Question: Please help with explanations! Thank you! Problem 19-02 The management of a firm wants to introduce a new product. The product will sell for $4

Please help with explanations! Thank you!

Please help with explanations! Thank you!

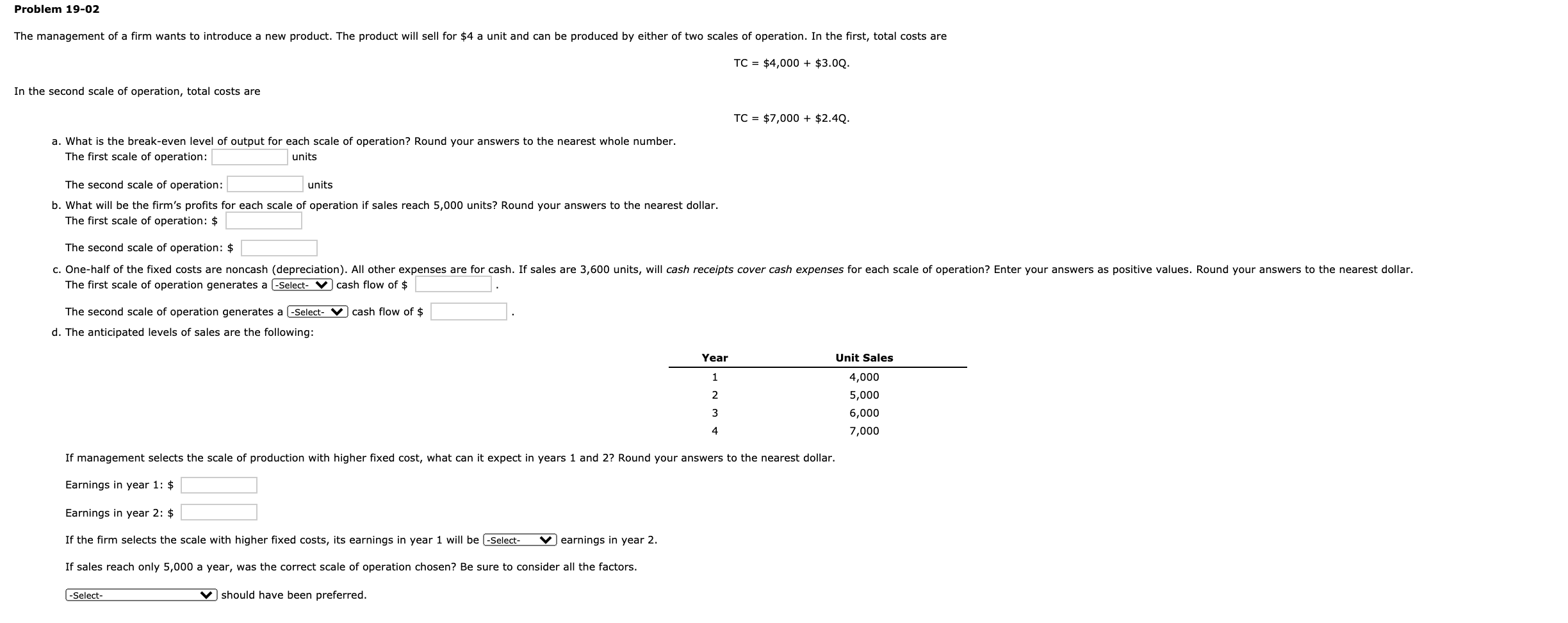

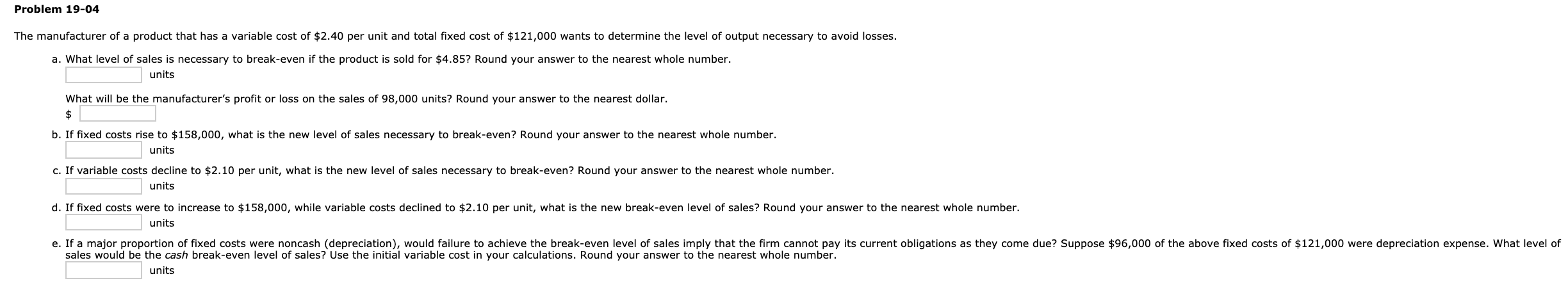

Problem 19-02 The management of a firm wants to introduce a new product. The product will sell for $4 a unit and can be produced by either of two scales of operation. In the first, total costs are TC = $4,000 + $3.00. In the second scale of operation, total costs are TC = $7,000 + $2.4Q. a. What is the break-even level of output for each scale of operation? Round your answers to the nearest whole number. The first scale of operation: units The second scale of operation: units b. What will be the firm's profits for each scale of operation if sales reach 5,000 units? Round your answers to the nearest dollar. The first scale of operation: $ The second scale of operation: $ c. One-half of the fixed costs are noncash (depreciation). All other expenses are for cash. If sales are 3,600 units, will cash receipts cover cash expenses for each scale of operation? Enter your answers as positive values. Round your answers to the nearest dollar. The first scale of operation generates a -Select- cash flow of $ The second scale of operation generates a -Select- cash flow of $ d. The anticipated levels of sales are the following: Year Unit Sales 1 2 4,000 5,000 6,000 7,000 3 4 If management selects the scale of production with higher fixed cost, what can it expect in years 1 and 2? Round your answers to the nearest dollar. Earnings in year 1: $ Earnings in year 2: $ If the firm selects the scale with higher fixed costs, its earnings in year 1 will be -Select- Vearnings in year 2. If sales reach only 5,000 a year, was the correct scale of operation chosen? Be sure to consider all the factors. -Select- should have been preferred. Problem 19-04 The manufacturer of a product that has a variable cost of $2.40 per unit and total fixed cost of $121,000 wants to determine the level of output necessary to avoid losses. a. What level of sales is necessary to break-even if the product is sold for $4.85? Round your answer to the nearest whole number. units What will be the manufacturer's profit or loss on the sales of 98,000 units? Round your answer to the nearest dollar. $ b. If fixed costs rise to $158,000, what is the new level of sales necessary to break-even? Round your answer to the nearest whole number. units c. If variable costs decline to $2.10 per unit, what is the new level of sales necessary to break-even? Round your answer to the nearest whole number. units d. If fixed costs were to increase to $158,000, while variable costs declined to $2.10 per unit, what is the new break-even level of sales? Round your answer to the nearest whole number. units e. If a major proportion of fixed costs were noncash (depreciation), would failure to achieve the break-even level of sales imply that the firm cannot pay its current obligations as they come due? Suppose $96,000 of the above fixed costs of $121,000 were depreciation expense. What level of sales would be the cash break-even level of sales? Use the initial variable cost in your calculations. Round your answer to the nearest whole number. units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts