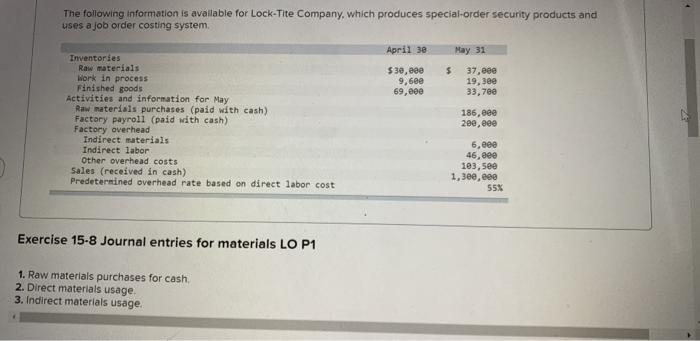

Question: please help with explanation if possible i dont understand The following information is available for Lock-Tite Company, which produces special-order security products and uses a

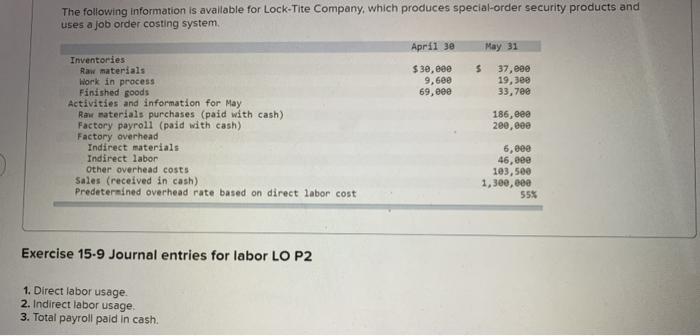

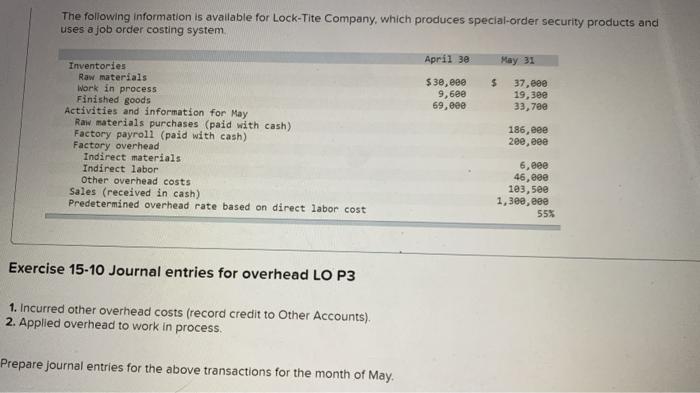

The following information is available for Lock-Tite Company, which produces special-order security products and uses a job order costing system. April 30 May 31 $ $30, eee 9,6ee 69, eee 37,eee 19,3ee 33,700 Inventories Raw materials Work in process Finished goods Activities and information for May Raw materiais purchases (paid with cash) Factory payroll (paid with cash) Factory overhead Indirect materials Indirect labor Other overhead costs Sales (received in cash) Predetermined overhead rate based on direct labor cost 186,eee 2ee, eee 6,000 46, eee 1e3, see 1,300,000 55% Exercise 15-8 Journal entries for materials LO P1 1. Raw materials purchases for cash, 2. Direct materials usage 3. Indirect materials usage The following information is available for Lock-Tite Company, which produces special-order security products and uses a job order costing system April 3e May 31 5 $ 30,eee 9,688 69,00 37, e80 19,300 33,700 Inventories Raw materials Work in process Finished goods Activities and information for May Raw materials purchases (paid with cash) Factory payroll (paid with cash) Factory overhead Indirect materials Indirect labor Other overhead costs Sales (received in cash) Predetermined overhead rate based on direct labor cost 186, eee 200,00e 6,eee 46, cee 103,500 1,300,000 55% Exercise 15-9 Journal entries for labor LO P2 1. Direct labor usage 2. Indirect labor usage 3. Total payroll paid in cash. The following information is available for Lock-Tite Company, which produces special-order security products and uses a job order costing system April 30 May 31 Inventories Raw materials $38, eee $ 37,000 Work in process 9,6ee 19,300 Finished goods 69, eee 33,78e Activities and information for May Raw materials purchases (paid with cash) 186, eee Factory payroll (paid with cash) 2ee, eee Factory overhead Indirect materials 6,eee Indirect labor Other overhead costs 46, eee Sales (received in cash) 103,5ee Predetermined overhead rate based on direct labor cost 1,3ee, eee 55% Exercise 15-10 Journal entries for overhead LO P3 1. Incurred other overhead costs (record credit to Other Accounts). 2. Applied overhead to work in process. Prepare journal entries for the above transactions for the month of May

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts