financing, and thus they own all of the shares. However, the company has now reached the stage where outside capital is necessary if the firm is to achieve its growth targets. Therefore, they have decided to leverage the company with swapping some of their shares with new debt. Currently the company has value of $5 million with outstanding shares of 100,000. The company generates $1,538,461.5 in earnings before interest and taxes (EBIT) in perpetuity. The corporate tax rate is 35 percent and all earnings are paid as dividends. The company is considering the effect of $2 million and $2.5 million debt -equity swap on its cost of capital and its value. The cost of debt is 10 percent and the cost of capital is currently 20 percent. Any investment in net working capital and capital expenditure is equal to its depreciation allowances. The corporate tax ra te is 35 percent Table 1 Current Debt Debt Capital Structure $2,000,000 $3,000,000 5,000,000 $2,000,000 $2,500,000 $2,500,000 5,000,000 $2,500,000 Book Value of Debt Book Value of Equit V-D+E Market Value of Debt Market Value of Equity V-D+E Pretax Cost of Debt After-Tax Cost of Debt (tax rate 35% Market Value Weights of $5,000,000 5,000,000 10.00% 10.00% 10.00% 6.50% 6.50% 6.50% Debt Equity Cost of Equity Weighted-Average Cost of Capital EBIT 20.00% 20.00% $1,538,461.501,538,461.501,538,461.50 Taxes (@ 35%, Net Income Depreciation -change in NWC -Capital ex Free Cash Flow Value of Firm (FCF/WACC Table 2 Current Capital Structure Debt Debt $2,000,000 $2,500,000 Pure Business Cash Flows: EBIT a35%) axes Net Income +Depreciation -Capital Exp. Change in net working capital Free Cash Flow Unlevered WACC Value of Pure Business Flows: (FCF/Unlevered WACC) Financing Cash Flows Interest at 10% Tax Reduction Pretax Cost of Debt Value of Financing Effect: (Tax Reduction/Pretax Cost of Debt Total Value (Sum of Values of Pure Business Flows and Financing effects Table 3 Current Capital Structure Debt Debt Cash Flow to Debtholders (interest) Pretax Cost of Debt Value of Debt:(Interest/Rd) Cash Flow to Shareholders: EBIT Interest Pretax Profit Taxes (@ 35%) Net Income + Depreciation - change in NWC Capital exp. Cash Flow to Shareholders: Cost of Equity Value of Equity (FCE Value of Equity plus Value of Debt a. b. c. What is the value of the firm under each capital structure? What is the cost of equity and weighted average cost of capital for each capital structure? What is the value of tax shield under each level of debt financing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts