Question: please help with developing cash budgetting for the attached; which option is better for the company (Las Vegas Sands) Develop a solution based on the

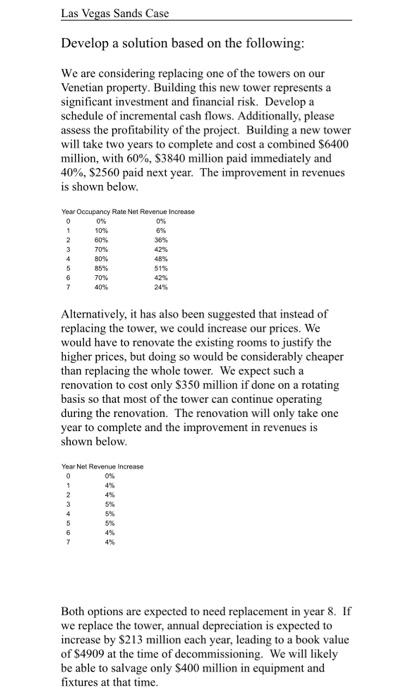

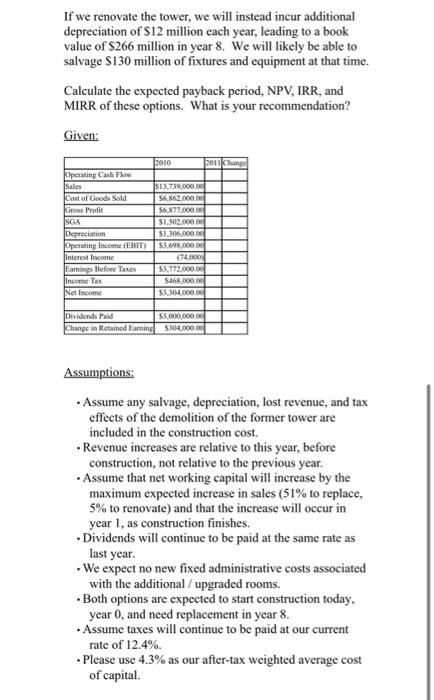

Develop a solution based on the following: We are considering replacing one of the towers on our Venetian property. Building this new tower represents a significant investment and financial risk. Develop a schedule of incremental cash flows. Additionally, please assess the profitability of the project. Building a new tower will take two years to complete and cost a combined $6400 million, with 60%,$3840 million paid immediately and 40%,$2560 paid next year. The improvement in revenues is shown below. Alternatively, it has also been suggested that instead of replacing the tower, we could increase our prices. We would have to renovate the existing rooms to justify the higher prices, but doing so would be considerably cheaper than replacing the whole tower. We expect such a renovation to cost only $350 million if done on a rotating basis so that most of the tower can continue operating during the renovation. The renovation will only take one year to complete and the improvement in revenues is shown below. Both options are expected to need replacement in year 8 . If we replace the tower, annual depreciation is expected to increase by $213 million each year, leading to a book value of $4909 at the time of decommissioning. We will likely be able to salvage only $400 million in equipment and fixtures at that time. If we renovate the tower, we will instead incur additional depreciation of $12 million each year, leading to a book value of $266 million in year 8 . We will likely be able to salvage $130 million of fixtures and equipment at that time. Calculate the expected payback period, NPV, IRR, and MIRR of these options. What is your recommendation? Given: Assumptions: - Assume any salvage, depreciation, lost revenue, and tax effects of the demolition of the former tower are included in the construction cost. - Revenue increases are relative to this year, before construction, not relative to the previous year. - Assume that net working capital will increase by the maximum expected increase in sales ( 51% to replace, 5% to renovate) and that the increase will occur in year 1 , as construction finishes. - Dividends will continue to be paid at the same rate as last year. - We expect no new fixed administrative costs associated with the additional / upgraded rooms. - Both options are expected to start construction today, year 0 , and need replacement in year 8 . - Assume taxes will continue to be paid at our current rate of 12.4%. - Please use 4.3% as our after-tax weighted average cost of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts