please help with explanation

You need to analyze the performance of three companies 180 days after an IPO. 180 days is a lock-up period for pre-IPO shareholders, so they cannot sell their stocks during this time. Sometimes shareholders may be better off if they wait until the end of the lock-up period, but they also can lose money.

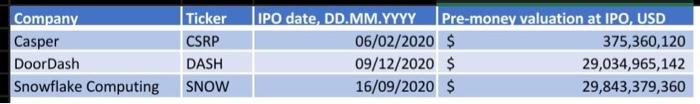

The tab in the Excel file contains

-three companies,

-their tickers,

-IPO date,

-a pre-money valuation right before an IPO.

One way to check whether these companies were successful 180 days after the liquidity event is to calculate the amount of money of the existing shareholders before and after an IPO. For simplicity, we do not control for capital structure changes now.

First, you will need to check which share of the company pre-IPO shareholders had at the end of the IPO day.

Hint: you have a pre-money valuation (net value), and you will need to find the company's total value at the end of the first day of trading (or a post-money valuation). This value is typically reported in various articles.

Second, you will need to find out a company's market capitalization 180 days after an IPO. Using it, you can determine the amount of money pre-IPO shareholders own in 180 days after an IPO.

Questions:

1) What is the purpose of the lock-up period?

2) Did the shareholders of these three companies win or lose right after this lock-up period expired? Why?

Company Casper DoorDash Snowflake Computing Ticker CSRP DASH SNOW IPO date, DD.MM.YYYY Pre-money valuation at IPO, USD 06/02/2020 $ 375,360,120 09/12/2020 $ 29,034,965,142 16/09/2020 $ 29,843,379,360