Question: Please help with figuring the Ratio Analysis with step-by-step instruction. begin{tabular}{|c|c|c|c|c|c|c|} hline Liabilities and Stockholder's Equity & & & & & & hline multicolumn{7}{|l|}{

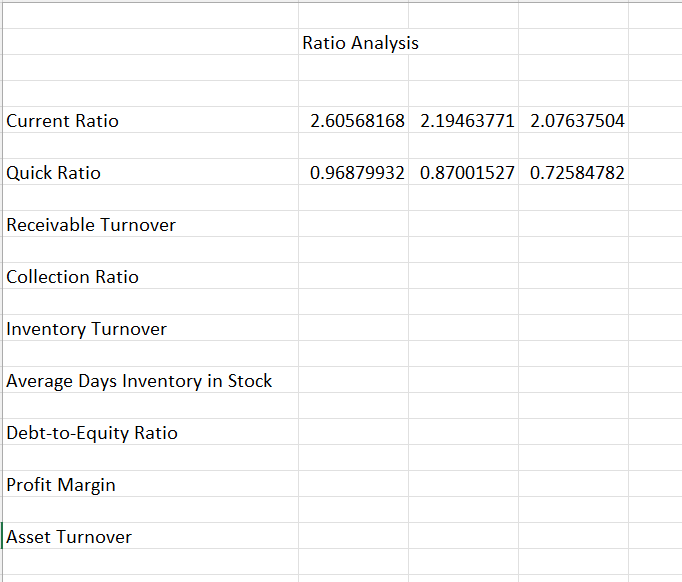

Please help with figuring the Ratio Analysis with step-by-step instruction.

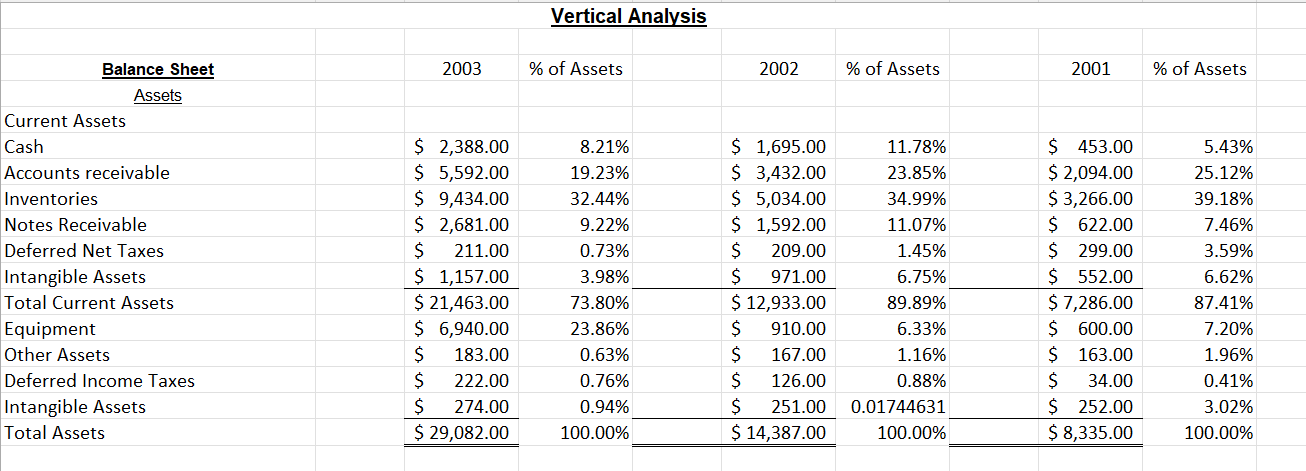

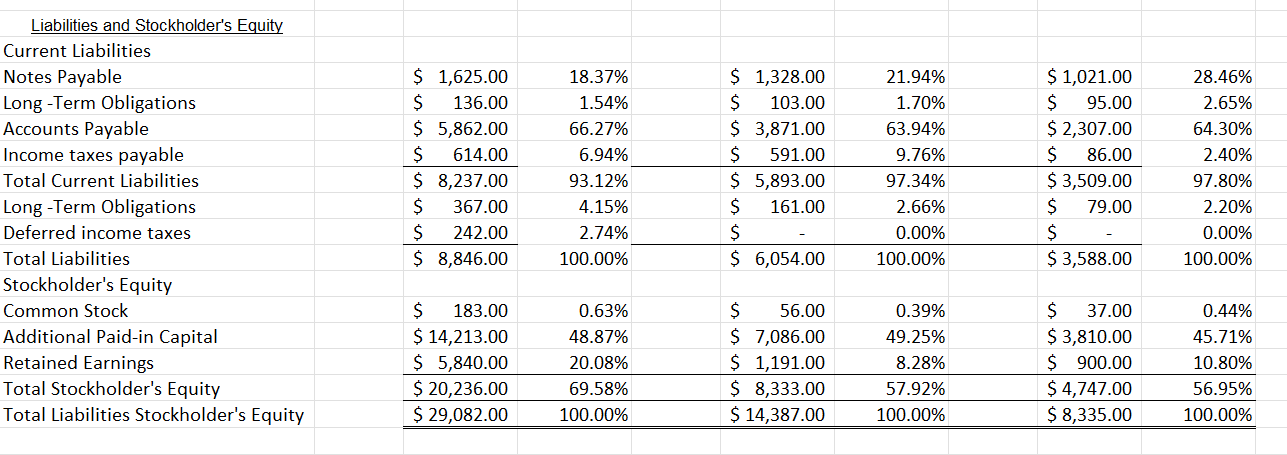

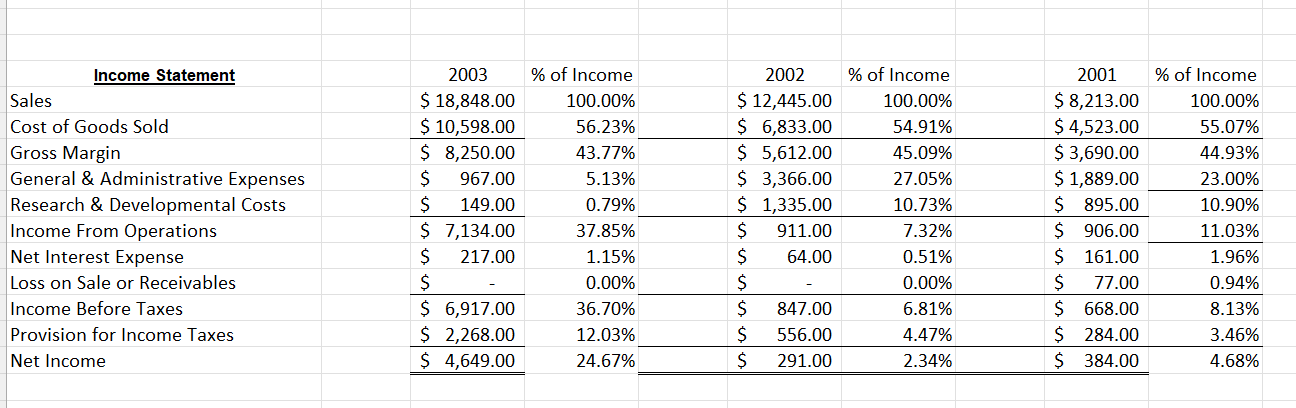

\begin{tabular}{|c|c|c|c|c|c|c|} \hline Liabilities and Stockholder's Equity & & & & & & \\ \hline \multicolumn{7}{|l|}{ Current Liabilities } \\ \hline Notes Payable & $1,625.00 & 18.37% & $1,328.00 & 21.94% & $1,021.00 & 28.46% \\ \hline Long -Term Obligations & $136.00 & 1.54% & $103.00 & 1.70% & $95.00 & 2.65% \\ \hline Accounts Payable & $5,862.00 & 66.27% & $3,871.00 & 63.94% & $2,307.00 & 64.30% \\ \hline Income taxes payable & $614.00 & 6.94% & 591.00 & 9.76% & 86.00 & 2.40% \\ \hline Total Current Liabilities & $8,237.00 & 93.12% & $5,893.00 & 97.34% & $3,509.00 & 97.80% \\ \hline Long -Term Obligations & $367.00 & 4.15% & 161.00 & 2.66% & 79.00 & 2.20% \\ \hline Deferred income taxes & $242.00 & 2.74% & $ & 0.00% & $ & 0.00% \\ \hline Total Liabilities & $8,846.00 & 100.00% & $6,054.00 & 100.00% & $3,588.00 & 100.00% \\ \hline \multicolumn{7}{|l|}{ Stockholder's Equity } \\ \hline Common Stock & $183.00 & 0.63% & 56.00 & 0.39% & 37.00 & 0.44% \\ \hline Additional Paid-in Capital & $14,213.00 & 48.87% & $7,086.00 & 49.25% & $3,810.00 & 45.71% \\ \hline Retained Earnings & $5,840.00 & 20.08% & $1,191.00 & 8.28% & $900.00 & 10.80% \\ \hline Total Stockholder's Equity & $20,236.00 & 69.58% & $8,333.00 & 57.92% & $4,747.00 & 56.95% \\ \hline Total Liabilities Stockholder's Equity & $29,082.00 & 100.00% & $14,387.00 & 100.00% & $8,335.00 & 100.00% \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|} \hline & & & & \\ \hline & & & \\ \hline Current Ratio Analysis & & \\ \hline Quick Ratio & 0.96879932 & 0.87001527 & 0.72584782 \\ \hline Receivable Turnover & & & \\ \hline Collection Ratio & & & \\ \hline Inventory Turnover & & & \\ \hline Average Days Inventory in Stock & & & \\ \hline Debt-to-Equity Ratio & & & \\ \hline Profit Margin & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline & 2003 & % of Income & & & & \\ \hline Sales & & & & & & \\ \hline Cost of Goods Sold & $10,598.00 & 56.23% & $6,833.00 & 54.91% & $4,523.00 & 55.07% \\ \hline Gross Margin & $8,250.00 & 43.77% & $5,612.00 & 45.09% & $3,690.00 & 44.93% \\ \hline General \& Administrative Expenses & 967.00 & 5.13% & $3,366.00 & 27.05% & $1,889.00 & 23.00% \\ \hline Research \& Developmental Costs & 149.00 & 0.79% & $1,335.00 & 10.73% & $895.00 & 10.90% \\ \hline Income From Operations & $7,134.00 & 37.85% & 911.00 & 7.32% & $906.00 & 11.03% \\ \hline Net Interest Expense & 217.00 & 1.15% & 64.00 & 0.51% & $161.00 & 1.96% \\ \hline Loss on Sale or Receivables & $ & 0.00% & $ & 0.00% & 77.00 & 0.94% \\ \hline Income Before Taxes & $6,917.00 & 36.70% & 847.00 & 6.81% & $668.00 & 8.13% \\ \hline Provision for Income Taxes & $2,268.00 & 12.03% & 556.00 & 4.47% & $284.00 & 3.46% \\ \hline Net Income & $4,649.00 & 24.67% & 291.00 & 2.34% & $384.00 & 4.68% \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multicolumn{7}{|c|}{ Vertical Analysis } \\ \hline Balance Sheet & 2003 & % of Assets & 2002 & % of Assets & 2001 & % of Assets \\ \hline \multicolumn{7}{|l|}{ Assets } \\ \hline Cash & $2,388.00 & 8.21% & $1,695.00 & 11.78% & $453.00 & 5.43% \\ \hline Accounts receivable & $5,592.00 & 19.23% & $3,432.00 & 23.85% & $2,094.00 & 25.12% \\ \hline Inventories & $9,434.00 & 32.44% & $5,034.00 & 34.99% & $3,266.00 & 39.18% \\ \hline Deferred Net Taxes & $211.00 & 0.73% & 209.00 & 1.45% & $299.00 & 3.59% \\ \hline Intangible Assets & $1,157.00 & 3.98% & 971.00 & 6.75% & $552.00 & 6.62% \\ \hline Total Current Assets & $21,463.00 & 73.80% & $12,933.00 & 89.89% & $7,286.00 & 87.41% \\ \hline Equipment & $6,940.00 & 23.86% & 910.00 & 6.33% & $600.00 & 7.20% \\ \hline Other Assets & 183.00 & 0.63% & 167.00 & 1.16% & $163.00 & 1.96% \\ \hline Deferred Income Taxes & 222.00 & 0.76% & 126.00 & 0.88% & $34.00 & 0.41% \\ \hline Intangible Assets & $274.00 & 0.94% & 251.00 & 0.01744631 & $252.00 & 3.02% \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts