Question: please help with correct answer and explanation 3 1-(3) Find the difference between Benchmark and Alternative with respect to Upfront Payment and Monthly Payment of

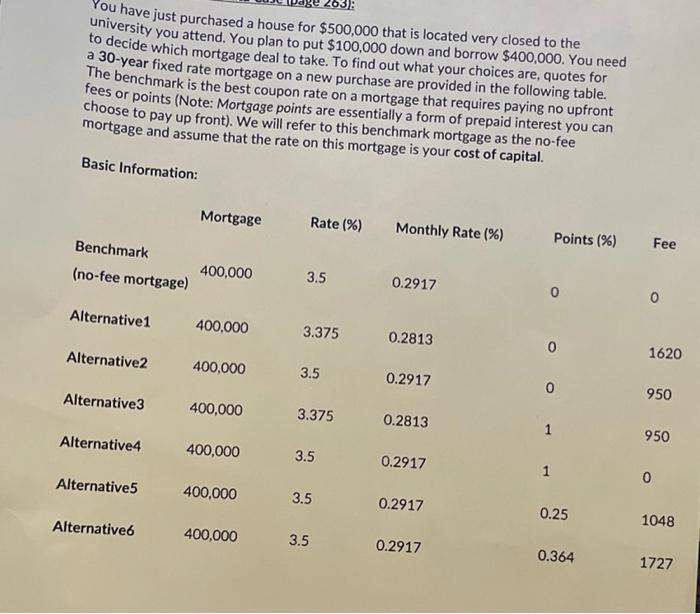

1-(3) Find the difference between Benchmark and Alternative with respect to Upfront Payment and Monthly Payment of Mortgage (13 points). For example, if an alternative has $100 upfront fee and 0% mortgage points, the difference of upfront payment for the alternative will be -100. Be careful about the unit of Monthly Rate and points. Read the footnote of the case about how to calculate upfront cost (page 263). 203 You have just purchased a house for $500,000 that is located very closed to the university you attend. You plan to put $100.000 down and borrow $400,000. You need to decide which mortgage deal to take. To find out what your choices are, quotes for a 30-year fixed rate mortgage on a new purchase are provided in the following table. The benchmark is the best coupon rate on a mortgage that requires paying no upfront fees or points (Note: Mortgage points are essentially a form of prepaid interest you can choose to pay up front). We will refer to this benchmark mortgage as the no-fee mortgage and assume that the rate on this mortgage is your cost of capital. Basic Information: Mortgage Rate (%) Monthly Rate (%) Points (%) Fee Benchmark (no-fee mortgage) 400,000 3.5 0.2917 0 0 Alternative1 400,000 3.375 0.2813 0 Alternative2 1620 400,000 3.5 0.2917 0 Alternative3 950 400,000 3.375 0.2813 1 Alternative4 950 400,000 3.5 0.2917 1 Alternative5 0 400,000 3.5 0.2917 0.25 Alternative 1048 400,000 3.5 0.2917 0.364 1727 1-(4) Find Net Present Value (NPV) of Alternative products based on 1-(3) (10 points). You can apply the formula for PV of Annuity (Chapter 4). Use the cost of capital as discount rate. 1-(5) Construct NPV profile for the best NPV mortgage product and show IRR (10 points) 1-(3) Find the difference between Benchmark and Alternative with respect to Upfront Payment and Monthly Payment of Mortgage (13 points). For example, if an alternative has $100 upfront fee and 0% mortgage points, the difference of upfront payment for the alternative will be -100. Be careful about the unit of Monthly Rate and points. Read the footnote of the case about how to calculate upfront cost (page 263). 203 You have just purchased a house for $500,000 that is located very closed to the university you attend. You plan to put $100.000 down and borrow $400,000. You need to decide which mortgage deal to take. To find out what your choices are, quotes for a 30-year fixed rate mortgage on a new purchase are provided in the following table. The benchmark is the best coupon rate on a mortgage that requires paying no upfront fees or points (Note: Mortgage points are essentially a form of prepaid interest you can choose to pay up front). We will refer to this benchmark mortgage as the no-fee mortgage and assume that the rate on this mortgage is your cost of capital. Basic Information: Mortgage Rate (%) Monthly Rate (%) Points (%) Fee Benchmark (no-fee mortgage) 400,000 3.5 0.2917 0 0 Alternative1 400,000 3.375 0.2813 0 Alternative2 1620 400,000 3.5 0.2917 0 Alternative3 950 400,000 3.375 0.2813 1 Alternative4 950 400,000 3.5 0.2917 1 Alternative5 0 400,000 3.5 0.2917 0.25 Alternative 1048 400,000 3.5 0.2917 0.364 1727 1-(4) Find Net Present Value (NPV) of Alternative products based on 1-(3) (10 points). You can apply the formula for PV of Annuity (Chapter 4). Use the cost of capital as discount rate. 1-(5) Construct NPV profile for the best NPV mortgage product and show IRR (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts