Question: Please help with exercise 5 and 2. Questions from the textbook Finance for non financial managers . Thank you very much. ABC Inc.'s revenue and

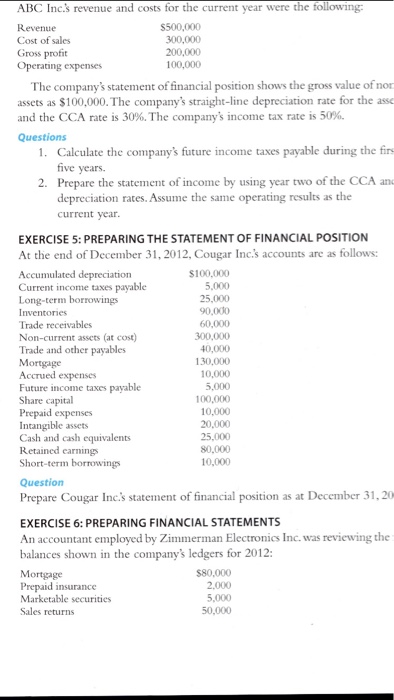

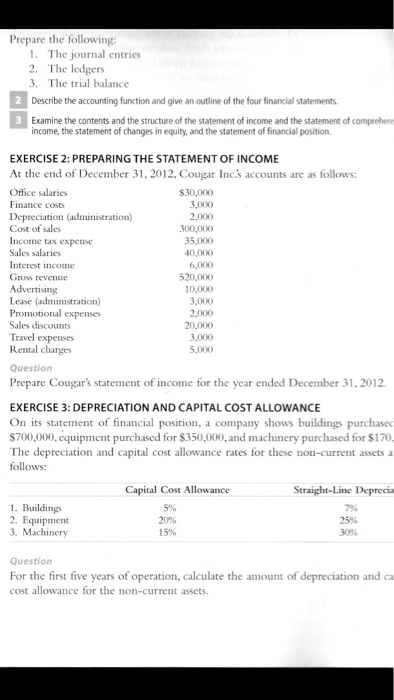

ABC Inc.'s revenue and costs for the current year were the tollowing: $500,000 300,000 Cost of sales Gross profit Operating expenses 100,000 The company's statement of financial position shows the gross value of nor assets as $100,000. The company's straight-line depreciation rate for the asse and the CCA rate is 30%. The company's income tax rate is 50%. Calculate the company's future income taxes payable during the fir five years. 1. 2. Prepare the statement of income by using year two of the CCA ano depreciation rates. Assume the same operating results as the current year EXERCISE 5: PREPARING THE STATEMENT OF FINANCIAL POSITION At the end of December 31, 2012, Cougar Inc's accounts are as follows: $100,000 5,000 25,000 90,000 Current income taxes payable Trade receivables Non-current assets (at cost) Trade and other payables 40,000 130,000 10,000 Accrued expenses Future income taxes payable Share capital Prepaid expenses Intangible assets Cash and cash equivalents Retained earnings Short-term borrowings 100,000 10,000 20,000 80,000 10,000 Prepare Cougar Inc.s statement of financial position as at December 31, 20 EXERCISE 6: PREPARING FINANCIAL STATEMENTS An accountant employed by Zimmerman Electronics Inc. was reviewing the balances shown in the company's ledgers for 2012 $80,000 Prepaid insurance Marketable securities Sales returns 5,000 50,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts