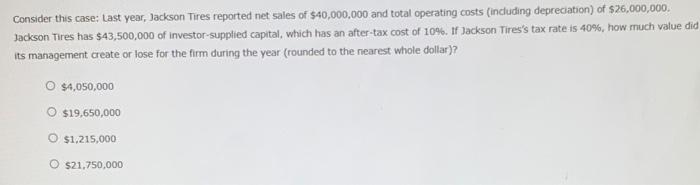

Question: Please help with explanation! TIA! Consider this case: Last year, Jackson Tires reported net sales of $40,000,000 and total operating costs (including depreciation) of $26,000,000.

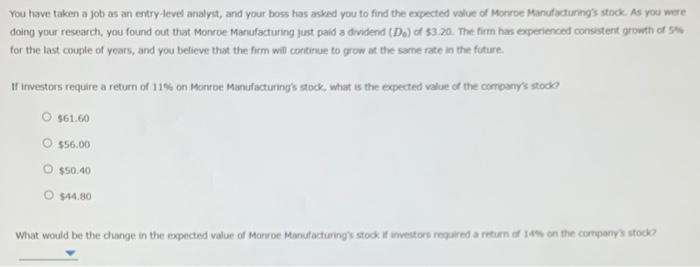

Consider this case: Last year, Jackson Tires reported net sales of $40,000,000 and total operating costs (including depreciation) of $26,000,000. Jackson Tires has 543,500,000 of investor-supplied capital, which has an after-tax cost of 10%. If Jackson Tires's tax rate is 40%, how much value did its management create or lose for the firm during the year (rounded to the nearest whole dollar)? $4,050,000 O $19,650,000 $1,215,000 O $21,750,000 You have taken a job as zin entry-level analyst, and your boss has asked you to find the expected value of Monroe Maructuring's stock. As you were doing your research, you found out that Monroe Mariufacturing just paid a dividend (D) of $3.20. The firm has experienced consistent growth of 5 for the last couple of years, and you believe that the firm will continue to grow at the same rate in the future. if investors require a return of 11% on Morice Manufacturing's stock, wist is the expected value of the company's stocke $61.60 $56.00 $50.40 O $4.80 What would be the change in the expected value of Monroe Manufacturing stock if investors required a return on the company stod

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts