Question: please help with c-e3 mework 6 2253A%252F%252Fims.mheducation.com%252Fmghmiddleware Saved a. Project A costs $6,000 and will generate annual after-tax net cash inflows of $2,150 for 5

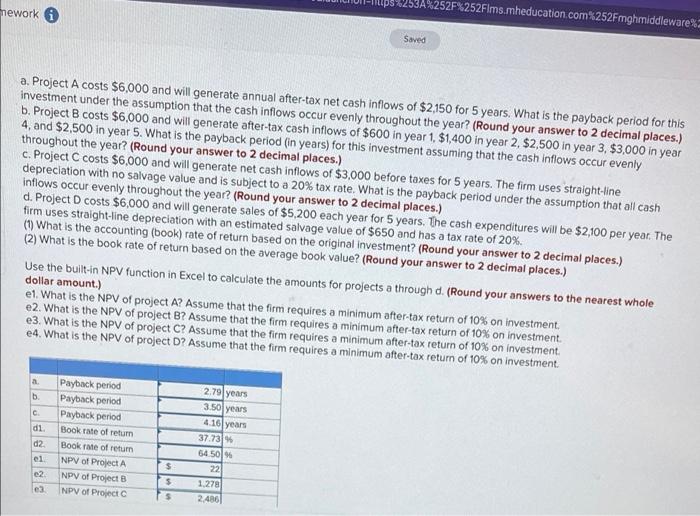

mework 6 2253A%252F%252Fims.mheducation.com%252Fmghmiddleware Saved a. Project A costs $6,000 and will generate annual after-tax net cash inflows of $2,150 for 5 years. What is the payback period for this investment under the assumption that the cash inflows occur evenly throughout the year? (Round your answer to 2 decimal places.) b. Project B costs $6,000 and will generate after-tax cash inflows of $600 in year 1, $1,400 in year 2, $2,500 in year 3, $3,000 in year 4, and $2,500 in year 5. What is the payback period (in years) for this investment assuming that the cash inflows occur evenly throughout the year? (Round your answer to 2 decimal places.) c. Project C costs $6,000 and will generate net cash inflows of $3,000 before taxes for 5 years. The firm uses straight-line depreciation with no salvage value and is subject to a 20% tax rate. What is the payback period under the assumption that all cash inflows occur evenly throughout the year? (Round your answer to 2 decimal places.) d. Project D costs $6,000 and will generate sales of $5,200 each year for 5 years. The cash expenditures will be $2,100 per year. The firm uses straight-line depreciation with an estimated salvage value of $650 and has a tax rate of 20%. () What is the accounting (book) rate of return based on the original investment? (Round your answer to 2 decimal places.) (2) What is the book rate of return based on the average book value? (Round your answer to 2 decimal places.) Use the built-in NPV function in Excel to calculate the amounts for projects a through d. (Round your answers to the nearest whole dollar amount.) e1. What is the NPV of project A? Assume that the firm requires a minimum after-tax return of 10% on investment, e2. What is the NPV of project B? Assume that the firm requires a minimum after-tax return of 10% on investment e3. What is the NPV of project C? Assume that the firm requires a minimum after-tax return of 10% on investment e4. What is the NPV of project D? Assume that the firm requires a minimum after-tax return of 10% on investment. a b c di Payback period Payback period Payback period Book rate of return Book re of retum NPV of Project NPV of Project NPV of Project d2 el 2 2.79 years 3.50 years 4.16 years 37.73% 54.50 22 1.278 2.4861 $ $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts