Question: please help!! with complete answer (WACC)Daves Inc. recently hired you as a consultant to estimate the company's WACC. You have obtained the following information. (1)

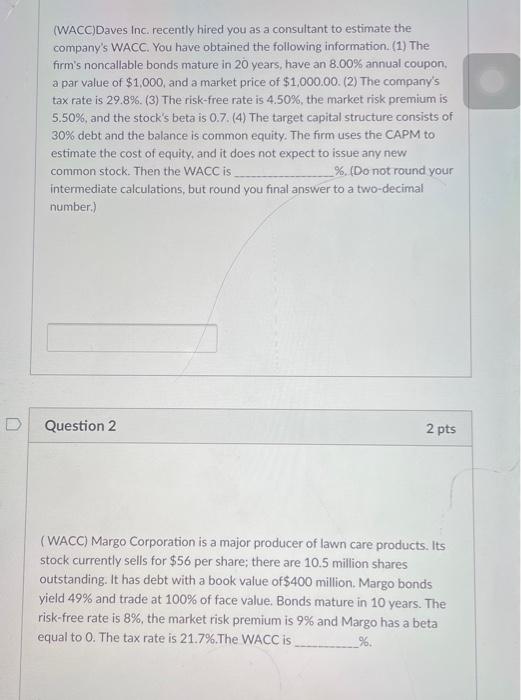

(WACC)Daves Inc. recently hired you as a consultant to estimate the company's WACC. You have obtained the following information. (1) The firm's noncallable bonds mature in 20 years, have an 8.00% annual coupon, a par value of $1,000, and a market price of $1,000.00. (2) The company's tax rate is 29.8%. (3) The risk-free rate is 4.50%, the market risk premium is 5.50%, and the stock's beta is 0.7 . (4) The target capital structure consists of 30% debt and the balance is common equity. The firm uses the CAPM to estimate the cost of equity, and it does not expect to issue any new common stock. Then the WACC is 6. (Do not round your intermediate calculations, but round you final answer to a two-decimal number.) Question 2 2 pts (WACC) Margo Corporation is a major producer of lawn care products. Its stock currently sells for $56 per share; there are 10.5 million shares outstanding. It has debt with a book value of $400 million. Margo bonds yield 49% and trade at 100% of face value. Bonds mature in 10 years. The risk-free rate is 8%, the market risk premium is 9% and Margo has a beta equal to 0 . The tax rate is 21.7%. The WACC is %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts