Question: Please help with explained calculations. Thank you! On January 1, 2021, the general ledger of Tripley Company included the following account balances: Accounts Debit Credit

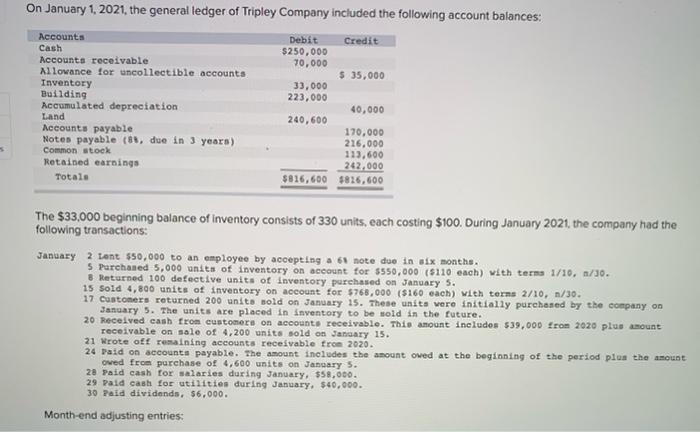

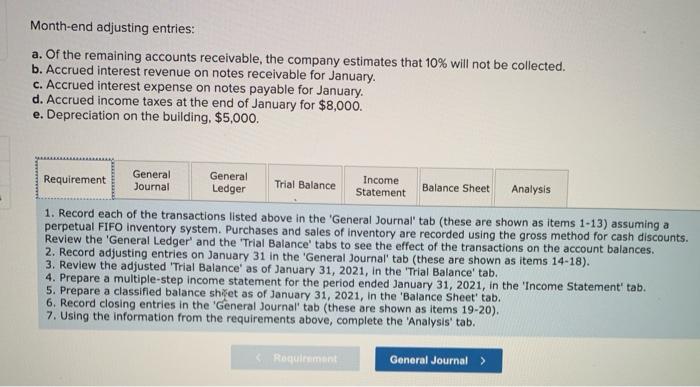

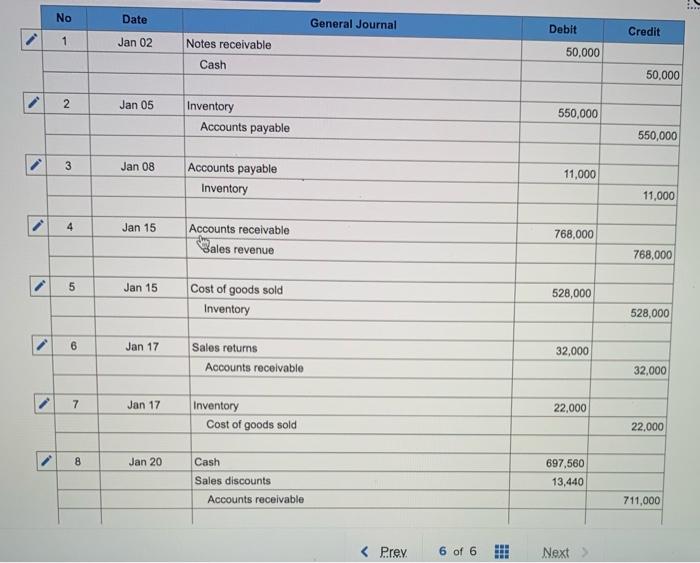

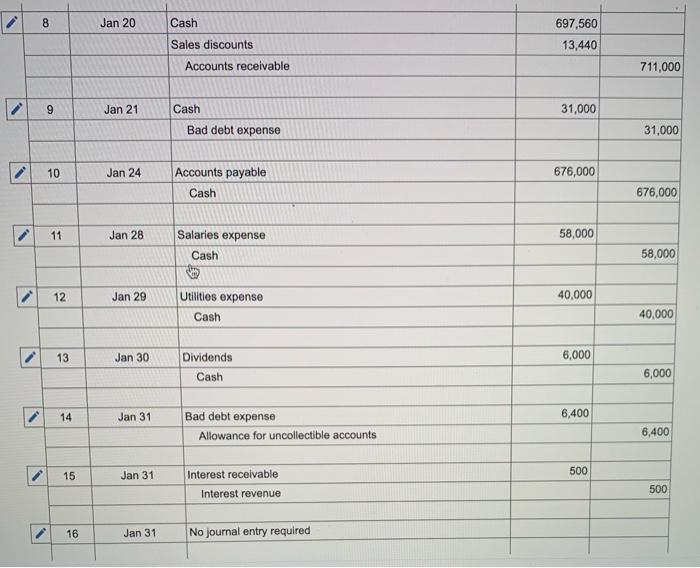

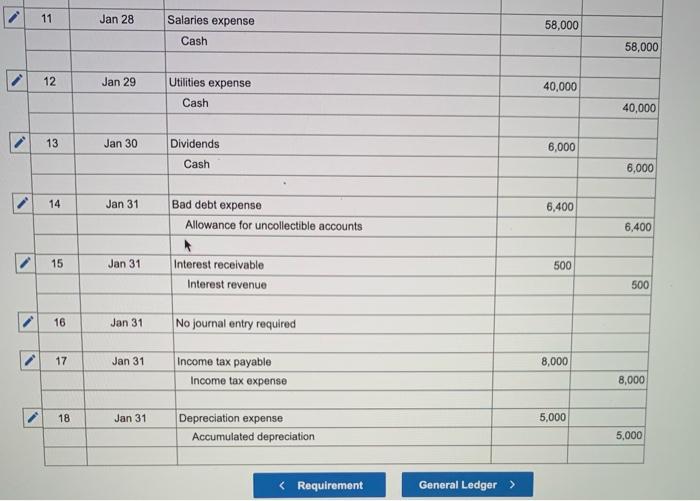

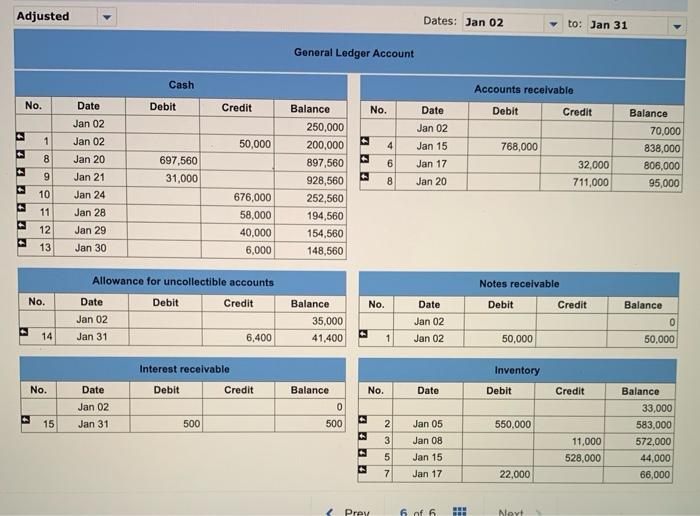

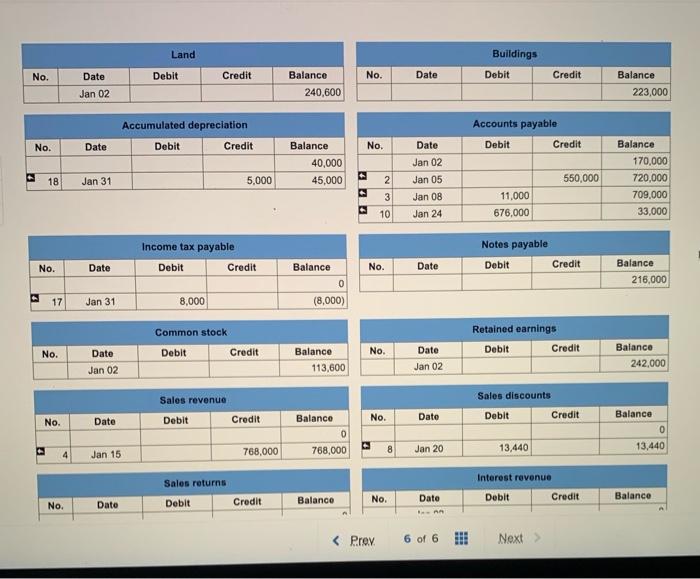

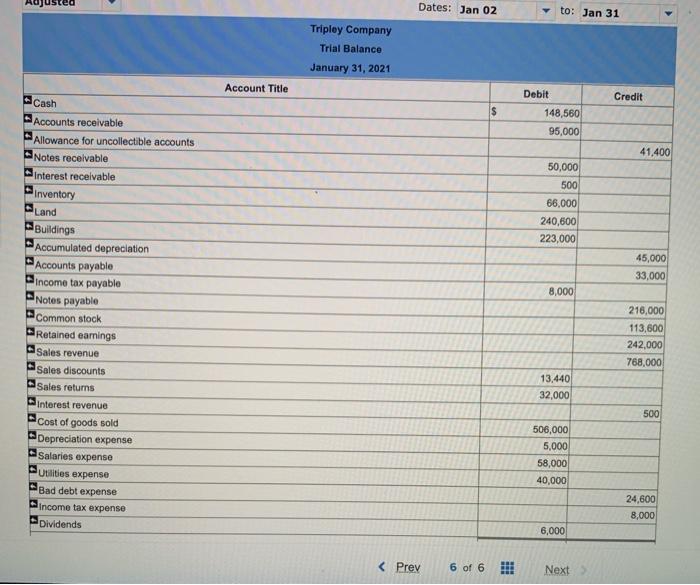

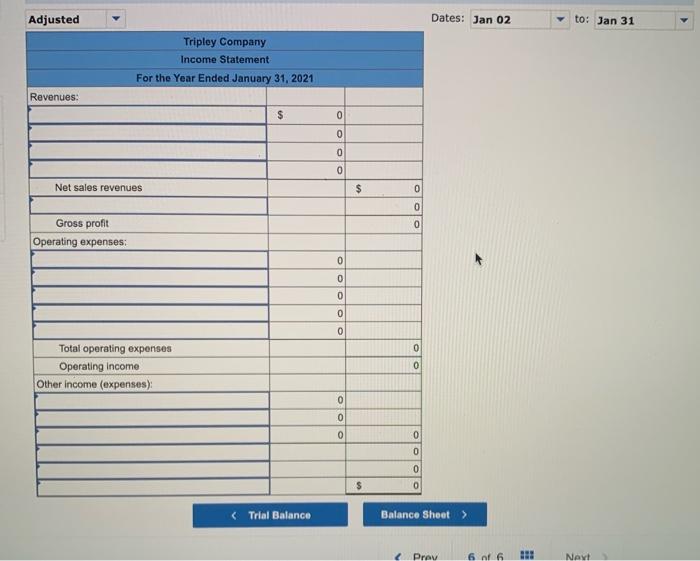

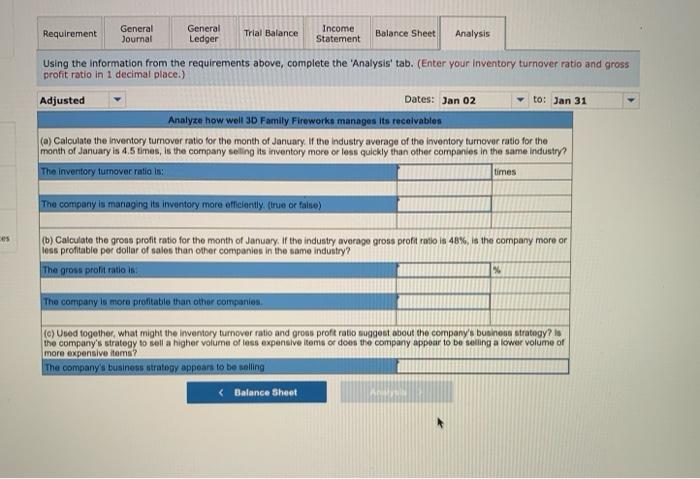

On January 1, 2021, the general ledger of Tripley Company included the following account balances: Accounts Debit Credit Cash $250,000 Accounts receivable 70,000 Allowance for uncollectible accounts $ 35,000 Inventory 33,000 Building 223,000 Accumulated depreciation 40,000 Land 240,600 Accounts payable 170,000 Noten payable (es, due in 3 years) 216,000 Common stock 113,600 Retained earnings 242.000 Totals $816,600 4826,600 3 The $33,000 beginning balance of inventory consists of 330 units, each costing $100. During January 2021, the company had the following transactions: January 2 Lent $50,000 to an employee by accepting a 61 note duo in six months. S Parchaned 5,000 units of inventory on account for $550,000 (5110 each) with terms 1/10, 1/30. 8 Returned 100 defective units of inventory purchased on January 5. 15 Sold 4,800 units of inventory on account for $760,000 ($160 each) with terms 2/10, n/30. 17 Customers returned 200 units sold on January 15. These units were initially purchased by the company on January 5. The units are placed in Inventory to be sold in the future. 20 Received cash from customers on account. receivable. This amount includes $39,000 from 2020 plus amount receivable on sale of 4,200 units sold on January 15. 21 Wrote oft remaining accounts receivable from 2020. 24 Paid on accounts payable. The amount includes the amount owed at the beginning of the period plus the amount oved from purchase of 4,600 units on January 5. 28 Paid cash for salaries during January, 558,000. 29 Paid cash for utilities during January, $40,000. 30 Pald dividends, 56,000. Month-end adjusting entries: Month-end adjusting entries: a. Of the remaining accounts receivable, the company estimates that 10% will not be collected. b. Accrued interest revenue on notes receivable for January c. Accrued interest expense on notes payable for January. d. Accrued income taxes at the end of January for $8,000. e. Depreciation on the building, $5,000. General Requirement General Journal Income Ledger Trial Balance Statement Balance Sheet Analysis 1. Record each of the transactions listed above in the 'General Journal' tab (these are shown as items 1-13) assuming a perpetual FIFO inventory system. Purchases and sales of inventory are recorded using the gross method for cash discounts. Review the 'General Ledger and the 'Trial Balance' tabs to see the effect of the transactions on the account balances. 2. Record adjusting entries on January 31 in the 'General Journal' tab (these are shown as items 14-18). 3. Review the adjusted 'Trial Balance' as of January 31, 2021, in the 'Trial Balance' tab. 4. Prepare a multiple-step income statement for the period ended January 31, 2021, in the 'Income Statement' tab. 5. Prepare a classified balance shet as of January 31, 2021, in the 'Balance Sheet' tab. 6. Record closing entries in the 'General Journal' tab (these are shown as items 19-20). 7. Using the information from the requirements above, complete the 'Analysis' tab. Roquirement General Journal > No Date General Journal Debit Credit 1 Jan 02 Notes receivable Cash 50,000 50,000 2 Jan 05 Inventory Accounts payable 550,000 550,000 3 Jan 08 Accounts payable Inventory 11,000 11,000 4 Jan 15 Accounts receivable Sales revenue 768,000 768,000 5 Jan 15 Cost of goods sold Inventory 528,000 528,000 6 Jan 17 Sales returns Accounts receivable 32,000 32,000 7 Jan 17 22,000 Inventory Cost of goods sold 22.000 8 Jan 20 Cash Sales discounts Accounts receivable 697,560 13,440 711,000 Adjusted Dates: Jan 02 to: Jan 31 General Ledger Account Cash No. Accounts receivable Debit Credit Debit Credit No. Date Jan 02 1 Jan 02 50,000 Date Jan 02 Jan 15 Jan 17 4 768,000 Balance 70,000 838,000 806,000 95,000 8 Jan 20 6 697,560 31,000 9 Balance 250,000 200,000 897,560 928,560 252,560 194,560 154,560 148,560 32,000 711,000 8 8 Jan 20 Jan 21 Jan 24 Jan 28 Jan 29 10 11 12 676,000 58,000 40,000 6,000 13 Jan 30 Notes receivable Debit Credit No. Allowance for uncollectible accounts Date Debit Credit Jan 02 Jan 31 6,400 No. Date Balance Balance 35,000 41,400 Jan 02 0 14 Jan 02 50,000 50,000 Inventory Interest receivable Debit Credit No. No. Date Debit Date Jan 02 Jan 31 Balance 0 Credit 15 500 500 550.000 2 3 5 7 Jan 05 Jan 08 Jan 15 Balance 33,000 583,000 572,000 44,000 66,000 11,000 528,000 Jan 17 22,000 Prey hof 6 Next Land Buildings Debit No. Debit Credit No. Date Credit Date Jan 02 Balance 240,600 Balance 223,000 Accumulated depreciation Accounts payable Debit Credit No. Date Debit Credit Date Jan 02 18 Jan 31 5,000 Balance No. 40.000 45,000 - 2 3 10 550,000 Jan 05 Jan 08 Jan 24 Balance 170,000 720,000 709,000 33,000 11,000 676,000 Income tax payable Debit Credit Notes payable Debit Credit No. Date No. Date Balance 0 (8,000) Balance 216,000 17 Jan 31 8,000 Common stock Debit Credit Retained earnings Debit Credit No. No. Date Jan 02 Balance 113,600 Date Jan 02 Balance 242.000 Sales revenue Sales discounts Debit Credit Balance No. Date No. Date Debit Credit Balance 0 13,440 768,000 8 768,000 4 Jan 15 13,440 Jan 20 Interest revenue Sales returns No. Date Balanco Debit Credit No. Credit Balance Date Debit Dates: Jan 02 to: Jan 31 Tripley Company Trial Balance January 31, 2021 Account Title Credit $ Debit 148,560 95,000 + 41,400 50,000 500 66,000 240,600 223,000 11 45,000 33,000 8,000 Cash Accounts receivable Allowance for uncollectible accounts Notes receivable Interest receivable Inventory Land Buildings Accumulated depreciation Accounts payable Income tax payable Notes payable Common stock Retained earnings Sales revenue Sales discounts Sales returns Interest revenue Cost of goods sold Depreciation expense Salaries expense Utilities expense Bad debt expense Income tax expense Dividends 216,000 113,600 242,000 768,000 DDDDD ALDO 13,440 32,000 500 506,000 5,000 58,000 40,000 24,600 8,000 6,000 Prey 6 of 6 Navt Trial Balance General General Income Requirement Balance Sheet Journal Ledger Statement Analysis Using the information from the requirements above, complete the 'Analysis' tab. (Enter your inventory turnover ratio and gross profit ratio in 1 decimal place.) Adjusted Dates: Jan 02 to: Jan 31 Analyze how well 3D Family Fireworks manages its receivables (m) Calculate the Inventory turnover ratio for the month of January. If tho Industry average of the inventory turnover ratio for the month of January is 4.5 times, is the company soling its inventory more or less quickly than other companies in the same Industry? The inventory turnover ratio 1: times The company is managing its inventory more efficiently. (true or false) es (1) Calculate the gross profit ratio for the month of January. If the industry average gross profit ratio is 48%, is the company more or loss profitable per dollar of sales than other companies in the same industry? The gross profit ratio is The company to more profitable than other companies (0) Used together, what might the inventory turnover ratio and gross proftratio suggest about the company's business strategy? la the company's strategy to sell a higher volume of less expensive items or does the company appear to be selling a lower volume of more expensive items? The company's business strategy appears to be selling

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts