Question: Please help with Cash flow and Journal entry with adjustments and closing entries Section B - Preparation of accounts and Cash flow statement. (20 points)

Please help with Cash flow and Journal entry with adjustments and closing entries

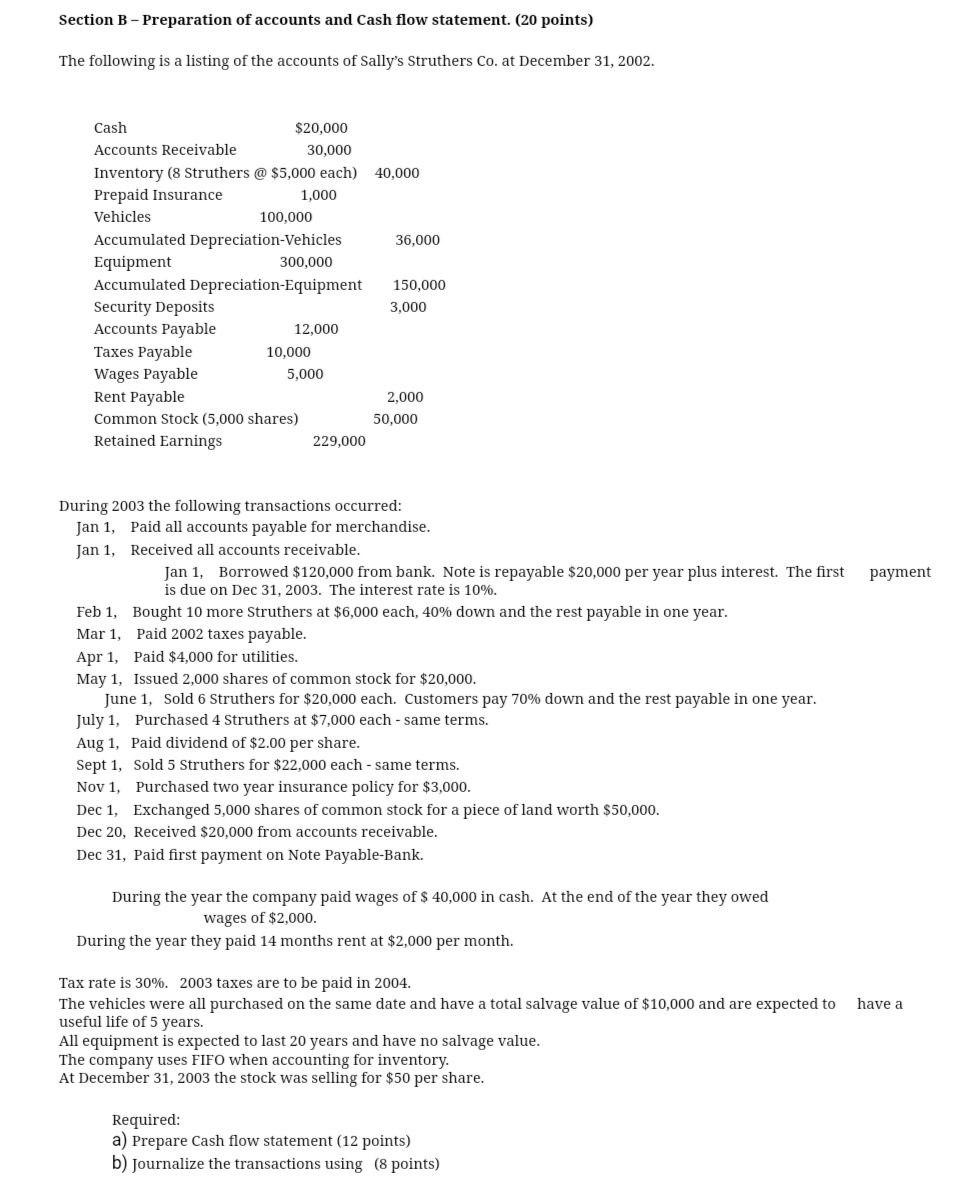

Section B - Preparation of accounts and Cash flow statement. (20 points) The following is a listing of the accounts of Sally's Struthers Co. at December 31, 2002. During 2003 the following transactions occurred: Jan 1, Paid all accounts payable for merchandise. Jan 1, Received all accounts receivable. Jan 1, Borrowed $120,000 from bank. Note is repayable $20,000 per year plus interest. The first paymer is due on Dec 31,2003 . The interest rate is 10%. Feb 1, Bought 10 more Struthers at $6,000 each, 40% down and the rest payable in one year. Mar 1, Paid 2002 taxes payable. Apr 1, Paid $4,000 for utilities. May 1, Issued 2,000 shares of common stock for $20,000. June 1, Sold 6 Struthers for $20,000 each. Customers pay 70% down and the rest payable in one year. July 1, Purchased 4 Struthers at $7,000 each - same terms. Aug 1, Paid dividend of $2.00 per share. Sept 1, Sold 5 Struthers for $22,000 each - same terms. Nov 1, Purchased two year insurance policy for $3,000. Dec 1, Exchanged 5,000 shares of common stock for a piece of land worth $50,000. Dec 20, Received $20,000 from accounts receivable. Dec 31, Paid first payment on Note Payable-Bank. During the year the company paid wages of $40,000 in cash. At the end of the year they owed wages of $2,000. During the year they paid 14 months rent at $2,000 per month. Tax rate is 30%. 2003 taxes are to be paid in 2004 . The vehicles were all purchased on the same date and have a total salvage value of $10,000 and are expected to have a useful life of 5 years. All equipment is expected to last 20 years and have no salvage value. The company uses FIFO when accounting for inventory. At December 31,2003 the stock was selling for $50 per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts